Get the free Invest in a Term Deposit - Mine Super

Show details

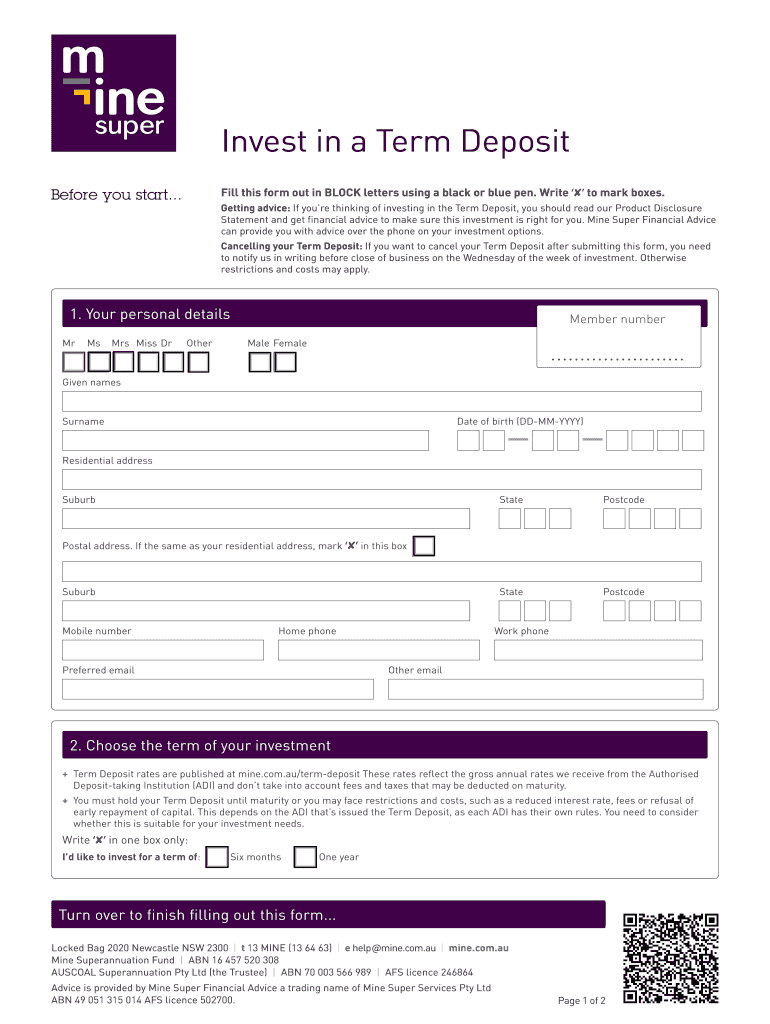

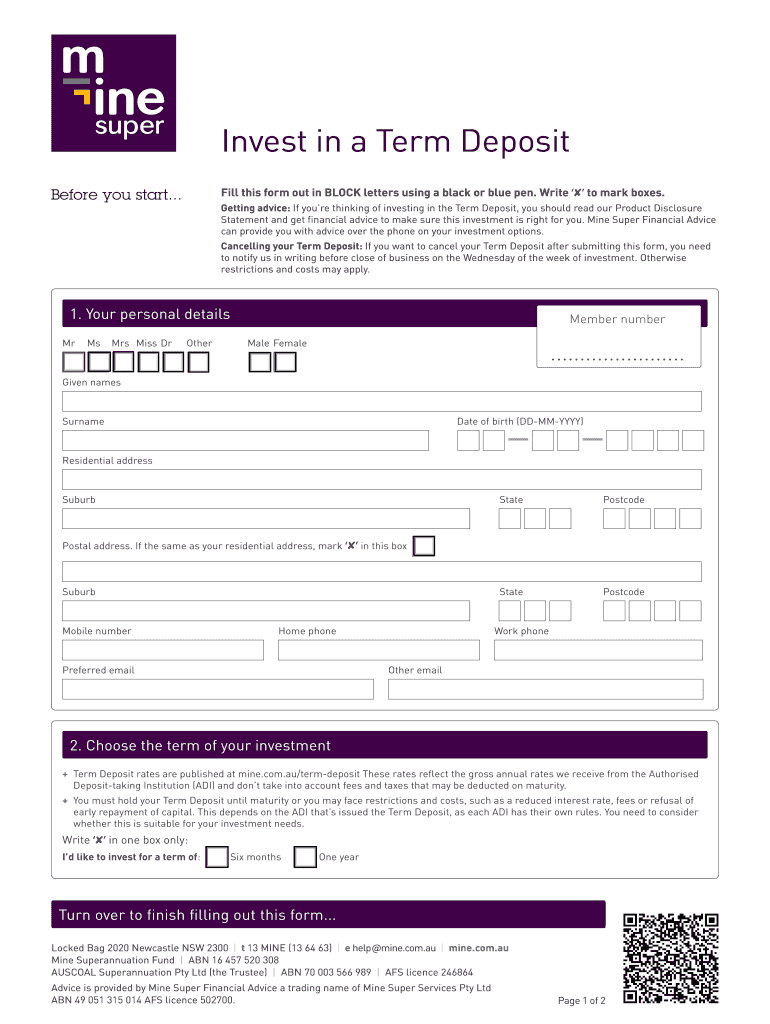

Invest in a Term Deposit

Fill this form out in BLOCK letters using a black or blue pen. WriteBefore you start...to mark boxes. Getting advice: If you're thinking of investing in the Term Deposit,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign invest in a term

Edit your invest in a term form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your invest in a term form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit invest in a term online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit invest in a term. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out invest in a term

How to fill out invest in a term

01

Understand the basics of investing in a term. Term investments typically refer to fixed-term deposits or bonds that have a pre-determined maturity date. It is important to understand the terms and conditions of the investment before moving forward.

02

Research and compare different investment options. Look for reliable financial institutions or government bonds that offer competitive interest rates and favorable terms. Consider factors such as the duration of the term, the interest rate, and any potential risks involved.

03

Evaluate your financial goals and risk tolerance. Determine how much money you are willing to invest and for how long. Assess your risk tolerance to choose an investment that aligns with your comfort level.

04

Fill out the necessary paperwork. This may involve opening a new account with a bank or financial institution, providing identification documents, and signing investment agreements or contracts.

05

Transfer the funds to the chosen investment account. Follow the instructions provided by the financial institution regarding the deposit process. Ensure that the funds are transferred securely and accurately.

06

Monitor your investment. Stay updated on the performance of your term investment. Track any changes in interest rates or market conditions that may impact your investment outcome.

07

Consider renewing or reinvesting when the term matures. Once the term investment reaches its maturity date, you can choose to renew the investment or reinvest the funds in another term investment.

08

Seek professional advice if needed. If you are unsure about any aspect of investing in a term, it is wise to consult with a financial advisor who can provide personalized guidance based on your individual circumstances.

Who needs invest in a term?

01

Individuals looking for a secure investment option: Term investments often provide a fixed return on investment, making them suitable for individuals who prioritize stability and low-risk.

02

Investors with a specific time frame: Term investments have a pre-determined maturity date, making them suitable for individuals who have a specific time frame in mind for their investment goals.

03

Those seeking regular income: Some term investments offer periodic interest payments, which can be beneficial for individuals who rely on a steady income stream.

04

Risk-averse individuals: Term investments typically involve less risk compared to other investment options such as stocks or mutual funds. This makes them attractive to individuals who want to minimize their exposure to market fluctuations.

05

Individuals saving for a specific goal: Term investments can be a good option for individuals saving for a specific goal, such as a down payment on a house or funding a child's education. The fixed maturity date allows for better planning and budgeting.

06

Anyone looking to diversify their investment portfolio: Including term investments in a diverse portfolio can help spread risk and provide a stable component to the investment mix.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in invest in a term?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your invest in a term to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the invest in a term electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your invest in a term in seconds.

Can I create an electronic signature for signing my invest in a term in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your invest in a term and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is invest in a term?

Investing in a term refers to allocating funds for a specific period of time in order to achieve financial returns.

Who is required to file invest in a term?

Individuals or entities who wish to invest in a term are required to file the necessary paperwork.

How to fill out invest in a term?

To fill out an invest in a term form, one must provide personal information, investment amount, term length, and investment goals.

What is the purpose of invest in a term?

The purpose of investing in a term is to grow wealth over a specified period of time.

What information must be reported on invest in a term?

Information such as personal details, investment amount, term length, and investment goals must be reported on an invest in a term form.

Fill out your invest in a term online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Invest In A Term is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.