Get the free Non-Retirement Accounts O - The Timothy Plan

Show details

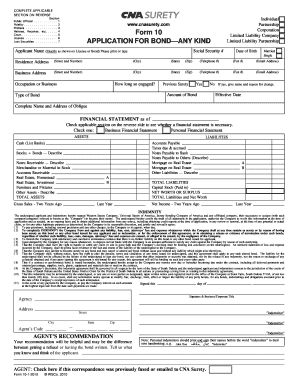

Reset FormNonRetirement AccountsUGMA/TMA SUCCESSOR CUSTODIAN DESIGNATIONO1 Current Account Registration

Account Information

FOR ASSISTANCE with this form, call

Shareholder Services at (800) 6620201,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-retirement accounts o

Edit your non-retirement accounts o form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-retirement accounts o form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-retirement accounts o online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-retirement accounts o. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-retirement accounts o

How to fill out non-retirement accounts o

01

Start by gathering all the necessary documentation such as your identification, social security number, and financial information.

02

Research and choose a financial institution or brokerage firm that offers non-retirement accounts.

03

Open an account by filling out the required forms and providing the necessary information.

04

Determine your investment goals and risk tolerance to decide on the type of account that suits your needs.

05

Consult with a financial advisor if needed to get guidance on selecting appropriate investments for your non-retirement account.

06

Once your account is set up, fund it by making an initial deposit or setting up regular contributions.

07

Monitor your account regularly and make adjustments to your investments based on your financial goals and market conditions.

08

Keep track of your account statements and tax documents for reporting purposes.

09

Consider seeking professional tax advice to understand the tax implications of your non-retirement account.

10

Review and update your investment strategy periodically to ensure it aligns with your changing financial circumstances.

Who needs non-retirement accounts o?

01

Non-retirement accounts are suitable for individuals who:

02

- Want to invest their money outside of tax-advantaged retirement accounts like 401(k)s or IRAs.

03

- Have already maximized their contributions to retirement accounts and want additional investment options.

04

- Need flexibility to access their funds before retirement without facing penalties.

05

- Are looking to save for specific financial goals such as buying a house, starting a business, or funding education.

06

- Want to diversify their investment portfolio and include different types of assets.

07

- Have a higher risk tolerance and are willing to take on more aggressive investment strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non-retirement accounts o for eSignature?

Once your non-retirement accounts o is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in non-retirement accounts o without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your non-retirement accounts o, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the non-retirement accounts o electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your non-retirement accounts o.

What is non-retirement accounts o?

Non-retirement accounts refer to investment accounts that are not specifically designated for retirement savings, such as brokerage accounts or savings accounts.

Who is required to file non-retirement accounts o?

Individuals with non-retirement investment accounts are typically required to file information about these accounts for tax reporting purposes.

How to fill out non-retirement accounts o?

Non-retirement accounts can be filled out by providing information about the account holder, account balances, investment income, and any capital gains or losses.

What is the purpose of non-retirement accounts o?

The purpose of non-retirement accounts is to help individuals grow their investment portfolios outside of traditional retirement accounts.

What information must be reported on non-retirement accounts o?

Information that must be reported on non-retirement accounts includes account holders name, address, account balances, investment income, and capital gains or losses.

Fill out your non-retirement accounts o online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Retirement Accounts O is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.