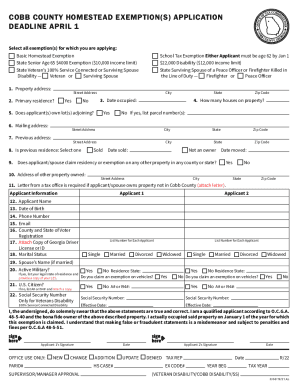

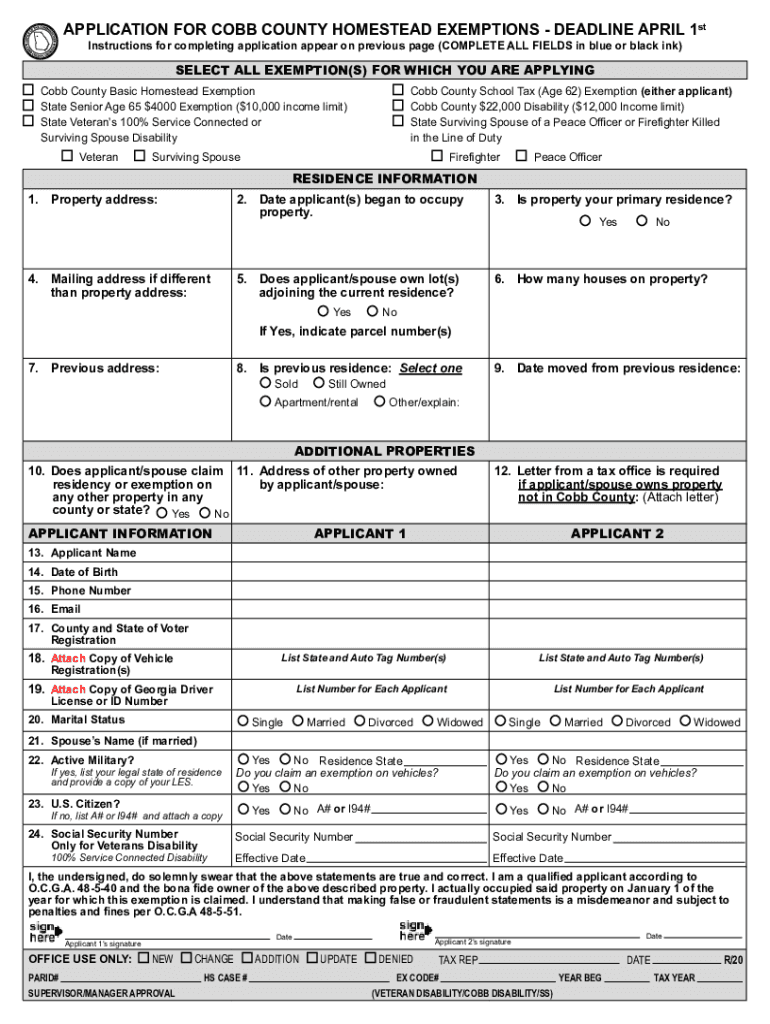

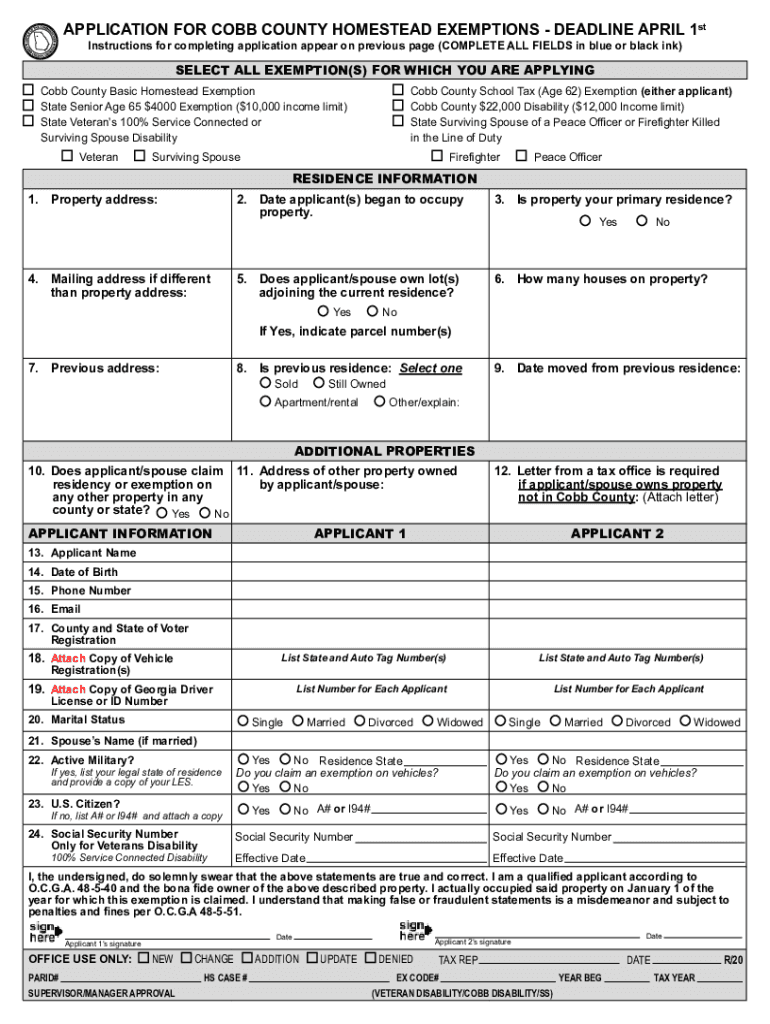

GA Application for Cobb County Homestead Exemptions 2020 free printable template

Show details

Instructions for Completing Your ApplicationApplications must be received, or U.S. postmarked by April 1st for processing in that tax year. Metered or kiosk postmark is not accepted as proof of timely

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cobb county homestead exemption

Edit your cobb county homestead exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cobb county homestead exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cobb county homestead exemption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cobb county homestead exemption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA Application for Cobb County Homestead Exemptions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cobb county homestead exemption

How to fill out GA Application for Cobb County Homestead Exemptions

01

Obtain the GA Application for Cobb County Homestead Exemptions form from the Cobb County Tax Assessor's Office or their website.

02

Fill out your personal information including name, address, and contact details.

03

Provide information about the property for which you are applying for the homestead exemption, including parcel number and address.

04

Indicate the type of exemptions you are applying for by marking the appropriate boxes on the form.

05

Provide proof of residency, which may include a Georgia driver's license or state ID showing the same address.

06

Include any additional documentation required, such as income statements for certain exemptions.

07

Review the completed application to ensure all information is accurate and complete.

08

Submit the application to the Cobb County Tax Assessor's Office by mail or in person before the deadline.

Who needs GA Application for Cobb County Homestead Exemptions?

01

Homeowners residing in Cobb County who wish to reduce their property taxes through available homestead exemptions.

02

Individuals who meet specific criteria for exemptions, such as senior citizens, disabled persons, or low-income homeowners.

Fill

form

: Try Risk Free

People Also Ask about

How much is the homestead exemption in Cobb County?

Cobb County Basic Homestead This is a $10,000 exemption in the county general and school general tax categories.

How much does a homestead exemption save you in Fulton County?

These Homestead Exemptions apply to the Fulton County portion of your property taxes anywhere in Fulton county, with no income or age limits. Fulton Schools Basic Exemption $2,000 Plus 3% Floating Homestead.

How much is Cobb County homestead exemption?

Cobb County Basic Homestead This is a $10,000 exemption in the county general and school general tax categories.

How much do you save if you homestead in Florida?

The Florida homestead exemption is a property tax break for eligible homeowners. It can reduce the taxable value on your primary home as much as $50,000, saving you approximately $750 per year. Additionally, your assessed value cannot increase more than 3 percent annually once you've been granted a homestead exemption.

What is needed for homestead exemption in GA?

To be granted a homestead exemption: A person must actually occupy the home, and the home is considered their legal residence for all purposes. Persons that are away from their home because of health reasons will not be denied homestead exemption.

How do I file for homestead exemption in Cobb County?

An application for homestead may be made with the county tax office at any time during the year subsequent to the property becoming the primary residence, up to April 1st of the first year for which the exemption is sought.

What is the floating homestead exemption in Cobb County?

The Floating Homestead Exemption increases each time the value of a homestead is increased so that the owner does not pay a higher County General Fund tax solely as a result of a reassessment. Over time this can amount to a significant exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cobb county homestead exemption for eSignature?

When you're ready to share your cobb county homestead exemption, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the cobb county homestead exemption electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your cobb county homestead exemption in seconds.

How do I edit cobb county homestead exemption on an iOS device?

Create, edit, and share cobb county homestead exemption from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is GA Application for Cobb County Homestead Exemptions?

The GA Application for Cobb County Homestead Exemptions is a form that residents of Cobb County, Georgia can fill out to apply for property tax exemptions on their primary residence, aimed at reducing the annual property tax burden.

Who is required to file GA Application for Cobb County Homestead Exemptions?

Homeowners who reside in Cobb County and own their primary residence are required to file the GA Application for Homestead Exemptions in order to qualify for any exemptions that may reduce their property taxes.

How to fill out GA Application for Cobb County Homestead Exemptions?

To fill out the GA Application for Cobb County Homestead Exemptions, applicants should obtain the form from the Cobb County Tax Assessor's website or office, complete it with necessary personal and property information, and submit it to the Tax Assessor's Office by the designated deadline.

What is the purpose of GA Application for Cobb County Homestead Exemptions?

The purpose of the GA Application for Cobb County Homestead Exemptions is to provide homeowners the opportunity to claim exemptions that can lower their property tax liability, thus offering financial relief to residents.

What information must be reported on GA Application for Cobb County Homestead Exemptions?

The information that must be reported on the GA Application for Cobb County Homestead Exemptions includes the applicant's name, address of the property, date of ownership, social security number, and any relevant income or age information required for specific exemptions.

Fill out your cobb county homestead exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cobb County Homestead Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.