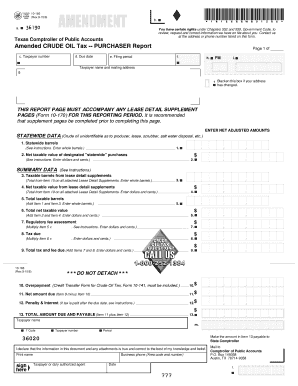

India Bhagwant Group Employees Income Tax Declaration Form 2018-2026 free printable template

Show details

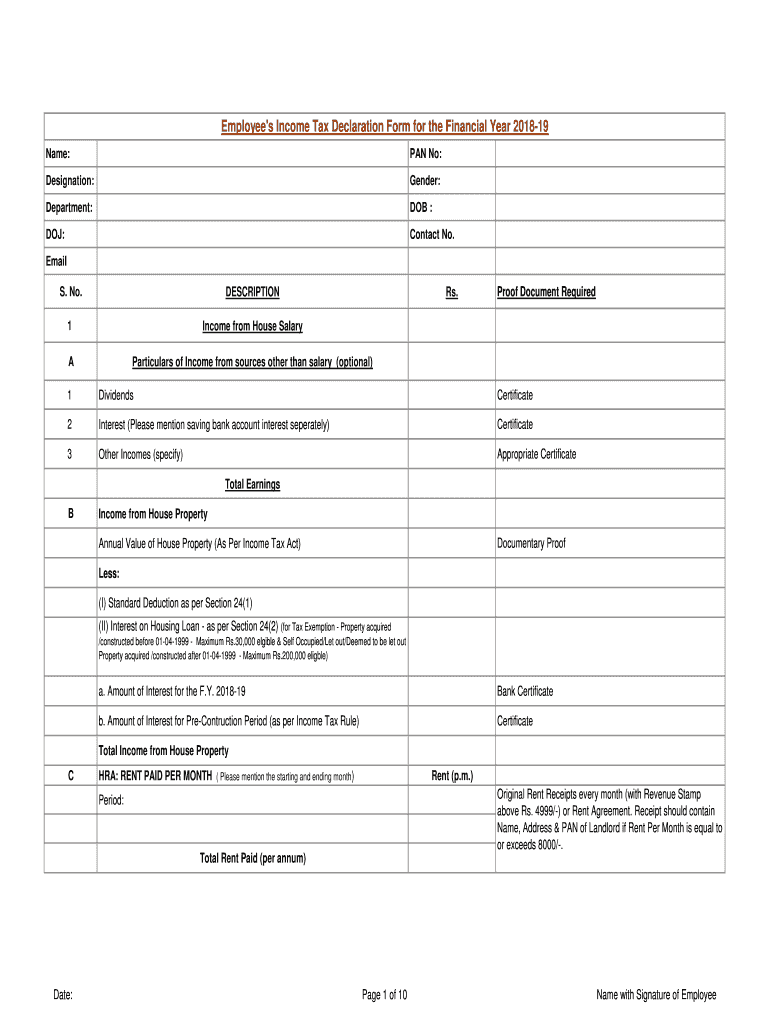

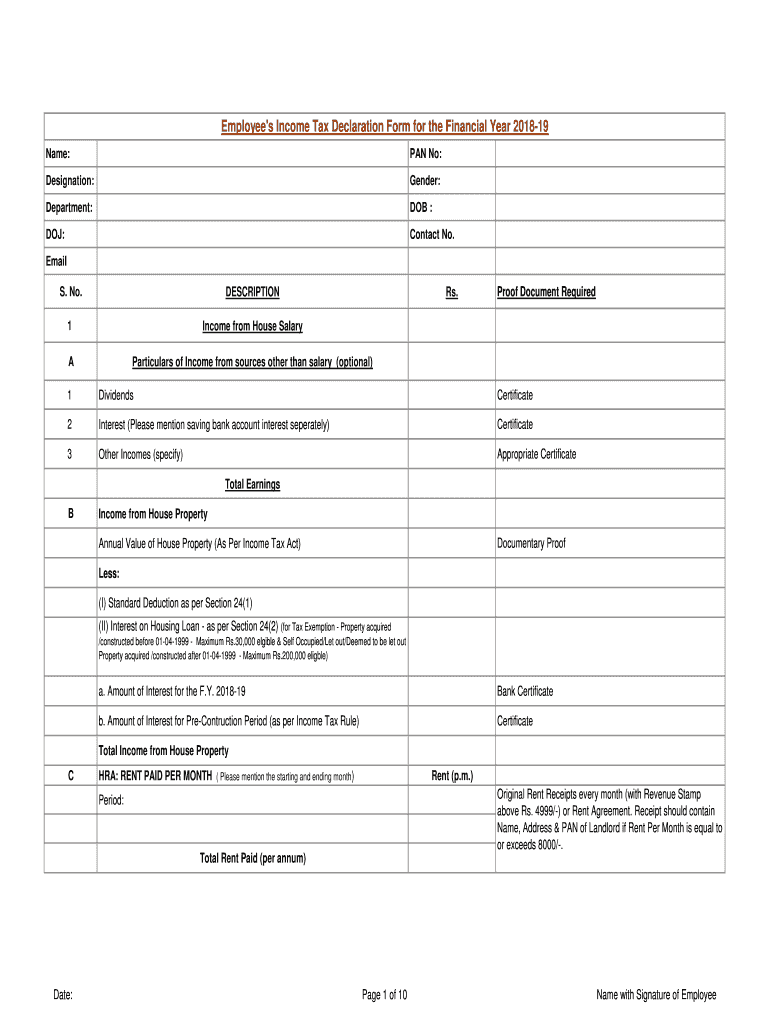

Employee\'s Income Tax Declaration Form for the Financial Year 201819

Name:PAN No:Designation:Gender:Department:DOB :DOJ:Contact No. Email

S. No.DESCRIPTION1Income from House SalaryAParticulars of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax declaration form pdf

Edit your income tax declaration form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income declaration form telangana form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income declaration form pdf telangana online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit income declaration form pdf. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out India Bhagwant Group Employees Income Tax

How to fill out India Bhagwant Group Employees Income Tax Declaration

01

Obtain the Income Tax Declaration form from the HR department.

02

Fill in your personal details such as name, employee ID, and designation.

03

Declare your income sources, including salary, bonuses, and any other earnings.

04

Provide details of deductions you wish to claim, such as Section 80C investments, medical insurance, etc.

05

Include details of any tax-saving instruments or funds you are utilizing.

06

Review all entries for accuracy and completeness.

07

Sign and date the declaration form.

08

Submit the completed form to the HR or finance department by the specified deadline.

Who needs India Bhagwant Group Employees Income Tax Declaration?

01

Employees of the India Bhagwant Group who are subject to income tax.

02

Any employee looking to declare their income and expenses to facilitate tax calculations.

03

New employees who have joined within the tax year and need to submit their declarations.

Fill

form

: Try Risk Free

People Also Ask about

What is tax return declaration?

There's no difference between tax return and tax declaration “ Just like in English, these all mean the same thing. All of these terms describe your final tax liability being evaluated and determining your overpaid or underpaid wage tax.

Can I download and print tax forms?

You can e-file directly to the IRS and download or print a copy of your tax return.

What is the tax declaration form in the US?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Is a 1040 the same as a w2?

"No, 1040 is not the same as a W-2. W-2 is a form provided by the employer to the employee that states the gross wages in a given year and all the tax withheld and deductions," says Armine Alajian, CPA and founder of the Alajian Group, a company providing accounting services and business management for startups.

What documents do I need to mail with my tax return?

These include: A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other tax-deductible expenses if you are itemizing your return.

What is a declaration of taxes?

Tax Declaration means a document on the standard form stipulated by the Ministry of Finance and used by taxpayers to declare information aimed at determining the amount of tax payable. A customs declaration shall be used to declare duty on import or export goods.

What is a 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the India Bhagwant Group Employees Income Tax in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my India Bhagwant Group Employees Income Tax in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your India Bhagwant Group Employees Income Tax right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out India Bhagwant Group Employees Income Tax using my mobile device?

Use the pdfFiller mobile app to fill out and sign India Bhagwant Group Employees Income Tax. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is India Bhagwant Group Employees Income Tax Declaration?

India Bhagwant Group Employees Income Tax Declaration is a document that employees are required to submit to declare their income and claim deductions for tax purposes.

Who is required to file India Bhagwant Group Employees Income Tax Declaration?

All employees of the India Bhagwant Group who have taxable income are required to file the Income Tax Declaration.

How to fill out India Bhagwant Group Employees Income Tax Declaration?

To fill out the declaration, employees must provide details of their total income, along with any deductions they wish to claim under applicable sections of the Income Tax Act.

What is the purpose of India Bhagwant Group Employees Income Tax Declaration?

The purpose of the declaration is to enable the employer to deduct the correct amount of tax at source and to help employees manage their tax liabilities efficiently.

What information must be reported on India Bhagwant Group Employees Income Tax Declaration?

Employees must report their gross income, details of tax-saving investments, and any other deductions or exemptions they are eligible for, such as those under sections 80C, 80D, etc.

Fill out your India Bhagwant Group Employees Income Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India Bhagwant Group Employees Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.