Get the free refundable insurance

Show details

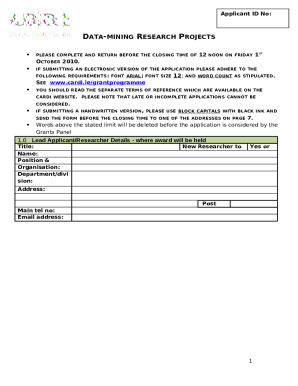

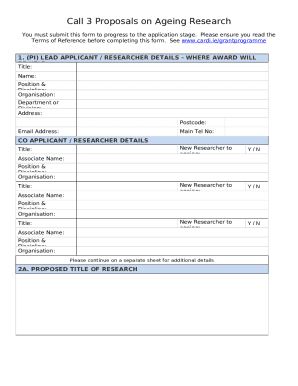

*REFUND×Request for Insurance Premium Refund Entity numerous/Division # Entity addressEmployee name Member ID or SSN Month/Bimonthly Premium Piedmont Premium Refund Teetotal Reason for overpaymentInsurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refundable insurance form

Edit your refundable insurance form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refundable insurance form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit refundable insurance form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit refundable insurance form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refundable insurance form

How to fill out request for insurance premium:

01

Begin by gathering all necessary information such as personal details, contact information, and relevant insurance policies.

02

Fill out the request form accurately, providing all required details and answering any specific questions or sections.

03

Make sure to double-check all the information filled in to avoid any mistakes or missing details.

04

Attach any supporting documents that may be required, such as proof of prior insurance or additional coverage options.

05

Review the completed request form and supporting documents to ensure everything is in order and nothing is missing.

06

Submit the filled-out request form along with any required documents through the specified method (online submission, mail, or in-person).

07

Keep a copy of the filled-out request form for your own records.

Who needs request for insurance premium?

01

Individuals or businesses looking to obtain insurance coverage.

02

Current policyholders who want to request a quote for a new policy or an updated premium amount.

03

Any individual or entity involved in a claim process, requiring a review of premium rates or changes in coverage.

Fill

form

: Try Risk Free

People Also Ask about

Which insurance is refundable?

Return of premium life insurance is usually a type of term life insurance. You lock in a rate for the level term period, such as 10, 20 or 30 years. But unlike traditional term life, if you outlive an ROP policy the insurer will refund the premiums you paid.

Can I get my PMI refund?

When PMI is canceled, the lender has 45 days to refund applicable premiums. That said, do you get PMI back when you sell your house? It's a reasonable question considering the new borrower is on the hook for mortgage insurance moving forward. Unfortunately for you, the seller, the premiums you paid won't be refunded.

How do I get a refund on my insurance premiums?

Communicate with Your Insurer: If you need to request a refund, contact your insurance company promptly and provide all necessary documentation. Clear communication will help expedite the refund process and minimize any potential issues.

How do I request a refund on my FHA connection?

Requesting a Refund On the FHA Connection, go to the Upfront Premium Collection menu and select Request a Refund in the Pay Upfront Premium section. The Upfront Refund Request page appears for entering refund information.

What is the benefit of a premium refund?

A return of premium rider provides for a refund of the premiums paid on a term life insurance policy if the policyholder doesn't die during the stated term. This effectively reduces the policyholder's net cost to zero. A policy with a return of premium provision is also referred to as return of premium life insurance.

Why did I receive a premium disbursement check?

There are two common instances when you'll get a home insurance refund check: when your lender made a mistake with your premium payment in escrow, often as a result of changing insurance carriers, or when you cancel a policy early.

What is a refund of premium amount?

An insurance refund refers to when the insurance company returns a part of the premium paid by the policyholder, usually due to the cancellation of the policy before its expiration date, overpayment of premiums, or adjustments made to the policy terms.

How do I get my MIP refund?

A refund of an upfront mortgage insurance premium (MIP) payment can be requested through HUD's Single Family Insurance Operations Division (SFIOD). On the FHA Connection, go to the Upfront Premium Collection menu and select Request a Refund in the Pay Upfront Premium section.

Can upfront MIP be refunded?

You will qualify for a refund of your upfront MIP payment, though, if you refinance your FHA loan to another FHA loan within 3 years of obtaining your mortgage. How much you get back, though, depends on how quickly you refinance. The sooner you refinance, the more you'll get back.

How do you politely ask for a refund?

Refund Letter Format: Guidelines and Tips Ask for a refund in a polite and respectful manner. Include the details about the product such as was purchased, when and at what price. Mention why you returned the item. Mention the relevant information of the transactions such as the date and place of delivery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify refundable insurance form without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your refundable insurance form into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find refundable insurance form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the refundable insurance form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit refundable insurance form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing refundable insurance form.

What is request for insurance premium?

A request for insurance premium is a formal application made by an individual or entity to obtain a quote or confirmation of the cost of insurance coverage from an insurer.

Who is required to file request for insurance premium?

Individuals or businesses seeking insurance coverage are required to file a request for insurance premium with the insurance provider.

How to fill out request for insurance premium?

To fill out a request for insurance premium, provide your personal or business details, specify the type of insurance needed, select the coverage limits, and submit any required documentation.

What is the purpose of request for insurance premium?

The purpose of a request for insurance premium is to evaluate the potential costs associated with obtaining insurance coverage and to enable the insurer to assess the risk involved.

What information must be reported on request for insurance premium?

The information that must be reported includes the applicant's name, contact information, type of insurance requested, coverage amounts, and any relevant risk factors or previous claims.

Fill out your refundable insurance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refundable Insurance Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.