Get the free Mortgage Protection - coverage form.pd - E-Risk Services

Show details

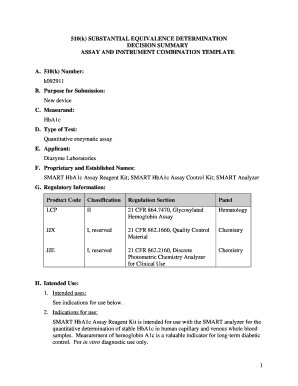

SPECIMEN MORTGAGE PROTECTION INSURANCE I. INSURING CLAUSES, COVERAGE SECTIONS AND EXTENSIONS In consideration of the payment of the premium, in reliance on the Application, and subject to all the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage protection - coverage

Edit your mortgage protection - coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage protection - coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage protection - coverage online

Follow the steps below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage protection - coverage. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage protection - coverage

How to fill out mortgage protection - coverage?

01

Gather the necessary information: Start by collecting all the relevant details regarding your mortgage, such as the loan amount, interest rate, and term. You will also need to know the current market value of your property and any existing insurance policies you may have.

02

Determine the coverage amount: Evaluate your financial situation and consider how much coverage you would need to protect your mortgage. This amount should be sufficient to pay off the remaining balance in case of your untimely death.

03

Research different insurance providers: Look for reputable insurance companies that offer mortgage protection coverage. Compare their policies, premiums, and benefits to find the best fit for your needs.

04

Contact insurance agents and get quotes: Reach out to the insurance companies you have shortlisted and inquire about their mortgage protection coverage. Provide them with the necessary information and request quotes for the desired coverage amount.

05

Review the policy terms and conditions: Carefully read and understand the terms and conditions of each policy before making a decision. Pay attention to premium payment options, policy exclusions, and any additional benefits or riders offered.

06

Select the appropriate policy: Based on your research and analysis, choose the mortgage protection coverage that aligns with your requirements and financial capabilities. Consider factors such as premium affordability, policy duration, and any additional features that may be beneficial.

07

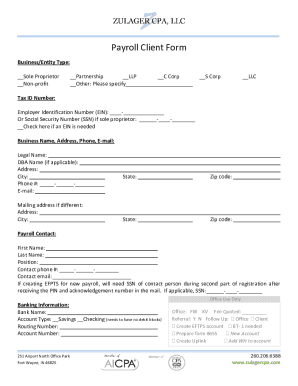

Complete the application form: Fill out the application form provided by the insurance company you have chosen. Provide accurate information about yourself, your mortgage, and your health status. Double-check all the details to ensure accuracy.

08

Undergo a medical examination (if required): Some insurance companies may require you to undergo a medical examination to assess your health condition and determine the premium rates. Follow the instructions given by the insurer and schedule the exam if necessary.

09

Submit the application and necessary documents: Once you have completed the application form and fulfilled any additional requirements, submit the documents to the insurance company. Keep copies of all the paperwork for your records.

10

Pay the premium: After your application is processed and accepted, you will need to pay the premium for your mortgage protection coverage. Choose a payment method that is convenient for you and ensure timely payments to keep your policy active.

Who needs mortgage protection - coverage?

01

Homeowners with dependents: If you have dependents who rely on your income to pay the mortgage, having mortgage protection coverage can provide them with financial security in case of your untimely death. It ensures that your loved ones are not burdened with the mortgage debt.

02

Individuals with high-value properties: If you have invested in a valuable property, mortgage protection coverage can help protect your assets. It ensures that your property remains with your family even if you pass away before paying off the mortgage.

03

Borrowers with insufficient savings: If you don't have enough savings to cover the mortgage balance, mortgage protection coverage can be essential. It prevents your loved ones from being forced to sell the property or struggle with the financial obligations in a difficult time.

04

Self-employed individuals: Self-employed individuals often face challenges when applying for life insurance due to the fluctuating income and lack of traditional employment benefits. Mortgage protection coverage can be a viable option for self-employed individuals to secure their mortgage payments.

05

Those with limited access to other insurance options: If you have pre-existing health conditions or other factors that make it difficult to obtain traditional life insurance, mortgage protection coverage can provide a viable alternative to protect your mortgage.

It is crucial to assess your personal circumstances and consider consulting with a financial advisor or insurance professional to determine if mortgage protection coverage is suitable for your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit mortgage protection - coverage on an iOS device?

You certainly can. You can quickly edit, distribute, and sign mortgage protection - coverage on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete mortgage protection - coverage on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your mortgage protection - coverage by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I fill out mortgage protection - coverage on an Android device?

Use the pdfFiller mobile app and complete your mortgage protection - coverage and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is mortgage protection - coverage?

Mortgage protection coverage is a type of insurance that helps cover your mortgage payments in case of unexpected events such as death, disability, or involuntary unemployment.

Who is required to file mortgage protection - coverage?

Mortgage protection coverage is typically required by mortgage lenders to protect their investment in case the borrower is unable to make payments.

How to fill out mortgage protection - coverage?

To fill out mortgage protection coverage, you will need to provide personal and financial information, select coverage options, and submit the application to the insurance provider.

What is the purpose of mortgage protection - coverage?

The purpose of mortgage protection coverage is to ensure that your mortgage payments are covered in case of unforeseen circumstances that may affect your ability to pay.

What information must be reported on mortgage protection - coverage?

The information required for mortgage protection coverage typically includes personal details, mortgage amount, coverage amount, beneficiaries, and policy terms.

Fill out your mortgage protection - coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Protection - Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.