Get the free NEW TAX MAP PARCEL FILE NO - Cayuga County Nursing Home

Show details

NEW TAX MAP PARCEL FILE NO. OFFICE USE ONLY CAYUGA COUNTY REAL PROPERTY SERVICES DEPARTMENT 160 Geneses Street Auburn NY 13021 315 2531502 Please help us determine or confirm the total number of separately

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new tax map parcel

Edit your new tax map parcel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new tax map parcel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new tax map parcel online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new tax map parcel. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new tax map parcel

How to fill out a new tax map parcel:

01

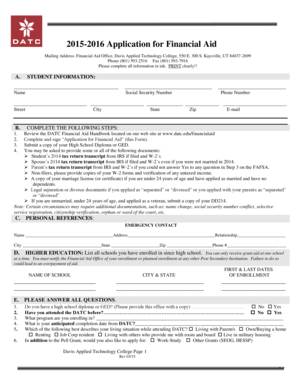

Gather all necessary documents and information: Before filling out a new tax map parcel, make sure you have gathered all the required documents such as property deeds, survey maps, and any other relevant paperwork. Additionally, gather important information such as property boundaries, lot numbers, and any changes in ownership.

02

Verify accuracy: Double-check all the information you have collected to ensure its accuracy. Mistakes or inaccuracies can lead to complications in the future, so it is essential to be diligent in verifying all the details.

03

Complete the application: Fill out the new tax map parcel application form or obtain it from the concerned authority. Provide all the required information, including property details, owner information, and any changes or additions.

04

Attach supporting documents: Attach all relevant supporting documents required for the new tax map parcel application. This may include property deeds, survey maps, and any other necessary paperwork.

05

Review and submit the application: Once you have completed the application and attached all required documents, review the entire form to ensure its completeness and accuracy. Look for any missing information or errors. Once you are satisfied with the application, submit it to the relevant authority, either in person or through the designated submission method.

06

Follow up: After submitting the application, it is essential to keep track of the process. Follow up with the concerned authority to inquire about the status of your application and ensure that it is being processed in a timely manner.

07

Receive the new tax map parcel: Once your application is approved and processed, you will receive the new tax map parcel. This updated parcel will serve as the official record of your property and its associated tax information.

Who needs a new tax map parcel?

01

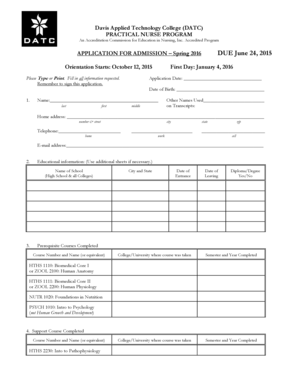

Property owners: Property owners who have made changes to their property boundaries, acquired new lots or tracts, or have undergone any changes in ownership may need a new tax map parcel. It serves as an official record of the property's updated details for taxation purposes.

02

Property developers: Developers who are involved in subdivide land or create new parcels for residential or commercial purposes may also require new tax map parcels. These parcels help in accurately identifying and assessing individual parcels within a larger development project.

03

Government agencies: Various government agencies involved in property taxation, planning, and land use management may need new tax map parcels to maintain accurate records and assess property values appropriately. Additionally, these parcels help in determining zoning regulations, infrastructure development, and other planning activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new tax map parcel?

A new tax map parcel is a specific identification number assigned to a piece of real estate for tax purposes.

Who is required to file new tax map parcel?

Property owners or those responsible for paying property taxes are required to file new tax map parcel.

How to fill out new tax map parcel?

To fill out a new tax map parcel, one must provide accurate information about the property including ownership details, address, and legal description.

What is the purpose of new tax map parcel?

The purpose of new tax map parcel is to accurately assess and collect property taxes based on the specific details of each property.

What information must be reported on new tax map parcel?

Information such as property ownership details, address, legal description, and any changes to the property must be reported on new tax map parcel.

How can I edit new tax map parcel from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including new tax map parcel, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit new tax map parcel online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your new tax map parcel and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out new tax map parcel on an Android device?

Use the pdfFiller app for Android to finish your new tax map parcel. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your new tax map parcel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Tax Map Parcel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.