Get the free Excise Act, 2001. Application for refund

Show details

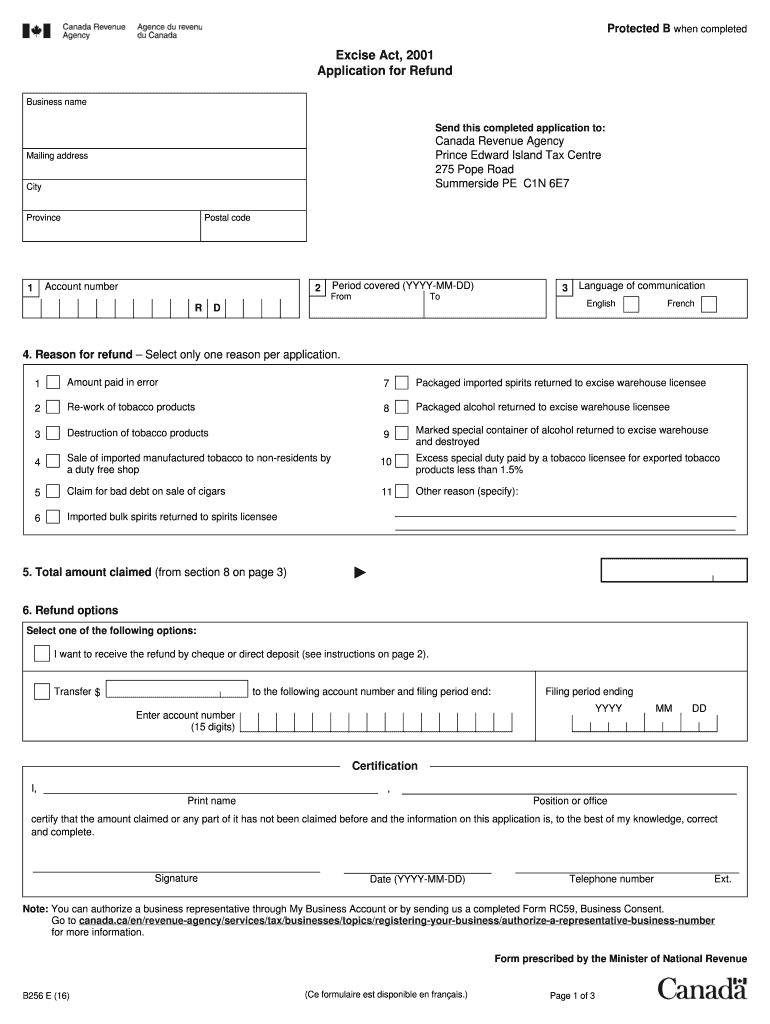

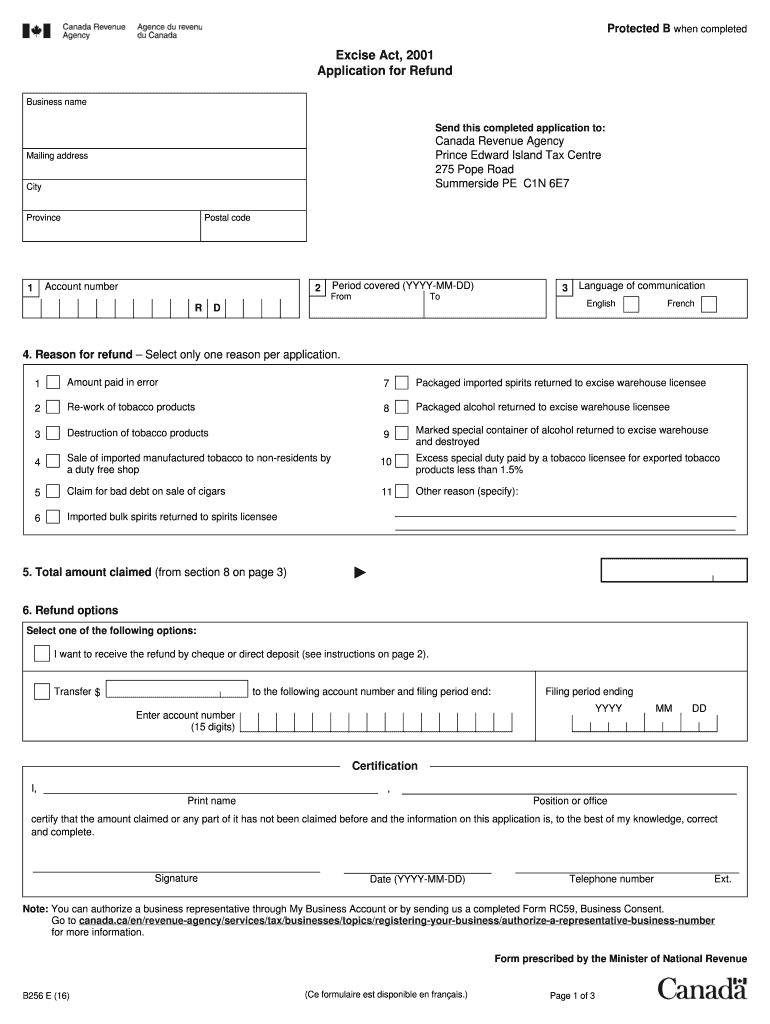

Protected B when completedExcise Act, 2001 Application for Refund Business named this completed application to:Canada Revenue Agency Prince Edward Island Tax Center 275 Pope Road Summer side PE C1N

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign excise act 2001 application

Edit your excise act 2001 application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your excise act 2001 application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing excise act 2001 application online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit excise act 2001 application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out excise act 2001 application

How to fill out excise act 2001 application

01

To fill out the Excise Act 2001 application, follow these steps:

02

Start by downloading the official application form from the government website or obtain a physical copy.

03

Read the instructions provided with the application form carefully to understand the requirements and necessary information.

04

Begin by entering your personal details, including your name, address, contact information, and any other relevant identification information.

05

Proceed to the section of the application that pertains to the specific excise duty you are applying for. This could be related to alcohol, tobacco, fuel, or any other applicable category.

06

Provide all the required details related to the specific excise duty, such as the type of product, quantity, value, and any applicable taxes or duties.

07

Ensure that all the information entered is accurate and complete. Double-check your entries before submitting the application.

08

If any supporting documents or additional information is required, make sure to attach them along with the application form.

09

Review the completed application thoroughly for any mistakes or omissions. Make necessary corrections if needed.

10

Once you are satisfied with the accuracy of the application, submit it to the designated authority or governing body responsible for handling excise act applications.

11

Keep copies of the submitted application and any supporting documents for your records.

12

Note: It is highly recommended to consult legal experts or professionals familiar with Excise Act 2001 and its application process for better accuracy and compliance.

Who needs excise act 2001 application?

01

Any individual, business, or organization that is required to comply with the Excise Act 2001 may need to fill out the application.

02

This includes manufacturers, importers, distributors, wholesalers, and retailers of excisable goods such as alcohol, tobacco, fuel, or any other product subject to excise duty.

03

Additionally, individuals or entities involved in activities regulated by Excise Act 2001, such as producing or dealing with designated substances like cannabis, may also require filling out the application.

04

It is advisable to refer to the specific laws and regulations applicable in your jurisdiction or consult with relevant authorities to determine if you need to fill out the Excise Act 2001 application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my excise act 2001 application directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your excise act 2001 application and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get excise act 2001 application?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the excise act 2001 application. Open it immediately and start altering it with sophisticated capabilities.

How can I edit excise act 2001 application on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing excise act 2001 application.

What is excise act application for?

The Excise Act application is used to apply for the necessary permits and licenses required for excise activities such as producing, packaging, and distributing excisable goods.

Who is required to file excise act application for?

Any individual or business involved in excise activities, such as producing, packaging, or distributing excisable goods, is required to file an Excise Act application.

How to fill out excise act application for?

To fill out the Excise Act application, individuals or businesses need to provide information about their excise activities, including details about the excisable goods being produced or distributed, as well as information about their business operations.

What is the purpose of excise act application for?

The purpose of the Excise Act application is to ensure that individuals and businesses involved in excise activities comply with the necessary regulations and obtain the required permits and licenses.

What information must be reported on excise act application for?

The Excise Act application typically requires information about the excisable goods being produced or distributed, details about the business operations, and any other relevant information required by the governing authority.

Fill out your excise act 2001 application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Excise Act 2001 Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.