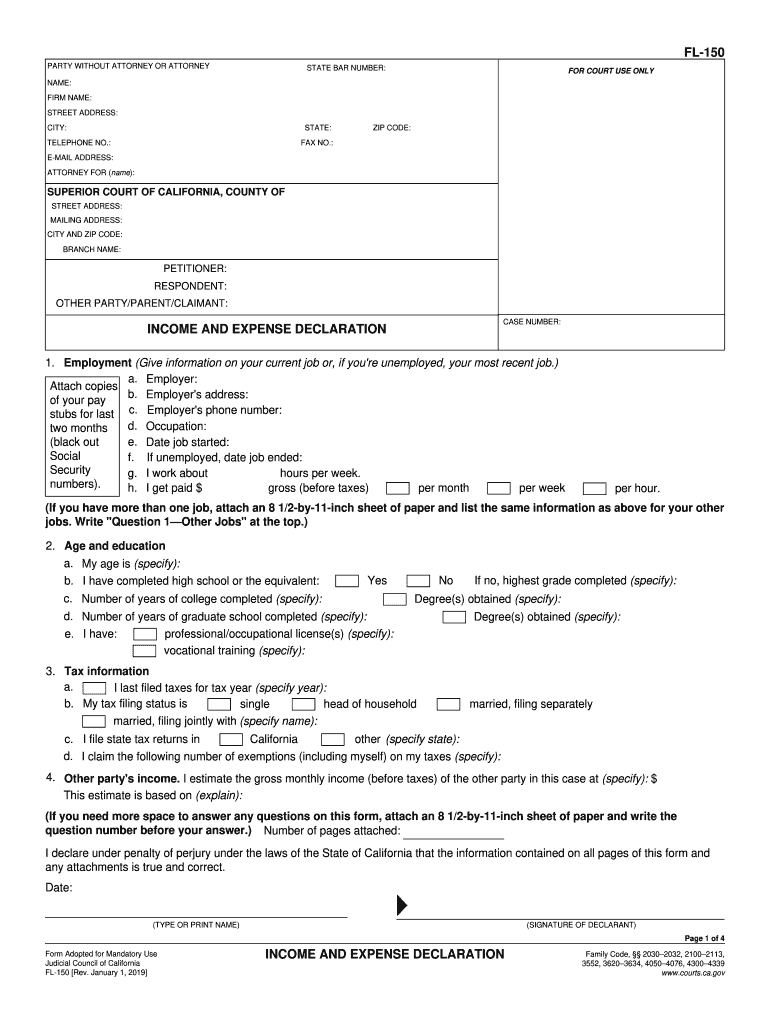

What is the FL 150?

Divorce courts in California require that both parties in the divorce report their financial situation fully and completely. This ensures that all financial decisions made by the court are given correct and complete context. The FL 150 form is filled out for this purpose. It asks questions about the income, living, and expense situations for each spouse.

In one sentence, what is the purpose of submitting this form?

The purpose of submitting the FL 150 form is to provide California’s divorce court with the income, living, and expense situation of each spouse.

What information do you need in order to complete this form?

There are many pieces of information required by this form. Ensure that you have them all before you begin to fill out the form. They include…

- Full name, address, telephone number, and email address of the attorney.

- Full name of the spouse the attorney is representing.

- Full street address, mailing address, city, zip code, and branch of the courthouse.

- Divorce case number.

- Name of employer, employer’s full address, employer’s phone number, occupation, date the job was started, date the job ended if relevant, how many hours are worked per week for the job, how much is paid, and the payment schedule for the relevant spouse.

- Age, high school degree status, undergraduate college years completed, graduate college years completed, and occupational licenses for the relevant spouse.

- Last year taxes were filed, tax filing status, where the tax return was filed, and tax exemptions for the relevant spouse.

- Gross income of the other spouse.

- Average salary, overtime, commissions, public assistance, spousal support, partner support, pension, social security, disability, unemployment, worker’s comp, and military payments made for the last 12 months.

- All information on investment income.

- All information on self-employment income, including the last two year’s tax returns.

- Any additional income information.

- Union dues, retirement payments, hospital fees, child support paid for children in other relationships, spousal support from a different marriage, and job related expenses.

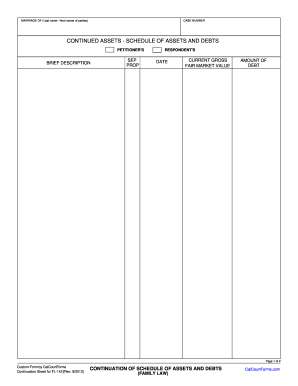

- All assets including checking accounts, saving accounts, stocks, bonds, and personal property.

- Who the spouse lives with including full names, ages, relationship to the spouse, and that person’s gross monthly income.

- Monthly expenses for rent or mortgages, health care, child care, groceries, eating out, utilities, laundry, clothes, education, entertainment, car insurance, gas, car repairs, life insurance, savings, charitable contributions, and telephone bills.

- Any additional installment payments or debts.

- Attorney fees.

- Number of children under the age of 18 and their health care, child care, travel, and educational expenses.

- Any special hardships experienced by the spouse.

- Any other information the spouse wishes the court to know.

Who must file this form?

This form must be filed by any married couple seeking divorce in the state of California. In some special cases, form FL 155 can be filled out in place of form FL 150.

In what professional field is this form most likely used?

This form is typically used by family lawyers in the state of California. In some cases, this form can be filled out by the spouse themselves.

Who is the intended recipient of this form?

The intended recipient of form FL 150 are divorce courts in the state of California.