PA Schedule PA-41X 2017 free printable template

Show details

1710310051SCHEDULE PA41 X

Amended PA Fiduciary

Income Tax Schedule

START

HERE

PA41 X 1017 (FI)

PA Department of RevenueName as shown on the PA41TO RETURN TO INSTRUCTIONS CLICK HERE2017OFFICIAL USE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA Schedule PA-41X

Edit your PA Schedule PA-41X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA Schedule PA-41X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA Schedule PA-41X online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA Schedule PA-41X. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA Schedule PA-41X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA Schedule PA-41X

How to fill out PA Schedule PA-41X

01

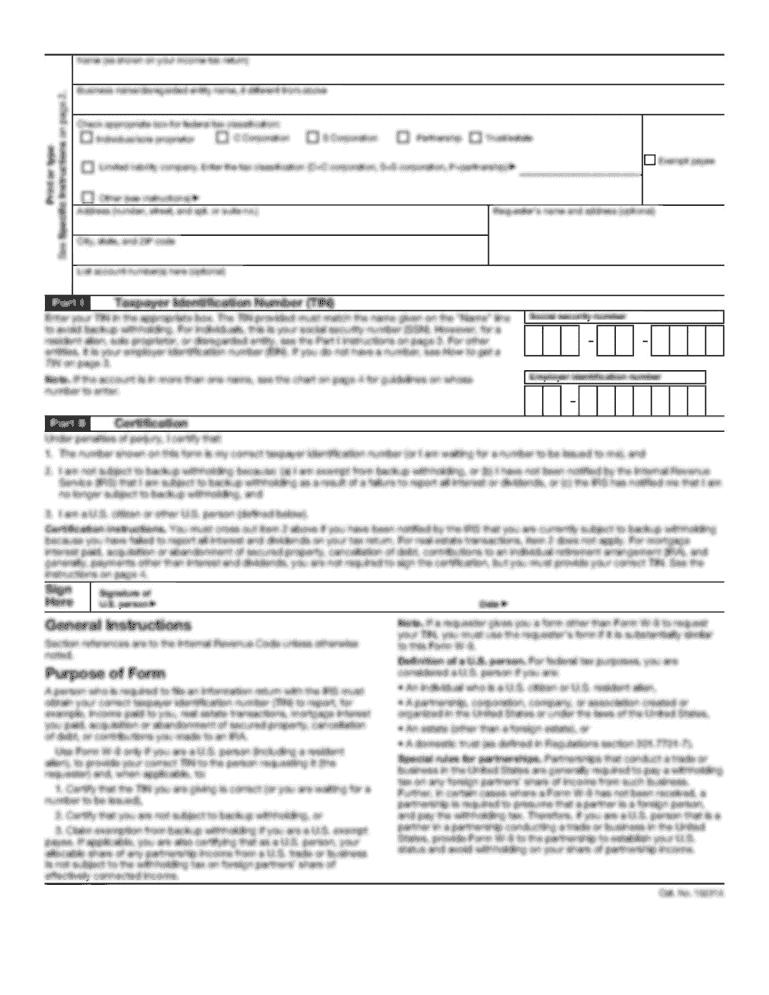

Begin with your basic information: your name, address, and tax identification number at the top of the form.

02

Indicate the tax year you are amending in the designated section.

03

Fill in the line for your original income as reported on the initial PA-41 form.

04

Adjust the amounts paid or any other relevant financial information that needs correction.

05

Provide a clear explanation of why you are amending the return in the explanation section.

06

Verify all calculations and ensure that the amended amounts are accurate.

07

Sign and date the form before submitting it to the Pennsylvania Department of Revenue.

Who needs PA Schedule PA-41X?

01

Anyone who previously filed a PA-41 return and needs to correct errors or update information on their tax return.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a PA-41?

The fiduciary of an estate or trust is required under Pennsylvania law to file a PA-41 Fiduciary Income Tax Return, and pay the tax on the taxable income of such estate or trust. If two or more fiduciaries are acting jointly, the return may be filed by any one of them.

What is the PA Schedule E for 2019?

Use PA-40 Schedule E to report the amount of net income (loss) from rents royalties, patents and copyrights for indi- vidual or fiduciary (estate or trust) taxpayers. Refer to the PA Personal Income Tax Guide – Net Income (Loss) from Rents, Royalties, Copyrights and Patents sec- tion for additional information.

Where can I get PA tax forms?

Many forms are available for download on the Internet. Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

What is the PA state income tax rate for 2019?

The state income tax rate for 2019 is 3.07 percent (0.0307). To remain consistent with the federal tax due date, the due date for filing 2019 Pennsylvania tax returns will be on or before midnight, Wednesday, April 15, 2020.

Does PA have state tax forms?

If you are trying to locate, download, or print state of Pennsylvania tax forms, you can do so on the Pennsylvania Department of Revenue. The most common Pennsylvania income tax form is the PA-40. This form is used by Pennsylvania residents who file an individual income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my PA Schedule PA-41X in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your PA Schedule PA-41X along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for the PA Schedule PA-41X in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your PA Schedule PA-41X in minutes.

How do I fill out PA Schedule PA-41X using my mobile device?

Use the pdfFiller mobile app to complete and sign PA Schedule PA-41X on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is PA Schedule PA-41X?

PA Schedule PA-41X is a supplementary form used by estates and trusts in Pennsylvania to amend previously filed PA-41 tax returns.

Who is required to file PA Schedule PA-41X?

Estates and trusts that need to amend their previously filed PA-41 tax returns are required to file PA Schedule PA-41X.

How to fill out PA Schedule PA-41X?

To fill out PA Schedule PA-41X, taxpayers need to provide the original amounts reported, the amended amounts, and the reasons for the changes.

What is the purpose of PA Schedule PA-41X?

The purpose of PA Schedule PA-41X is to correct errors or make changes to prior PA-41 tax returns filed by estates and trusts.

What information must be reported on PA Schedule PA-41X?

PA Schedule PA-41X must report the original return details, the amended figures, the reasons for the amendments, and any additional relevant information.

Fill out your PA Schedule PA-41X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA Schedule PA-41x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.