IRS 1040 Schedule D Instructions 2020 free printable template

Show details

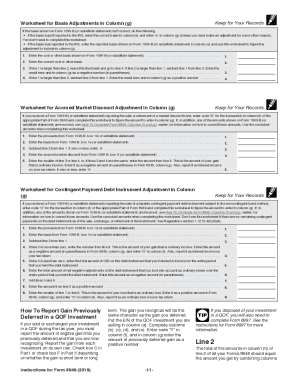

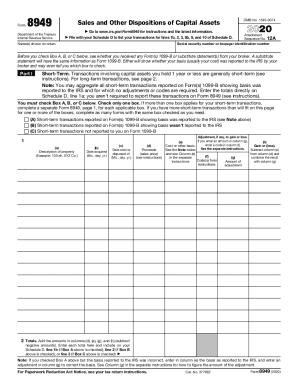

See How to Report an Election to Defer D-5 Tax on Eligible Gain Invested in a QO Fund in the Form 8949 instructions. See the Instructions for Form 8949. Complete all necessary pages of Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D. Exclusion of Gain on Qualified Small Business QSB Stock later. Rate Gain Worksheet in these instructions if you complete line 18 of Schedule D. See Pub. 550. Also see the instructions for Form Specific Rounding Off to Whole Dollars You can...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1040 Schedule D Instructions

Edit your IRS 1040 Schedule D Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040 Schedule D Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1040 Schedule D Instructions online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 1040 Schedule D Instructions. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040 Schedule D Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040 Schedule D Instructions

How to fill out IRS 1040 Schedule D Instructions

01

Gather all necessary documents, including sales records, brokerage statements, and any relevant tax forms from the year.

02

Start with Part I to report short-term capital gains and losses. Enter each transaction's details one by one.

03

Use Form 8949 to provide specifics on each sale, including the date acquired, date sold, proceeds, and cost basis.

04

Calculate the totals for short-term gains and losses and carry them to Schedule D.

05

Move to Part II for long-term capital gains and losses and repeat the process as in Part I.

06

Add the short-term and long-term totals to see overall capital gains or losses.

07

Check the instructions for any applicable adjustments, such as carryovers from previous years.

08

Review the completed Schedule D for accuracy before filing.

Who needs IRS 1040 Schedule D Instructions?

01

Individuals who sold stocks, bonds, or other capital assets during the tax year.

02

Taxpayers who received capital gains distributions from mutual funds or other investments.

03

Those who have capital losses to report in order to offset taxes owed on gains.

Instructions and Help about IRS 1040 Schedule D Instructions

Fill

form

: Try Risk Free

People Also Ask about

What are capital gains or losses Schedule D?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

How do I report capital gains and losses on my tax return?

Capital gains and deductible capital losses are reported on Form 1040, Schedule D, Capital Gains and Losses, and then transferred to line 13 of Form 1040, U.S. Individual Income Tax Return.

What is the 2022 capital gains schedule?

For example, in 2022, individual filers won't pay any capital gains tax if their total taxable income is $41,675 or below. However, they'll pay 15 percent on capital gains if their income is $41,676 to $459,750. Above that income level, the rate jumps to 20 percent.

What are the capital gains tax rates for 2022?

The tax rate on most net capital gain is no higher than 15% for most individuals.

Do all capital gain distributions have to be reported on Schedule D?

Capital Gain Distributions Instead, they are included on Form 1099-DIV as ordinary dividends. Enter on Schedule D, line 13, the total capital gain distributions paid to you during the year, regardless of how long you held your investment.

What schedule is capital gains on?

About Schedule D (Form 1040), Capital Gains and Losses. Internal Revenue Service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 1040 Schedule D Instructions in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your IRS 1040 Schedule D Instructions and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify IRS 1040 Schedule D Instructions without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including IRS 1040 Schedule D Instructions, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete IRS 1040 Schedule D Instructions online?

pdfFiller makes it easy to finish and sign IRS 1040 Schedule D Instructions online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

What is IRS 1040 Schedule D Instructions?

IRS 1040 Schedule D Instructions provide the guidelines for reporting capital gains and losses from the sale of assets on your tax return.

Who is required to file IRS 1040 Schedule D Instructions?

Taxpayers who have sold stocks, bonds, real estate, or other capital assets that resulted in gains or losses are required to file IRS 1040 Schedule D.

How to fill out IRS 1040 Schedule D Instructions?

To fill out IRS 1040 Schedule D, report each transaction that resulted in a capital gain or loss on the form, detailing the asset's purchase price, sale price, and the resulting gain or loss.

What is the purpose of IRS 1040 Schedule D Instructions?

The purpose of IRS 1040 Schedule D Instructions is to provide a systematic approach for taxpayers to report their capital gains and losses and calculate the overall tax impact.

What information must be reported on IRS 1040 Schedule D Instructions?

Taxpayers must report the dates of acquisition and sale, the cost basis, the sales proceeds, and the resulting gain or loss from each transaction on IRS 1040 Schedule D.

Fill out your IRS 1040 Schedule D Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040 Schedule D Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.