Get the free Long Island Parcel Tax Data by Lot Number

Show details

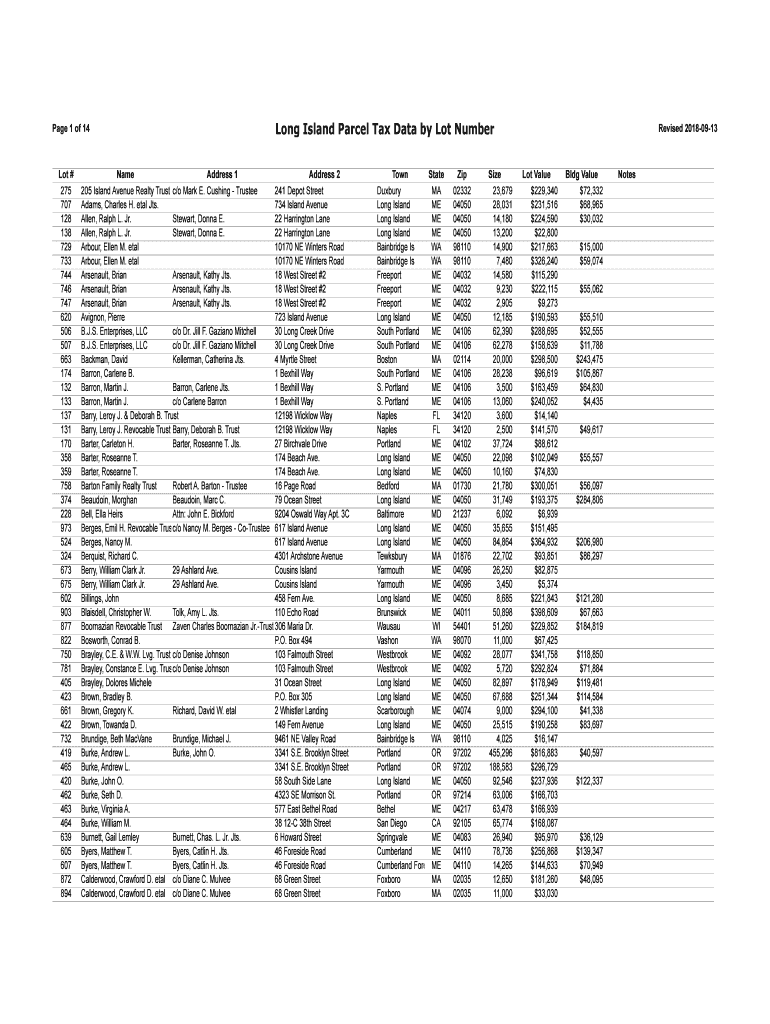

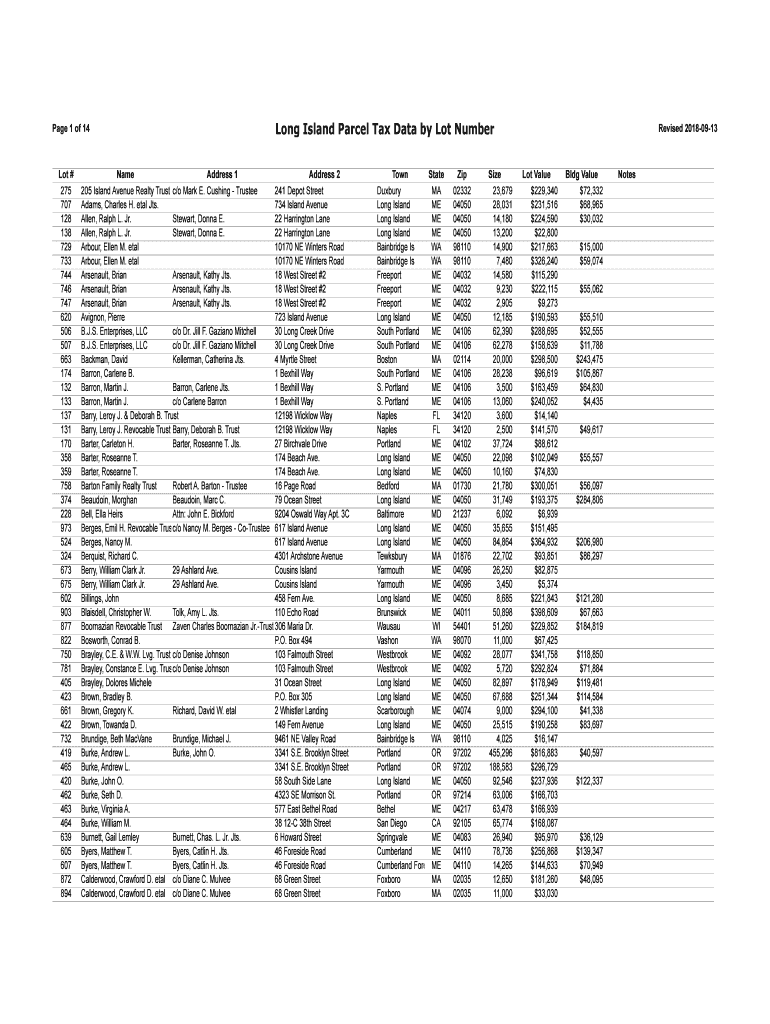

Page 1 of 14Lot # 275 707 128 138 729 733 744 746 747 620 506 507 663 174 132 133 137 131 170 358 359 758 374 228 973 524 324 673 675 602 903 877 822 750 781 405 423 661 422 732 419 465 420 462 463

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long island parcel tax

Edit your long island parcel tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long island parcel tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long island parcel tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit long island parcel tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long island parcel tax

How to fill out long island parcel tax

01

To fill out the Long Island Parcel Tax, follow these steps:

02

Gather all the necessary information, including the tax form, property details, and any supporting documents.

03

Identify the specific parcel for which you need to pay the tax.

04

Fill in the required personal information, such as name, address, and contact details.

05

Provide details about the property, including its location, size, and any improvements or changes made.

06

Calculate the tax amount based on the given guidelines and enter it correctly.

07

Double-check all the entered information for accuracy and make any necessary corrections.

08

Sign and date the form as required.

09

Attach any supporting documents, such as property deeds or appraisal reports, if requested.

10

Submit the filled-out tax form along with the payment by the specified deadline.

11

Retain a copy of the filled-out form and payment receipt for future reference.

Who needs long island parcel tax?

01

Long Island Parcel Tax is needed by individuals or entities who own property in Long Island and are subject to the parcel tax.

02

Property owners who reside or have real estate holdings in Long Island must pay the parcel tax according to local regulations and requirements.

03

The tax helps generate revenue for various public services and improvements in the Long Island region.

04

It is necessary for property owners to fulfill their tax obligations to support the local community and maintain the functioning of essential services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send long island parcel tax for eSignature?

When you're ready to share your long island parcel tax, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get long island parcel tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the long island parcel tax in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete long island parcel tax on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your long island parcel tax. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is long island parcel tax?

Long Island parcel tax is a tax imposed on property owners in Long Island to fund various local services and infrastructure projects.

Who is required to file long island parcel tax?

All property owners in Long Island are required to file the parcel tax.

How to fill out long island parcel tax?

To fill out the Long Island parcel tax, property owners must provide information about their property and pay the required tax amount.

What is the purpose of long island parcel tax?

The purpose of Long Island parcel tax is to generate revenue to support local services and infrastructure projects.

What information must be reported on long island parcel tax?

Property owners must report details about their property including its location, size, and assessed value.

Fill out your long island parcel tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Island Parcel Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.