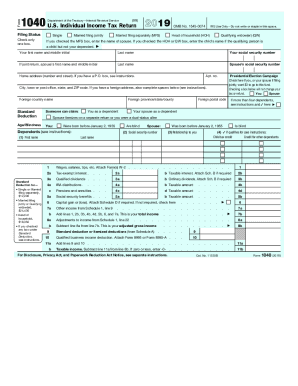

IRS 1040 Schedule D Instructions 2019 free printable template

Show details

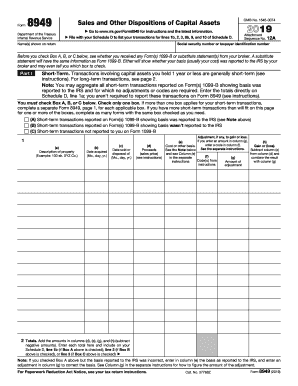

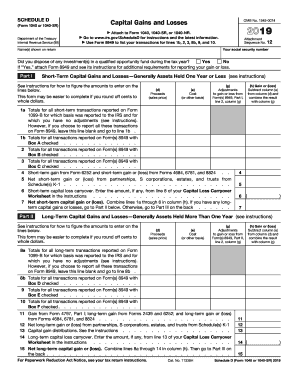

See How to Report an Election to Defer D-5 Tax on Eligible Gain Invested in a QO Fund in the Form 8949 instructions. See the Instructions for Form 8949. Complete all necessary pages of Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D. Exclusion of Gain on Qualified Small Business QSB Stock later. Rate Gain Worksheet in these instructions if you complete line 18 of Schedule D. See Pub. 550. Also see the instructions for Form Specific Rounding Off to Whole Dollars You can...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1040 Schedule D Instructions

Edit your IRS 1040 Schedule D Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040 Schedule D Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1040 Schedule D Instructions online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 1040 Schedule D Instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040 Schedule D Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040 Schedule D Instructions

How to fill out IRS 1040 Schedule D Instructions

01

Gather all your relevant tax documents, including Form 1040, brokerage statements, and records of any investment transactions.

02

Determine your capital gains and losses by reviewing your stock sales and other investment transactions for the year.

03

Complete Part I of Schedule D for short-term capital gains and losses. Report each transaction with the date acquired, date sold, proceeds, cost basis, and gain or loss.

04

Move to Part II for long-term capital gains and losses, following the same reporting format as Part I.

05

Calculate the totals for both short-term and long-term capital gains and losses at the end of each section.

06

Carry over the net gain or loss from Schedule D to Form 1040, following the instructions provided.

07

Ensure all calculations are correct and all necessary forms are attached before submission.

Who needs IRS 1040 Schedule D Instructions?

01

Individuals who sold capital assets such as stocks, bonds, real estate, or other investments during the tax year.

02

Taxpayers needing to report capital gains and losses to accurately determine their tax liability.

Instructions and Help about IRS 1040 Schedule D Instructions

Fill

form

: Try Risk Free

People Also Ask about

Where do I put schedule C on 1040?

Income you report on Sched- ule C may be qualified business income and entitle you to a de- duction on Form 1040 or 1040-SR, line 13. Enter gross receipts from your trade or business. Be sure to check any Forms 1099 you received for business income that must be reported on this line.

What is a Schedule C on 1040 2017?

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Is there a limit on itemized deductions for 2017?

Limit on itemized deductions. You may not be able to deduct all of your itemized deductions if your adjusted gross income is more than $156,900 if married filing separately; $261,500 if single; $287,650 if head of household; or $313,800 if married filing jointly or qualifying widow(er).

What is irs Schedule F 2017?

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040NR, 1041, 1065, or 1065-B. Your farming activity may subject you to state and local taxes and other require- ments such as business licenses and fees. Check with your state and local governments for more information.

What is the standard deduction for 2017?

For tax year 2017, the IRS increased the value of some different tax benefits, while leaving some the same as last year: Personal and dependent exemptions remain $4,050. The standard deduction rises to $6,350 for single, $9,350 for head of household, and $12,700 for married filing jointly.

Is a schedule C the same as a W-2?

Schedule C is not the same as a W-2. Schedule C reports income earned as a self-employed person either through a sole proprietorship or single-member LLC. W-2s report income you've earned as an employee of a business. You can earn W-2 income and also still report separate income on Schedule C.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS 1040 Schedule D Instructions?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the IRS 1040 Schedule D Instructions in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in IRS 1040 Schedule D Instructions?

The editing procedure is simple with pdfFiller. Open your IRS 1040 Schedule D Instructions in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete IRS 1040 Schedule D Instructions on an Android device?

Complete IRS 1040 Schedule D Instructions and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IRS 1040 Schedule D Instructions?

IRS 1040 Schedule D Instructions provide guidance on how to report capital gains and losses from the sale of capital assets, such as stocks, bonds, and real estate, on your tax return.

Who is required to file IRS 1040 Schedule D Instructions?

Taxpayers who have capital gains or losses from the sale of assets or investments during the tax year are required to file IRS 1040 Schedule D Instructions.

How to fill out IRS 1040 Schedule D Instructions?

To fill out IRS 1040 Schedule D, you will need to gather your records of capital asset transactions, report each transaction's details on the form, calculate your gain or loss, and then transfer the information to your Form 1040.

What is the purpose of IRS 1040 Schedule D Instructions?

The purpose of IRS 1040 Schedule D Instructions is to ensure that taxpayers accurately report their capital gains and losses, which are important for determining the correct amount of taxes owed or refund due.

What information must be reported on IRS 1040 Schedule D Instructions?

You must report details about each capital asset transaction, including the date acquired, date sold, sale price, cost basis, and any adjustments for expenses or other factors affecting the gain or loss.

Fill out your IRS 1040 Schedule D Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040 Schedule D Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.