Get the free APPRAISER TAX APPEAL SERVICES

Show details

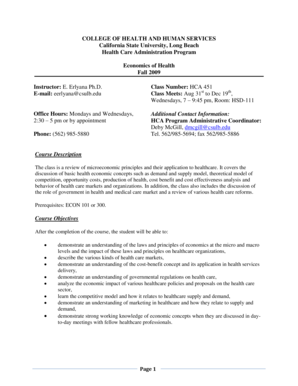

TOWNSHIP OF WEST CALDWELLREQUEST FOR PROPOSALS PROFESSIONAL SERVICES APPRAISER TAX APPEAL SERVICES APPRAISER TAX ASSESSMENTS The Township of West Caldwell, a municipal corporation in the County of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appraiser tax appeal services

Edit your appraiser tax appeal services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appraiser tax appeal services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing appraiser tax appeal services online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit appraiser tax appeal services. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out appraiser tax appeal services

How to fill out appraiser tax appeal services

01

Start by gathering all relevant documents, such as property assessments, tax bills, and any supporting evidence of errors or discrepancies.

02

Carefully review the property assessments and tax bills to identify any potential mistakes or inaccuracies.

03

Prepare a written appeal letter detailing the specific errors or discrepancies found and providing supporting evidence for each claim.

04

Submit the appeal letter along with all relevant documents to the appropriate tax authority or appeals board. Make sure to follow any specific filing instructions or deadlines.

05

Await a response from the tax authority or appeals board regarding the status of your appeal. Be prepared to provide additional supporting evidence or attend a hearing if required.

06

If your appeal is successful, ensure that any necessary adjustments or corrections are made to your property assessment and tax bill.

07

If your appeal is denied, consider consulting with a professional appraiser or tax appeal specialist for further assistance or advice.

Who needs appraiser tax appeal services?

01

Property owners who believe their property assessments are overvalued and wish to lower their tax burden.

02

Homeowners who have recently made improvements or renovations to their property and believe their assessments have not been properly adjusted.

03

Commercial property owners who suspect errors or discrepancies in their tax assessments that are affecting their business expenses.

04

Individuals or businesses facing financial hardship and seeking to reduce their property tax obligations.

05

Anyone who believes they have been unfairly charged or assessed for property taxes and wishes to seek a fair resolution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my appraiser tax appeal services directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your appraiser tax appeal services and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I sign the appraiser tax appeal services electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out appraiser tax appeal services on an Android device?

On an Android device, use the pdfFiller mobile app to finish your appraiser tax appeal services. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is appraiser tax appeal services?

Appraiser tax appeal services are services provided to assist property owners in appealing their property tax assessments.

Who is required to file appraiser tax appeal services?

Property owners who believe their property tax assessments are inaccurate or too high are required to file appraiser tax appeal services.

How to fill out appraiser tax appeal services?

To fill out appraiser tax appeal services, property owners need to provide information about their property, reasons for the appeal, and supporting evidence.

What is the purpose of appraiser tax appeal services?

The purpose of appraiser tax appeal services is to help property owners challenge unfair or incorrect property tax assessments.

What information must be reported on appraiser tax appeal services?

Property owners must report details about their property, recent sales of similar properties, and any additional information that supports their appeal.

Fill out your appraiser tax appeal services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appraiser Tax Appeal Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.