CO DR 1002 2019 free printable template

Show details

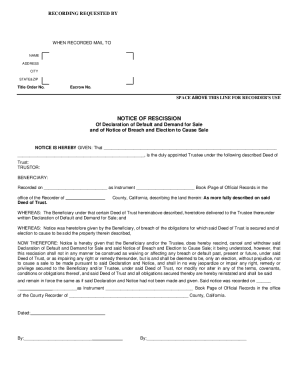

DR 1002 (06/19/19)

COLORADO DEPARTMENT OF REVENUE

Taxpayer Service Division

PO Box 17087

Denver CO 802170087Colorado Sales/Use Tax Rates

For most recent version see Colorado.gov/TaxThis publication,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DR 1002

Edit your CO DR 1002 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DR 1002 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CO DR 1002 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CO DR 1002. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR 1002 Form Versions

Version

Form Popularity

Fillable & printabley

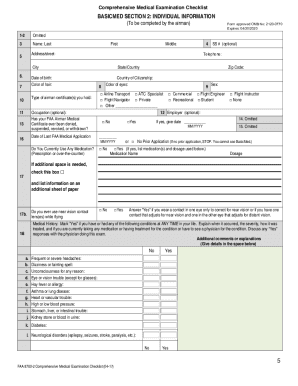

How to fill out CO DR 1002

How to fill out CO DR 1002

01

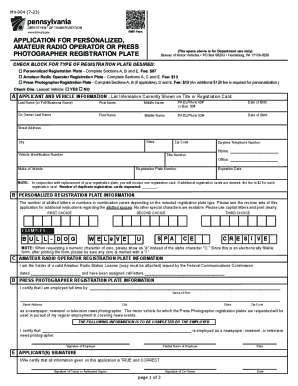

Obtain the CO DR 1002 form from the appropriate government website or office.

02

Carefully read the instructions provided with the form.

03

Fill out the personal information section, including your name, address, and contact details.

04

Provide any required identification numbers, such as Social Security Number or Tax ID.

05

Clearly state the purpose of filling out the form in the designated section.

06

Review all the information you have entered for accuracy.

07

Sign and date the form as required.

08

Submit the completed form either online, by mail, or in person, as indicated.

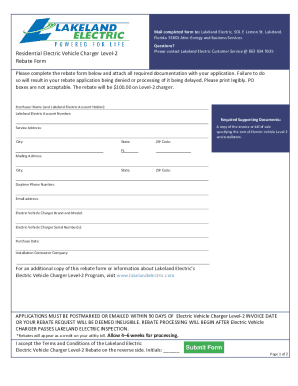

Who needs CO DR 1002?

01

Individuals or businesses applying for certain licenses or permits in Colorado.

02

Anyone needing to update or amend previously filed documents with the state.

03

Legal representatives acting on behalf of clients who require the CO DR 1002.

Fill

form

: Try Risk Free

People Also Ask about

What city has the highest sales tax in Colorado?

Combined with the state sales tax, the highest sales tax rate in Colorado is 11.2% in the city of Winter Park.

What is the use tax rate in Denver Colorado?

The minimum combined 2022 sales tax rate for Denver, Colorado is 8.81%. This is the total of state, county and city sales tax rates. The Colorado sales tax rate is currently 2.9%. The County sales tax rate is 0%.

What is Colorado sales tax rate 2022?

What is the sales tax rate in Denver, Colorado? The minimum combined 2022 sales tax rate for Denver, Colorado is 8.81%. This is the total of state, county and city sales tax rates. The Colorado sales tax rate is currently 2.9%.

How do I find sales and use tax rates in Colorado?

The Geographic Information System (GIS) now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. The GIS not only shows state sales tax information, but it also includes sales tax information for counties, municipalities, and special taxation districts.

Where is the lowest sales tax in Colorado?

Colorado Sales Tax Rates By City and County Including these local taxes, the lowest sales tax rate in Colorado is 2.9% in twenty cities, including Gill and Weldona, and the highest sales tax is 11.2% in Winter Park.

What is the state sales tax for Colorado?

Colorado sales tax details The Colorado (CO) state sales tax rate is currently 2.9%. Depending on local municipalities, the total tax rate can be as high as 11.2%.

What's the sales tax in Denver Colorado?

Sales Tax. The Denver Revised Municipal Code (DRMC) imposes a 4.81% sales tax on the purchase price paid or charged on retail sales including retail sales made online to Denver customers, leases, or rentals of taxable tangible personal property, products, and on certain services.

What is Colorado's sales tax rate?

Colorado sales tax details The Colorado (CO) state sales tax rate is currently 2.9%. Depending on local municipalities, the total tax rate can be as high as 11.2%. Companies doing business in Colorado need to register with the Colorado Department of Revenue.

Does Colorado have a sales and use tax?

Colorado imposes sales tax on retail sales of tangible personal property. In general, the tax does not apply to sales of services, except for those services specifically taxed by law.

How do you calculate sales tax in Colorado?

How 2022 Sales taxes are calculated in Colorado. The state general sales tax rate of Colorado is 2.9%. Cities and/or municipalities of Colorado are allowed to collect their own rate that can get up to 7% in city sales tax.

What state has the highest sales tax in 2022?

2022 Combined State and Local Sales Tax Rates The five states with the highest average combined state and local sales tax rates are Louisiana (9.55 percent), Tennessee (9.547 percent), Arkansas (9.48 percent), Washington (9.29 percent), and Alabama (9.22 percent).

How do I calculate Colorado use tax?

Colorado has a use tax rate of 2.9% on all tangible goods, including lumber. So, the Consumer Use Tax rate on that lumber would be 7.385%. To determine the amount of Consumer Use Tax you would need to pay in this example, you would multiply the cost of the lumber by 0.07385. 5.

What is Colorado retailers use tax?

The state consumer use tax rate is the same as the sales tax rate: 2.9%. With proof of payment, sales tax paid to another state may be credited against consumer use tax due in Colorado for a particular item. Use tax is also collected by some local governments and special districts.

What is the Colorado state sales tax rate for 2022?

You can read more about Colorado sales tax and retailer's use tax at the Colorado Department of Revenue website. The Colorado state sales tax rate is 2.9%.

Does Amazon collect Colorado use tax?

Customers purchasing on Amazon and shipping to the following states may have consumer use tax obligations. If tax is not collected on your order, the state of Colorado requires that a Colorado purchaser file a sales and use tax return at the end of the year.

What is the sales tax in Colorado 2022?

You can read more about Colorado sales tax and retailer's use tax at the Colorado Department of Revenue website. The Colorado state sales tax rate is 2.9%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CO DR 1002 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your CO DR 1002 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete CO DR 1002 online?

pdfFiller has made it easy to fill out and sign CO DR 1002. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit CO DR 1002 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as CO DR 1002. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is CO DR 1002?

CO DR 1002 is a tax form used in Colorado for reporting certain tax-related information, particularly for businesses.

Who is required to file CO DR 1002?

Businesses operating in Colorado that meet specific criteria regarding their income or transactions may be required to file CO DR 1002.

How to fill out CO DR 1002?

To fill out CO DR 1002, businesses must gather relevant financial data, carefully complete each section of the form according to the provided instructions, and ensure all calculations are accurate before submission.

What is the purpose of CO DR 1002?

The purpose of CO DR 1002 is to provide tax authorities with detailed information about business transactions and tax obligations to ensure compliance with Colorado tax laws.

What information must be reported on CO DR 1002?

CO DR 1002 requires the reporting of various business financial details, including income, expenses, and other pertinent data relating to tax obligations.

Fill out your CO DR 1002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DR 1002 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.