Get the free Life Insurance Fact Finder - Richon Planning

Show details

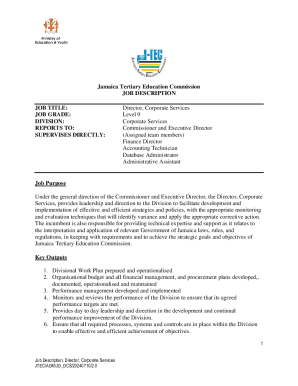

LifeInsuranceFactFinder Client ProfileTodaysDate: / / Section1: Name: Tobacco Use: NonsmokerSmokerDOB: / / For Other(SpecifyType) Frequency: Life Insurance Type: Universalize WholeLifeTermLifeYearsforTerm

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance fact finder

Edit your life insurance fact finder form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance fact finder form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance fact finder online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit life insurance fact finder. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance fact finder

How to fill out life insurance fact finder

01

To fill out a life insurance fact finder, follow these steps:

02

Gather necessary information: Collect information about your personal details, financial situation, health history, and insurance needs.

03

Start with basic information: Provide your name, contact details, date of birth, and social security number (if required).

04

Answer health-related questions: Provide details about your medical history, current health conditions, medications, and lifestyle habits.

05

Discuss financials: Specify your annual income, assets, debts, and expenses. This helps determine the coverage amount you may need.

06

Evaluate insurance needs: Consider factors like your marital status, dependents, family's financial goals, and future expenses.

07

Determine coverage amount: Assess the recommended coverage amount based on your financial situation and insurance requirements.

08

Choose policy features: Select the type of life insurance policy (term, whole life, universal life) and any additional riders or benefits.

09

Review and revise: Double-check all information provided and make necessary revisions before submitting the fact finder.

10

Seek professional guidance: If you need assistance or have complex financial circumstances, consult with a licensed insurance agent or financial advisor.

11

Submit the fact finder: Submit the completed life insurance fact finder to your chosen insurance provider or agent.

Who needs life insurance fact finder?

01

Anyone who is considering purchasing a life insurance policy should fill out a life insurance fact finder.

02

This includes individuals who are:

03

- Married or with dependents: to ensure financial protection for their loved ones in case of an untimely death.

04

- Starting a family: to secure their children's future and cover expenses like education and childcare.

05

- Planning for retirement: to have a source of income or funds available during the retirement years.

06

- Owning significant assets or debt: to protect their assets and ensure debts are covered.

07

- Running a business: to provide financial security for their business partners, employees, or heirs.

08

- In a high-risk occupation or have health conditions: as life insurance may be necessary to obtain coverage at affordable rates.

09

Ultimately, anyone who wants to safeguard their loved ones or provide for their financial goals should consider filling out a life insurance fact finder.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send life insurance fact finder to be eSigned by others?

When your life insurance fact finder is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the life insurance fact finder in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your life insurance fact finder in seconds.

Can I create an electronic signature for signing my life insurance fact finder in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your life insurance fact finder right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is life insurance fact finder?

Life insurance fact finder is a document used to gather information about a person's financial situation, goals, and insurance needs in order to recommend the most suitable life insurance policy.

Who is required to file life insurance fact finder?

Insurance agents, financial advisors, or brokers who are assisting clients in selecting a life insurance policy are required to complete a life insurance fact finder.

How to fill out life insurance fact finder?

To fill out a life insurance fact finder, the advisor must meet with the client to gather information about their financial status, goals, and insurance needs. The advisor then uses this information to recommend a suitable life insurance policy.

What is the purpose of life insurance fact finder?

The purpose of a life insurance fact finder is to gather comprehensive information about a person's financial situation and insurance needs to help the advisor recommend the most suitable life insurance policy.

What information must be reported on life insurance fact finder?

Information such as the client's income, assets, debts, beneficiaries, and financial goals must be reported on a life insurance fact finder.

Fill out your life insurance fact finder online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Fact Finder is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.