Get the free (CRR) and Statutory Liquidity Ratio (SLR) - IIBF

Show details

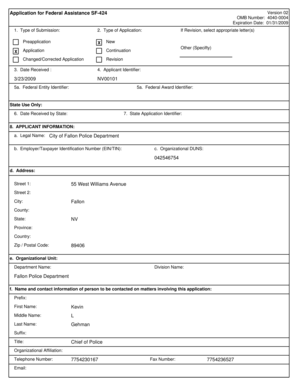

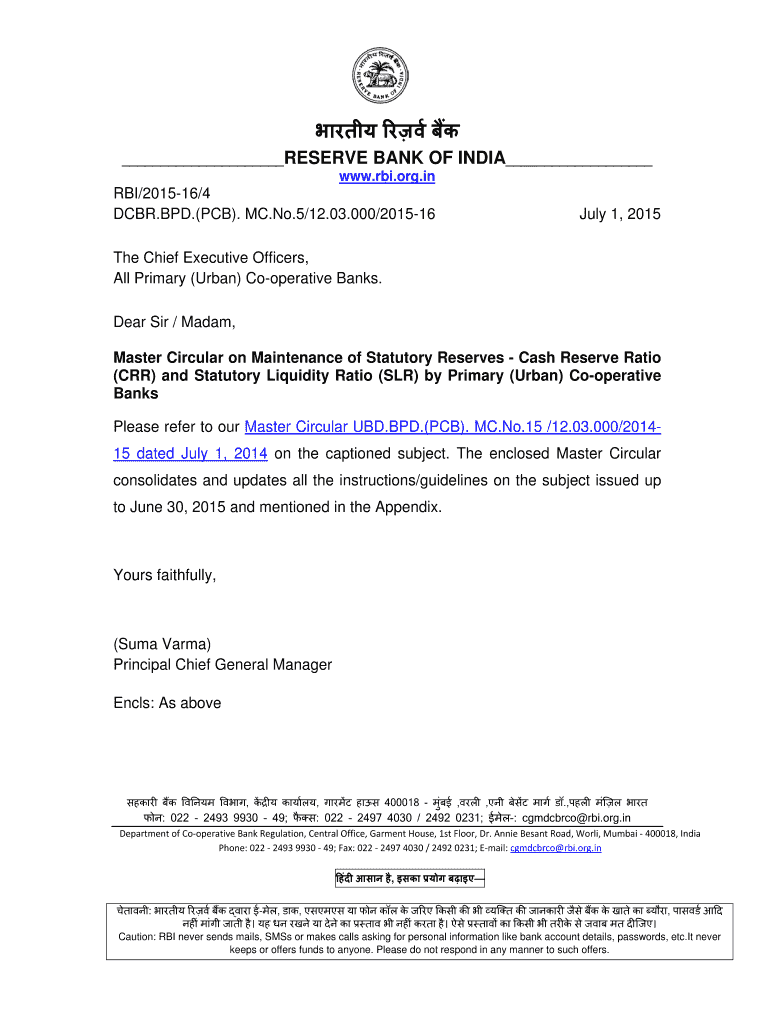

RESERVE BANK OF www.rbi.org.inINDIA RBI/201516/4 CBR.BPD.(PCB). MC. No.5/12.03.000/201516July 1, 2015The Chief Executive Officers, All Primary (Urban) Cooperative Banks. Dear Sir / Madam, Master Circular

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign crr and statutory liquidity

Edit your crr and statutory liquidity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your crr and statutory liquidity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit crr and statutory liquidity online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit crr and statutory liquidity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out crr and statutory liquidity

How to fill out crr and statutory liquidity

01

To fill out CRR (Cash Reserve Ratio), follow these steps:

02

Gather the required documents and information such as bank statements, balance sheets, and transaction details.

03

Calculate the percentage of total deposits that need to be maintained as cash reserves based on the prevailing CRR rate set by the central bank.

04

Deduct this calculated amount from the cash and bank balances to determine the remaining funds available for lending and investment purposes.

05

Ensure that the cash reserves are maintained on a daily basis and report any deviations to the central bank as per their guidelines.

06

To fill out statutory liquidity, follow these steps:

07

Identify the eligible liquid assets that can be included in statutory liquidity, such as cash, gold, government securities, and approved securities.

08

Calculate the percentage of total liabilities that need to be maintained as statutory liquidity based on the prevailing SLR (Statutory Liquidity Ratio) rate set by the central bank.

09

Monitor the value of the eligible liquid assets and ensure that it is maintained at or above the required SLR level at all times.

10

Submit regular reports and statements to the central bank providing details of the assets included in statutory liquidity.

11

Note: It is advisable to consult the specific guidelines and regulations of the respective central bank for accurate and up-to-date information on filling out CRR and statutory liquidity.

Who needs crr and statutory liquidity?

01

Banks and financial institutions need to maintain CRR and statutory liquidity as it is a regulatory requirement imposed by the central bank.

02

CRR helps in ensuring the stability of the banking system by controlling the liquidity in the economy and providing a buffer against potential financial shocks.

03

Statutory liquidity ensures that banks have enough liquid assets to meet their short-term obligations and maintain stability in the financial system.

04

Non-compliance with CRR and statutory liquidity requirements can result in penalties and regulatory action by the central bank.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out crr and statutory liquidity using my mobile device?

Use the pdfFiller mobile app to complete and sign crr and statutory liquidity on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit crr and statutory liquidity on an iOS device?

Use the pdfFiller mobile app to create, edit, and share crr and statutory liquidity from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit crr and statutory liquidity on an Android device?

With the pdfFiller Android app, you can edit, sign, and share crr and statutory liquidity on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is crr and statutory liquidity?

CRR stands for Cash Reserve Ratio and SLR stands for Statutory Liquidity Ratio. CRR is the percentage of net demand and time liabilities that banks must keep with the central bank in cash form, while SLR is the percentage of deposits that banks must invest in government securities or other approved securities.

Who is required to file crr and statutory liquidity?

All commercial banks in India are required to maintain CRR and SLR as mandated by the Reserve Bank of India (RBI).

How to fill out crr and statutory liquidity?

CRR and SLR are maintained by keeping a certain percentage of liabilities in the form of cash and investments respectively. Banks need to ensure they meet the required ratios on a daily basis.

What is the purpose of crr and statutory liquidity?

The purpose of CRR and SLR is to ensure that banks maintain a certain level of liquidity to meet depositor withdrawals and to maintain financial stability in the banking system.

What information must be reported on crr and statutory liquidity?

Banks need to report the amount of cash reserves held for CRR and the investments made for SLR in their periodic regulatory filings.

Fill out your crr and statutory liquidity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Crr And Statutory Liquidity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.