Get the free case 18-10153-jks

Show details

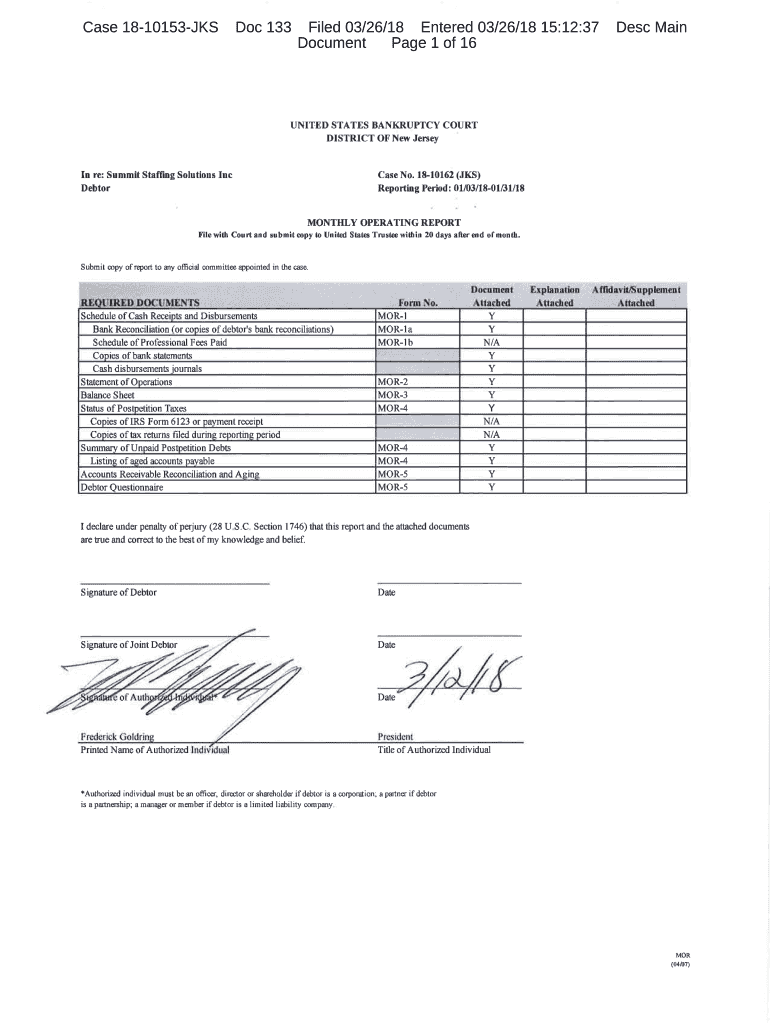

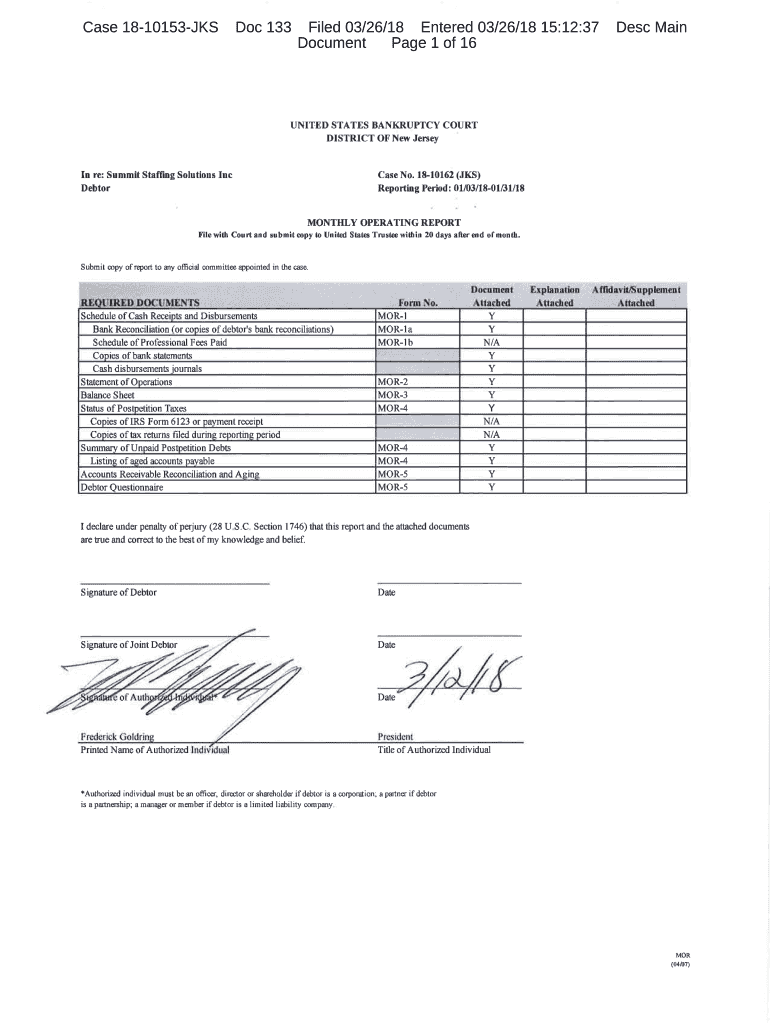

82 76 553. 44 CHECKS Number 01-18 01-30 400. 00 244. 03 403. 52 Skip in check sequence DEBITS 01-02 01-03 01-09 01-11 Description Preauthorized Wd LEASING SERVICES CNTRCT PMT 180102 908-0008174-000 PAYMENTECH FEE 180103 6142852 Bebwire Transfer Out 201801090004076 COMDATA NETWORK UB067 IRS USATAXPYMT 180109 270840911611193 UNEMP COMP EFT PADLIUCCON TXP461464022 UC000180331T0000000282 34930720 270841143257431 NJ WEB PMT 01120 NJWEB01120 TXPB461464022000 01120180331T18336SUMM Subtractions 1...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign padliuccon unemp comp eft form

Edit your unemp comp eft padliuccon form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your case 18-10153-jks form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit padliuccon form online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit padliuccon form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out case 18-10153-jks

How to fill out case 18-10153-jks

01

Gather all necessary documents related to your case.

02

Review the filing requirements for case 18-10153-jks.

03

Complete the required forms, ensuring all information is accurate.

04

Attach any supporting documents needed for your case.

05

Double-check all entries for errors or omissions.

06

Submit the completed forms and documents to the appropriate court.

07

Pay any required filing fees if applicable.

08

Keep copies of everything submitted for your records.

Who needs case 18-10153-jks?

01

Individuals or entities involved in legal proceedings related to case 18-10153-jks.

02

Parties seeking to understand their rights and obligations under this case.

03

Lawyers or legal representatives assisting clients with matters concerning this case.

Fill

form

: Try Risk Free

People Also Ask about

Do you report unemployment on PA tax return?

Benefits paid to you are considered taxable income. You must include information from this form when filing your taxes for the applicable year. The UC 1099-G tax form includes the amount of benefits paid to you for any of the following programs: Unemployment Compensation (UC)

Is PA unemployment taxable?

These benefits are not taxable by the Commonwealth of Pennsylvania and local governments. You may choose to have federal income tax withheld from your benefit payments at the rate of 10 percent of your weekly benefit rate plus the allowance for dependents (if any).

What is my PA UC account number?

Your PA UC Account Number This seven-digit number can be found on the following UC Tax and UC Benefit forms: UC-1408 New Employer Confirmation Letter. UC-851 Notice of PA Unemployment Compensation Responsibilities. UC-657 Contribution Rate Notice.

What is the PA UC tax rate?

Employee contributions (UC withholding) is 0.06 percent (60 cents per $1,000 gross wages). This applies to all employees, including employees of reimbursable employers, and is not subject to appeal. There is no cap on the gross wages upon which employee withholding is calculated.

What is Pa Sui employee tax?

A 0.07 percent (. 0007) tax on employee gross wages, or 70 cents on each $1,000 paid. Employee withholding contributions are submitted with each quarterly report. Employee withholding applies to the total wages paid in 2023.

Is PA unemployment taxable for federal taxes?

All benefits are considered gross income for federal income tax purposes. This includes benefits paid under these programs: Unemployment Compensation (UC)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is case 18-10153-jks?

Case 18-10153-jks refers to a specific legal case filed in the United States Bankruptcy Court, which involves a debtor seeking bankruptcy protection under Chapter 11 or Chapter 13 of the Bankruptcy Code.

Who is required to file case 18-10153-jks?

In general, individuals or businesses facing financial distress and seeking to reorganize or discharge their debts may be required to file case 18-10153-jks. This typically includes debtors who qualify under the applicable bankruptcy laws.

How to fill out case 18-10153-jks?

To fill out case 18-10153-jks, one must complete the required bankruptcy forms, including a petition and schedules that outline assets, liabilities, income, and expenses. It's advisable to seek legal assistance to ensure all documents are completed correctly.

What is the purpose of case 18-10153-jks?

The purpose of case 18-10153-jks is to provide legal relief to the debtor by discharging certain debts or reorganizing their financial obligations, allowing for a fresh start and the opportunity to get back on stable financial footing.

What information must be reported on case 18-10153-jks?

Information that must be reported on case 18-10153-jks includes personal or business details, a list of creditors, a summary of assets and liabilities, income and expense statements, and any previous bankruptcy filings.

Fill out your case 18-10153-jks online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Padliuccon Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.