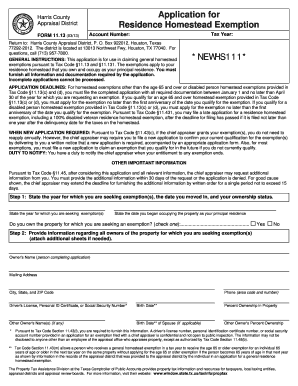

TX HCAD 11.13 2019-2025 free printable template

Show details

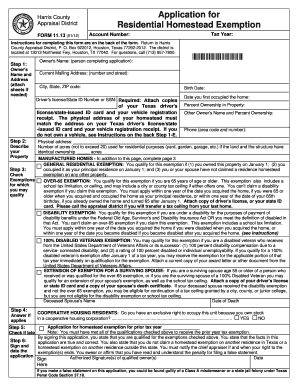

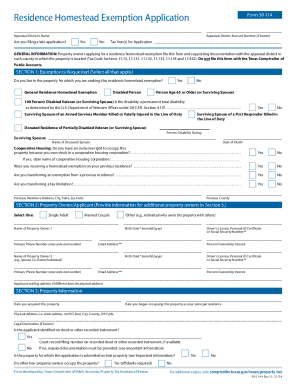

This document serves as an application for residence homestead exemptions in Harris County, Texas, including instructions and necessary information for applicants.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hcad homestead exemption form

Edit your hcad form 11 13 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hcad 11 13 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hcad exemption application online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form residence homestead exemption application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX HCAD 11.13 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out hcad exemption application online form

How to fill out TX HCAD 11.13

01

Obtain the TX HCAD 11.13 form from the appropriate county appraisal district's website or office.

02

Fill in your personal information including your name, address, and contact information at the top of the form.

03

Specify the property details, such as the property ID and the type of property you are reporting on.

04

Provide a clear and concise description of the issue or request regarding your property.

05

Attach any supporting documentation that may be necessary to substantiate your claim.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the form to the appropriate office by mail, email, or in person before the deadline.

Who needs TX HCAD 11.13?

01

Property owners who wish to contest the assessed value of their property for tax purposes.

02

Individuals seeking to explore exemptions or reductions related to property taxes.

03

Anyone wanting to address discrepancies or issues related to their property appraisal.

Fill

hcad residence homestead exemption application

: Try Risk Free

People Also Ask about 11 residence homestead get

Are property taxes capped at 65 in Texas?

In Texas, there is no age at which you stop paying property taxes.

At what age do senior citizens stop paying property taxes in Texas?

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

What is the homestead exemption in Texas 2023?

You may file an Application for Residential Homestead Exemption (PDF) with your appraisal district for the $25,000 homestead exemption up to two years after the taxes on the homestead are due. Once you receive the exemption, you do not need to reapply unless the chief appraiser sends you a new application.

At what age do you stop paying property taxes in Harris County?

What this means is that, at the age of 65, you can file your affidavit requesting that the local tax authority stop collecting taxes on your homestead - not indefinitely, but for a specific period. The deferral will end 181 days after one of two events: 1) the homeowner's death or 2) the sale of the property.

At what age can you stop paying property taxes in Texas?

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

What is the over 65 property tax exemption in Texas?

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send hcad residence homestead application for eSignature?

hcad form 11 13 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit hcad form 11 13 online?

With pdfFiller, it's easy to make changes. Open your hcad form 11 13 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit hcad form 11 13 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign hcad form 11 13 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is TX HCAD 11.13?

TX HCAD 11.13 is a form used for reporting certain business personal property to the Harris County Appraisal District in Texas.

Who is required to file TX HCAD 11.13?

Business owners who own tangible personal property with a total value exceeding a specific threshold are required to file TX HCAD 11.13.

How to fill out TX HCAD 11.13?

To fill out TX HCAD 11.13, provide accurate descriptions of the property, its location, and estimated values as required by the form instructions.

What is the purpose of TX HCAD 11.13?

The purpose of TX HCAD 11.13 is to ensure accurate assessment of business personal property for taxation purposes.

What information must be reported on TX HCAD 11.13?

The information that must be reported includes a description of the property, its location, value, and other relevant details as required by the form.

Fill out your hcad form 11 13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hcad Form 11 13 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.