Get the free Non-qualified stock option grant for service as Director on Company's Board of direc...

Show details

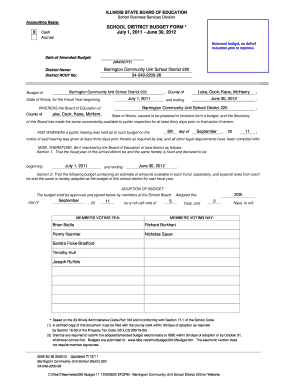

FORM 4OMB APPROVAL

OMB Number:

32350287

Estimated average burden

hours per response...

0.5UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549Check this box if no

longer subject

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-qualified stock option grant

Edit your non-qualified stock option grant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-qualified stock option grant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-qualified stock option grant online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit non-qualified stock option grant. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-qualified stock option grant

How to fill out non-qualified stock option grant

01

To fill out a non-qualified stock option grant, follow these steps:

02

Gather all necessary information, including the grant date, number of options granted, exercise price, vesting schedule, and expiration date.

03

Determine if any additional documents need to be completed, such as a stock option agreement or any tax-related forms.

04

Understand the tax implications and consequences of exercising the stock options, including any potential tax liabilities or benefits.

05

Consult with a financial or legal advisor if needed, to ensure compliance with relevant laws and regulations.

06

Fill out the stock option grant form accurately and completely, providing all required information in the appropriate sections.

07

Review the filled-out form for any errors or omissions before submitting it.

08

Submit the filled-out stock option grant form to the relevant parties, such as your employer or the stock plan administrator.

09

Keep a copy of the completed form for your records.

10

Monitor the stock options' vesting schedule and keep track of any key dates or milestones.

11

Make informed decisions regarding exercising the stock options based on market conditions, personal financial goals, and tax considerations.

Who needs non-qualified stock option grant?

01

Non-qualified stock option grants are typically offered to employees of a company as a form of compensation.

02

The employees who may benefit from non-qualified stock option grants include:

03

- Executives and high-ranking employees who have a significant impact on the company's performance.

04

- Key employees who contribute to the company's growth and success.

05

- Employees in startups or early-stage companies where stock options are commonly used as an incentive.

06

- Employees in publicly traded companies where stock options are part of the overall compensation package.

07

Non-qualified stock option grants can provide employees with the opportunity to purchase company stock at a predetermined price, potentially gaining value as the stock price appreciates. Additionally, stock options can align employees' interests with those of the company's shareholders, fostering a sense of ownership and motivation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-qualified stock option grant directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign non-qualified stock option grant and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for the non-qualified stock option grant in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your non-qualified stock option grant in minutes.

Can I create an electronic signature for signing my non-qualified stock option grant in Gmail?

Create your eSignature using pdfFiller and then eSign your non-qualified stock option grant immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is non-qualified stock option grant?

A non-qualified stock option grant is a type of stock option that does not qualify for special tax treatment.

Who is required to file non-qualified stock option grant?

Employers who grant non-qualified stock options to employees are required to file the grant with the appropriate tax authorities.

How to fill out non-qualified stock option grant?

Non-qualified stock option grants should be filled out following the guidelines provided by the tax authorities, including disclosing the details of the grant and the parties involved.

What is the purpose of non-qualified stock option grant?

The purpose of a non-qualified stock option grant is to provide employees with an opportunity to purchase company stock at a predetermined price, with the potential for financial gain.

What information must be reported on non-qualified stock option grant?

Information such as the grant date, exercise price, number of shares, and expiration date must be reported on a non-qualified stock option grant.

Fill out your non-qualified stock option grant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Qualified Stock Option Grant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.