Get the free (Home Equity Conversion Mortgage)

Show details

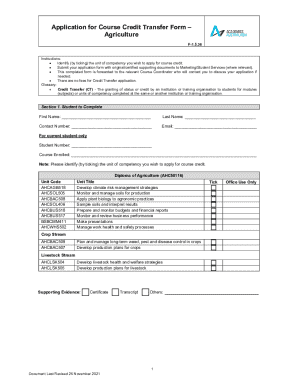

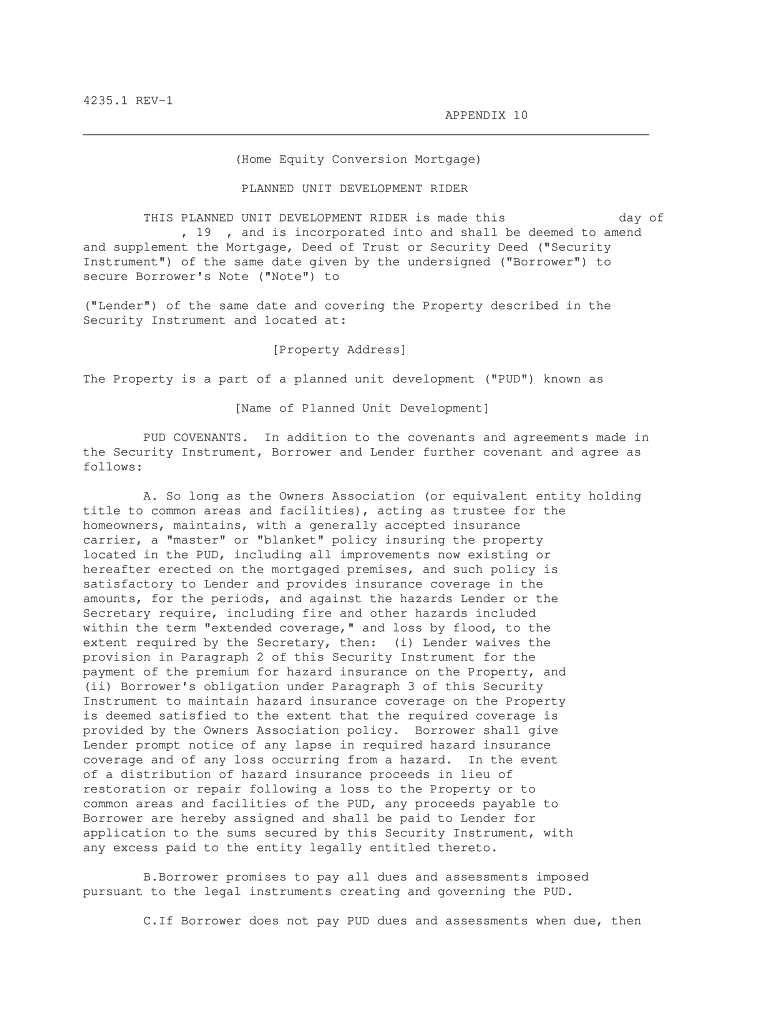

4235.1 REV1 APPENDIX 10 (Home Equity Conversion Mortgage) PLANNED UNIT DEVELOPMENT RIDER THIS PLANNED UNIT DEVELOPMENT RIDER is made this day of, 19, and is incorporated into and shall be deemed to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home equity conversion mortgage

Edit your home equity conversion mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home equity conversion mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home equity conversion mortgage online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit home equity conversion mortgage. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home equity conversion mortgage

How to fill out home equity conversion mortgage

01

To fill out a home equity conversion mortgage, follow these steps:

02

Find a reputable lender that offers home equity conversion mortgages.

03

Contact the lender to inquire about their specific application process.

04

Gather all necessary documents, which may include proof of age (at least 62 years old), proof of homeownership, and financial information.

05

Complete the application form with accurate and detailed information.

06

Provide any additional required documentation as requested by the lender.

07

Wait for the lender to review your application and determine your eligibility.

08

If approved, carefully review the loan terms, conditions, and costs.

09

Sign the loan documents and arrange for a closing date.

10

Attend the closing to finalize the loan and receive your funds.

11

Use the funds as intended, whether it is to pay off an existing mortgage, cover medical expenses, or enhance your retirement lifestyle.

12

Remember to comply with the loan requirements, including keeping up with property taxes, homeowner's insurance, and home maintenance.

13

Seek professional financial advice if needed throughout the process.

Who needs home equity conversion mortgage?

01

A home equity conversion mortgage, also known as a reverse mortgage, is primarily designed for:

02

Seniors who are at least 62 years old and own a home with significant equity.

03

Individuals or couples looking to supplement their retirement income.

04

Homeowners who want to eliminate their existing mortgage payments.

05

Those who have substantial home equity and want to access it for various purposes, such as medical expenses, home renovations, or improving their overall quality of life in retirement.

06

Individuals who plan to age in place and want to use their home equity to enhance their financial stability.

07

It is important to note that eligibility requirements, loan terms, and other factors may vary depending on the specific lender and the country in which you reside.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my home equity conversion mortgage in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign home equity conversion mortgage and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send home equity conversion mortgage to be eSigned by others?

When your home equity conversion mortgage is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out the home equity conversion mortgage form on my smartphone?

Use the pdfFiller mobile app to fill out and sign home equity conversion mortgage on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is home equity conversion mortgage?

A Home Equity Conversion Mortgage (HECM) is a type of reverse mortgage that allows homeowners aged 62 or older to convert part of their home equity into cash.

Who is required to file home equity conversion mortgage?

Homeowners aged 62 or older are required to file for a Home Equity Conversion Mortgage (HECM).

How to fill out home equity conversion mortgage?

To fill out a Home Equity Conversion Mortgage (HECM), homeowners need to work with a lender approved by the Federal Housing Administration (FHA) and provide information about their age, home value, and existing mortgage balance.

What is the purpose of home equity conversion mortgage?

The purpose of a Home Equity Conversion Mortgage (HECM) is to provide homeowners aged 62 or older with a way to access their home equity without having to sell their home.

What information must be reported on home equity conversion mortgage?

Information such as the homeowner's age, home value, existing mortgage balance, and property address must be reported on a Home Equity Conversion Mortgage (HECM).

Fill out your home equity conversion mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Equity Conversion Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.