Get the free Member Business Loan Application REQUESTED LOAN ...

Show details

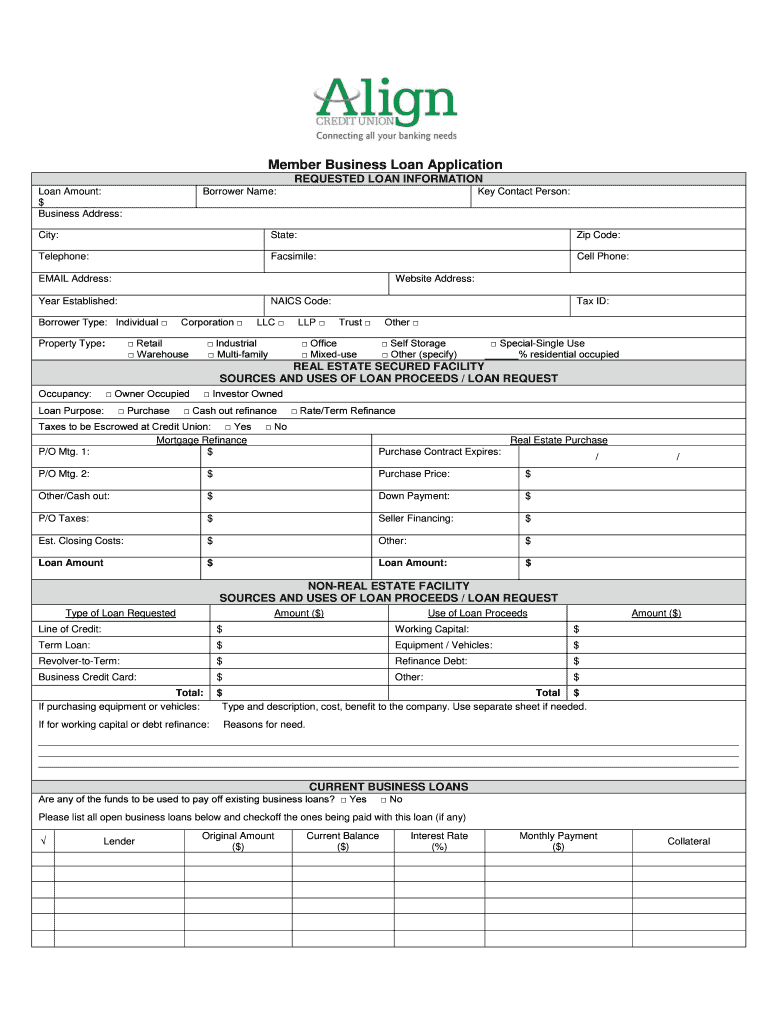

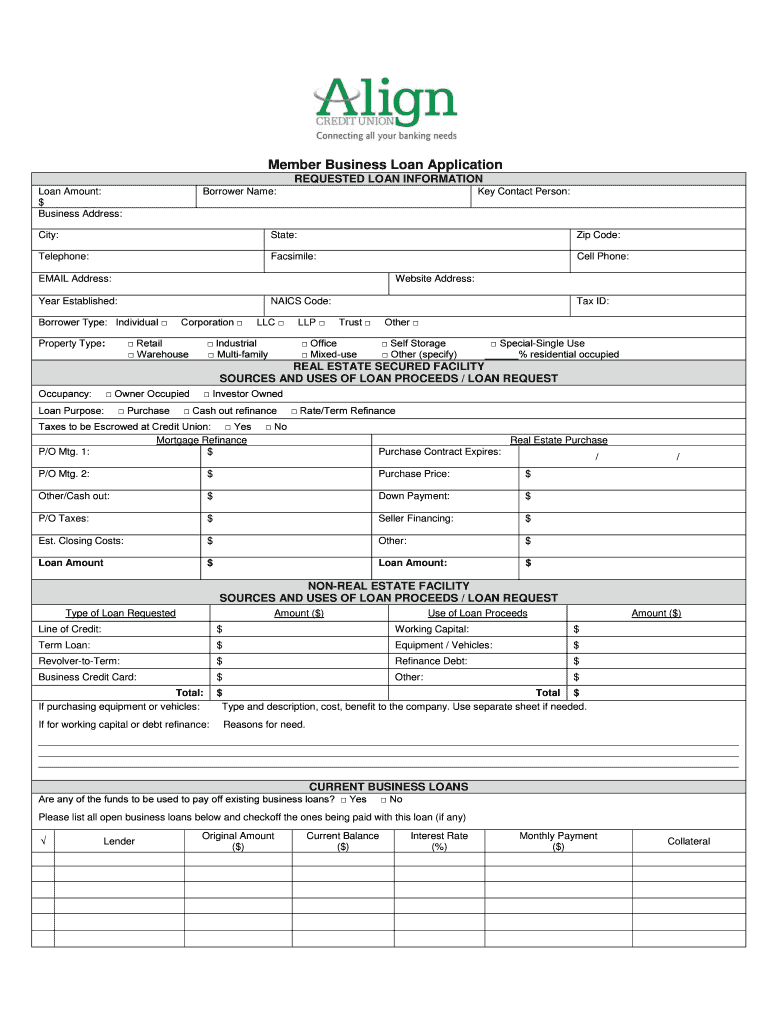

Member Business Loan Application REQUESTED LOAN INFORMATION Loan Amount: $ Business Address:Borrower Name:Key Contact Person:City:State:Zip Code:Telephone:Facsimile:Cell Phone:EMAIL Address:Website

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign member business loan application

Edit your member business loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your member business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing member business loan application online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit member business loan application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out member business loan application

How to fill out member business loan application

01

To fill out a member business loan application, follow these steps:

02

Gather all the required documents and information. This may include personal identification documents, financial statements, business plans, and collateral details.

03

Read the instructions provided with the application form carefully to understand the requirements and eligibility criteria.

04

Fill in personal and business information accurately, such as name, address, contact details, and business structure.

05

Provide detailed financial information about your business, including income, expenses, assets, and liabilities.

06

Attach any supporting documents requested, such as tax returns, bank statements, and legal documents.

07

Review the completed application form and all attached documents to ensure everything is accurate and complete.

08

Submit the application along with the required documents to the appropriate lender or financial institution.

09

Follow up with the lender to check the status of your application and provide any additional information if requested.

10

Once approved, carefully review the terms and conditions of the loan before accepting and signing any agreements.

11

Make sure to fulfill all the obligations and responsibilities associated with the loan repayment to maintain a good credit history.

Who needs member business loan application?

01

Anyone who owns a business and requires funding for various purposes can apply for a member business loan. This includes small business owners, entrepreneurs, startups, and established companies.

02

Individuals who need capital to start a new business, expand an existing business, purchase equipment or inventory, refinance existing debt, or meet short-term financial needs can benefit from member business loans.

03

Member business loan applications are designed to cater to the financial needs of businesses in different industries and sectors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit member business loan application online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your member business loan application to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the member business loan application form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign member business loan application and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out member business loan application on an Android device?

Use the pdfFiller app for Android to finish your member business loan application. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is member business loan application?

Member business loan application is a form that business members fill out to apply for a loan from a credit union or financial institution.

Who is required to file member business loan application?

Business owners who are members of a credit union or financial institution are required to file member business loan application.

How to fill out member business loan application?

To fill out the member business loan application, business owners need to provide information about their company, financial statements, business plan, and any collateral they are willing to offer.

What is the purpose of member business loan application?

The purpose of member business loan application is to assess the creditworthiness of the business and determine if it qualifies for a loan.

What information must be reported on member business loan application?

Information such as company financials, business history, loan amount requested, intended use of funds, and collateral must be reported on member business loan application.

Fill out your member business loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Member Business Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.