NY RET-54 2019 free printable template

Show details

RET54 (5/19)OFFICE SERVICES ONLINE YORK STATE TEACHERS RETIREMENT SYSTEM

10 Corporate Woods Drive, Albany, NY 122112395APPLICATION FOR RETIREMENTEmplIDSocial Security NumberORInstructions: Print clearly

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY RET-54

Edit your NY RET-54 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY RET-54 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY RET-54 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY RET-54. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY RET-54 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY RET-54

How to fill out NY RET-54

01

Download the NY RET-54 form from the New York State Department of Taxation and Finance website.

02

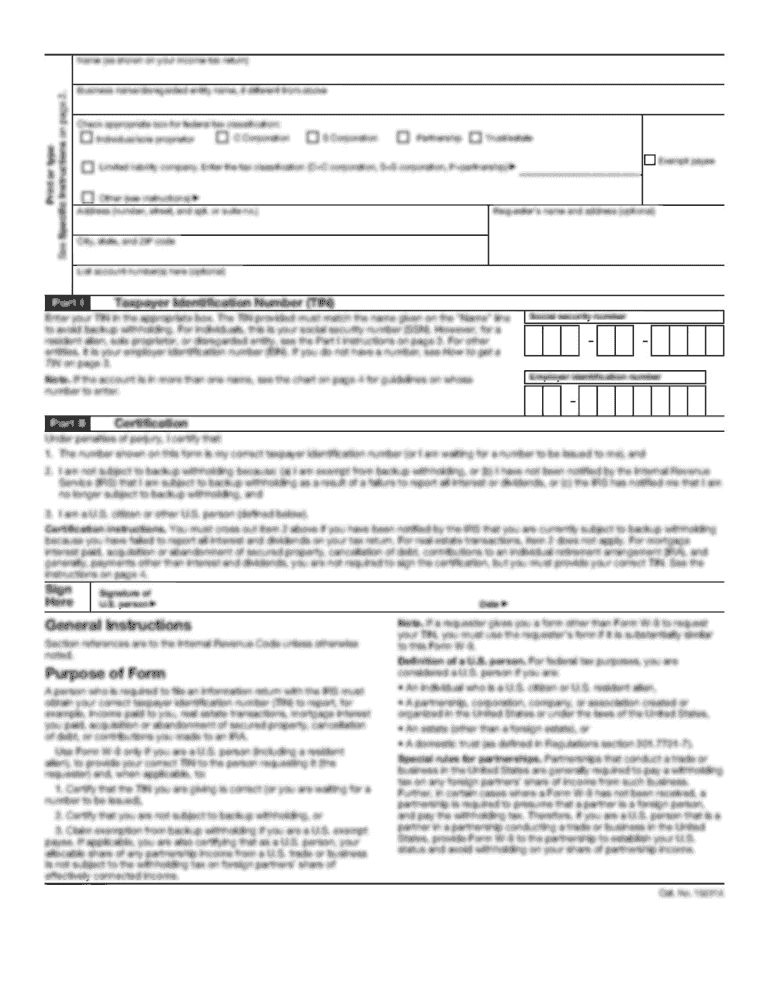

Fill out the taxpayer information section, including your name, address, and Social Security number.

03

Provide details about the property for which the exemption is being requested, including the property address and tax identification number.

04

Indicate the type of exemption you are applying for by checking the appropriate box.

05

Attach any necessary supporting documentation, such as proof of ownership or income verification.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form.

08

Submit the form to your local tax assessor's office by the specified deadline.

Who needs NY RET-54?

01

Property owners in New York who are seeking a property tax exemption.

02

Individuals claiming exemptions based on disability, senior status, or other qualifying criteria.

Fill

form

: Try Risk Free

People Also Ask about

What forms are needed for NYS retirement?

Applications for Retirement. Application for Service Retirement (RS-6037) Beneficiaries. Eligibility of Retired Employee for Survivor's Benefit (RS-6355) Change of Address. Change of Address Form for Active Members (RS-5512) Health Benefits. Health Insurance Transaction Form (PS-404) M/C Life Insurance. Sign Up / Decline.

How to apply for retirement in NY?

You can file for a service retirement benefit online. Sign in to your Retirement Online account, go to the 'My Account Summary' area of your Account Homepage and click “Apply for Retirement.” Paper forms are available on our Forms page, or from our Call Center or your employer.

How do I contact NYS teacher retirement?

Retiree Inquiries Call (800) 348-7298 and use the following extensions.

What are the retirement requirements for NYSTRS?

Tier 1 members may retire at any age with 35 years of service, or at age 55 with five or more years of service. Retirement may also occur at age 55 with less than five years of NYS service, if two years of NYS service are rendered after their current membership date and since they reached age 53.

How do I file for retirement in NY?

You can file for a service retirement benefit online. Sign in to your Retirement Online account, go to the 'My Account Summary' area of your Account Homepage and click “Apply for Retirement.” Paper forms are available on our Forms page, or from our Call Center or your employer.

How do you start retirement process?

You can apply: Online; or. By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. Call ahead to make an appointment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY RET-54 online?

With pdfFiller, it's easy to make changes. Open your NY RET-54 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit NY RET-54 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your NY RET-54, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out NY RET-54 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NY RET-54 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is NY RET-54?

NY RET-54 is a tax form used in New York State for reporting real estate transfer taxes.

Who is required to file NY RET-54?

The seller or the grantor of the real property is required to file NY RET-54.

How to fill out NY RET-54?

To fill out NY RET-54, provide details about the transaction, including the names of the parties involved, the property address, and the total consideration paid for the property.

What is the purpose of NY RET-54?

The purpose of NY RET-54 is to report the transfer of real estate and calculate the applicable transfer taxes owed to the state.

What information must be reported on NY RET-54?

NY RET-54 must report information such as the date of transfer, names and addresses of the grantor and grantee, the property's legal description, and the amount of consideration.

Fill out your NY RET-54 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY RET-54 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.