CA Declaration of Gross Receipts - City of Ceres 2019 free printable template

Show details

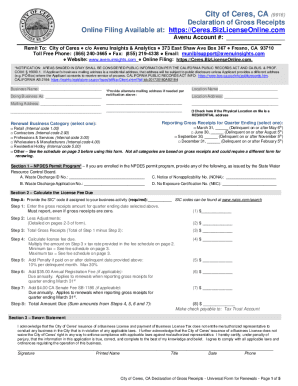

City of Ceres, CA (9916) Declaration of Gross Receipts Online Filing Available at: https://Ceres.BizLicenseOnline.com Remit To: City of Ceres c/o Avenue Insights & Analytics 373 East Shaw Ave Box

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Declaration of Gross Receipts - City

Edit your CA Declaration of Gross Receipts - City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Declaration of Gross Receipts - City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Declaration of Gross Receipts - City online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA Declaration of Gross Receipts - City. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Declaration of Gross Receipts - City of Ceres Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Declaration of Gross Receipts - City

How to fill out CA Declaration of Gross Receipts - City of Ceres

01

Obtain the CA Declaration of Gross Receipts form from the City of Ceres website or designated office.

02

Review the instructions provided with the form carefully to understand the requirements.

03

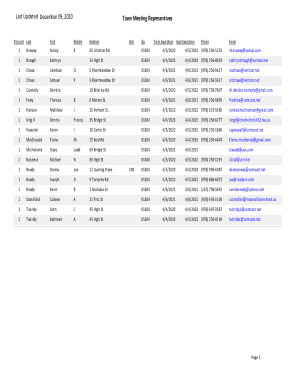

Fill in your business name and address in the designated fields.

04

Report your total gross receipts for the specified period accurately, ensuring to include all sources of revenue.

05

Include any deductions or adjustments as instructed, ensuring you have documentation to support these figures.

06

Provide your contact information, including phone number and email address.

07

Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

08

Submit the completed form to the City of Ceres by the specified deadline, through the method outlined in the instructions (mail, online, or in-person).

Who needs CA Declaration of Gross Receipts - City of Ceres?

01

Any business operating within the City of Ceres that is required to report gross receipts for tax purposes.

02

Businesses that are applying for licenses or permits that require proof of gross receipts.

03

Entities that need to demonstrate compliance with local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What are gross receipts for an LLC?

Gross income Generally, gross receipts is all revenue that your business received during a given year from: Sales of goods.

What is the LLC gross receipts tax?

LLC gross receipts tax is the gross income of the limited liability company. Before choosing to form an LLC, you should first be mindful of the benefits and drawbacks of the LLC, particularly in terms of the tax structure. Generally, the Internal Revenue Service (IRS) disregards the LLC as a taxable entity.

What document shows gross receipts?

Documents for gross receipts include the following: Cash register tapes. Deposit information (cash and credit sales) Receipt books.

How do you provide gross receipts?

How do I Estimate Gross Receipts? Add all of your transactions to get the sum of your business's expenditure, then subtract the cost of goods sold. Include sales returns and allowances when calculating this sum. This amount is your whole estimate for that month or year.

How do you calculate the gross receipts?

To find your gross receipts for personal income, add up your sales. Then, subtract your cost of goods sold and sales returns and allowances to get total income. The better your financial records are, the easier the process will be.

What are the gross receipts for a business?

Generally, gross receipts is all revenue that your business received during a given year from: Sales of goods. Provision of services. Other income producing assets or activities.

What are examples of gross receipts?

Gross receipts include all revenue in whatever form received or accrued (in ance with the entity's accounting method) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances.

How much is New Mexico gross receipts tax?

Unlike the gross receipts taxes that are in lieu of income taxes, which tend to be low, the base or state New Mexico GRT is 5%. Municipal and county gross receipts taxes are on top of that and can bring the total GRT rate to 9.3125% (as of this writing).

How do you calculate gross receipts?

To find your gross receipts for personal income, add up your sales. Then, subtract your cost of goods sold and sales returns and allowances to get total income. The better your financial records are, the easier the process will be.

How do you fill out a gross receipt?

How do I Estimate Gross Receipts? Add all of your transactions to get the sum of your business's expenditure, then subtract the cost of goods sold. Include sales returns and allowances when calculating this sum. This amount is your whole estimate for that month or year.

What does enter gross receipts mean?

Gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items. Unlike gross sales, gross receipts capture anything that is not related to the normal business activity of an entity—tax refunds, donations, interest and dividend income, and others.

What is proof of gross receipts?

Documents for gross receipts include the following: Cash register tapes. Deposit information (cash and credit sales) Receipt books. Invoices.

What may be included in gross receipts?

Gross receipts include all revenue in whatever form received or accrued (in ance with the entity's accounting method) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances.

How do I calculate gross receipts for IRS?

How do I Estimate Gross Receipts? Add all of your transactions to get the sum of your business's expenditure, then subtract the cost of goods sold. Include sales returns and allowances when calculating this sum. This amount is your whole estimate for that month or year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CA Declaration of Gross Receipts - City on an iOS device?

Create, modify, and share CA Declaration of Gross Receipts - City using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out CA Declaration of Gross Receipts - City on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your CA Declaration of Gross Receipts - City. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete CA Declaration of Gross Receipts - City on an Android device?

Complete CA Declaration of Gross Receipts - City and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is CA Declaration of Gross Receipts - City of Ceres?

The CA Declaration of Gross Receipts for the City of Ceres is a document required for businesses operating within the city to report their total revenue for a specific period, typically used to assess business taxes.

Who is required to file CA Declaration of Gross Receipts - City of Ceres?

All businesses operating within the City of Ceres that generate gross receipts are required to file the CA Declaration of Gross Receipts, regardless of their business structure or revenue level.

How to fill out CA Declaration of Gross Receipts - City of Ceres?

To fill out the CA Declaration of Gross Receipts, businesses must provide accurate information about their total gross receipts, complete any required sections regarding business identification, and submit the form to the appropriate city department along with any necessary fees.

What is the purpose of CA Declaration of Gross Receipts - City of Ceres?

The purpose of the CA Declaration of Gross Receipts is to ensure that businesses report their revenue accurately for tax assessment and compliance with local regulations.

What information must be reported on CA Declaration of Gross Receipts - City of Ceres?

Businesses must report total gross receipts, business identification details, and any additional information required by the city, such as business type and periods of operation.

Fill out your CA Declaration of Gross Receipts - City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Declaration Of Gross Receipts - City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.