Get the free Employer bContributionb Rate Group 5 - BC Pension Corporation

Show details

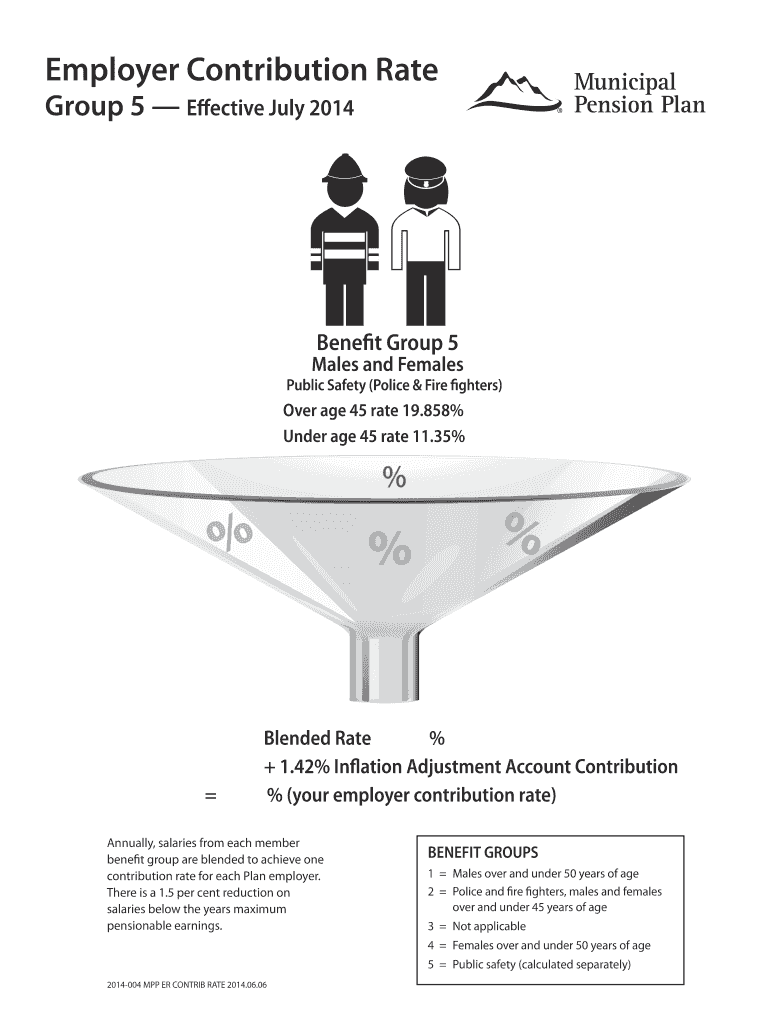

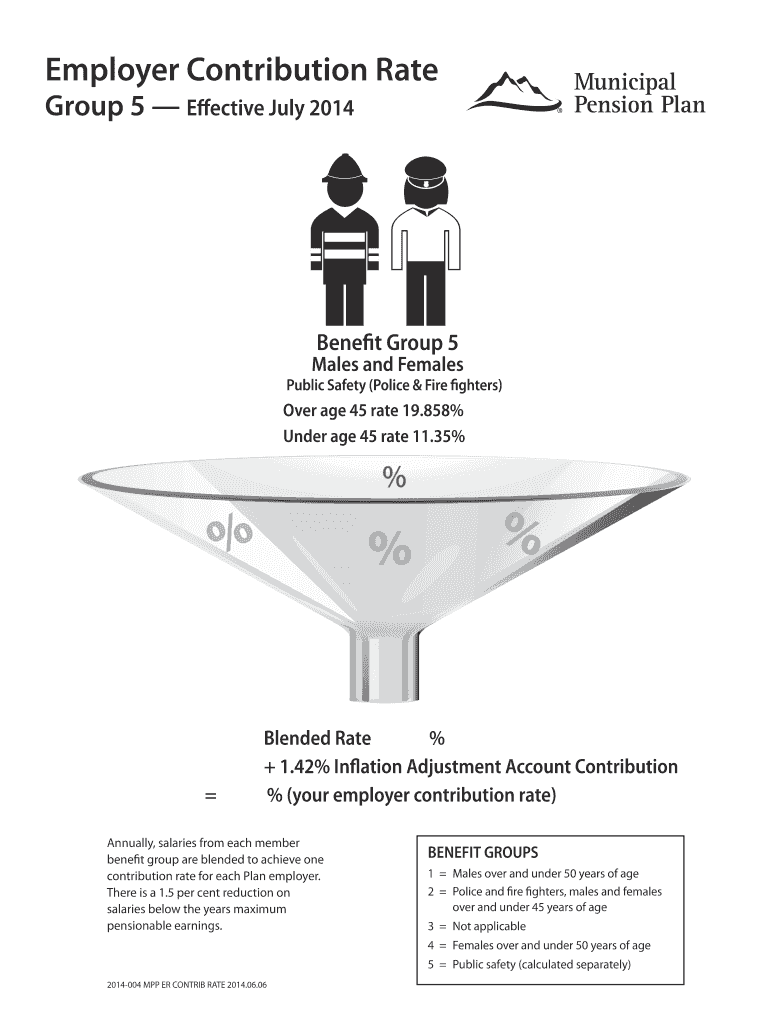

Employer Contribution Rate Group 5 Effective July 2014 Benefit Group 5 Males and Females Public Safety (Police & firefighters) Over age 45 rate 19.858% Under age 45 rate 11.35% % % % % Blended Rate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer bcontributionb rate group

Edit your employer bcontributionb rate group form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer bcontributionb rate group form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer bcontributionb rate group online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employer bcontributionb rate group. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer bcontributionb rate group

How to fill out employer contribution rate group?

01

Determine eligibility: Before filling out the employer contribution rate group form, you need to check if you qualify for this option. Typically, this applies to employers who offer retirement plans to their employees.

02

Gather necessary information: Prepare all the required information for filling out the form. This includes your company's tax identification number, number of employees, and the overall contribution rate you wish to allocate towards the retirement plan.

03

Access the form: Obtain the employer contribution rate group form from the appropriate source. This could be your retirement plan provider or the relevant government agency overseeing retirement plans.

04

Fill in the company details: Start by filling in the necessary company details on the form. This may include the company name, address, contact information, and any other required identification information.

05

Indicate the desired rate group: Specify the contribution rate group you wish to assign to your employees. This determines how much of the employees' salaries will be allocated towards the retirement plan. Ensure that the rate group chosen aligns with your company's financial capabilities and the benefits you want to provide.

06

Complete any additional sections: The form may ask for additional information, such as the effective date for the new contribution rate group or any specific requirements for employee participation. Fill in these sections accordingly.

07

Review and submit the form: Thoroughly review the completed form to ensure accuracy and consistency. Double-check all information before submitting it to the designated authority, whether electronically or in hard copy format.

Who needs employer contribution rate group?

01

Employers offering retirement plans: Businesses that provide retirement plans for their employees often need to establish an employer contribution rate group. This allows them to determine how much of the employees' compensation will be dedicated to retirement savings.

02

Companies with variable contribution rates: Some employers may opt for different contribution rate groups based on factors such as employee tenure, job level, or compensation package. Customizing the contribution rate group helps tailor the retirement plan benefits to suit the diverse needs of employees.

03

Businesses seeking compliance with regulations: In certain jurisdictions, employers are required to contribute a specific percentage of their employees' salaries towards retirement plans. They need to establish an employer contribution rate group to ensure compliance with these legal obligations.

Note: The specific requirements for employer contribution rate groups may vary depending on the country and the retirement plan provider. It is recommended to consult with a professional advisor or the relevant authority to ensure accurate completion of the form and compliance with regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit employer bcontributionb rate group from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including employer bcontributionb rate group, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit employer bcontributionb rate group on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign employer bcontributionb rate group. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out employer bcontributionb rate group on an Android device?

Use the pdfFiller app for Android to finish your employer bcontributionb rate group. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is employer contribution rate group?

Employer contribution rate group is a classification that determines the rate at which an employer must contribute to a retirement or pension plan on behalf of their employees.

Who is required to file employer contribution rate group?

Employers who offer retirement or pension plans to their employees are required to file employer contribution rate group.

How to fill out employer contribution rate group?

Employer contribution rate group can be filled out by providing details of the employer, the retirement or pension plan, and the contribution rates for each employee.

What is the purpose of employer contribution rate group?

The purpose of employer contribution rate group is to ensure that employees receive the correct contributions to their retirement or pension plans in accordance with regulations.

What information must be reported on employer contribution rate group?

Information such as employer details, employee details, contribution rates, and plan details must be reported on employer contribution rate group.

Fill out your employer bcontributionb rate group online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Bcontributionb Rate Group is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.