Get the free Financial inclusion, universal banking and post offices in Britain

Show details

THE POST OFFICE NETWORK consultation

document

DECEMBER 2006Why the DTI is

conducting this

consultation

Post offices play an important social and economic role in the communities they

serve. With new

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial inclusion universal banking

Edit your financial inclusion universal banking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial inclusion universal banking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial inclusion universal banking online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit financial inclusion universal banking. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

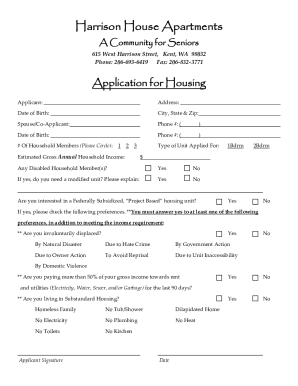

How to fill out financial inclusion universal banking

How to fill out financial inclusion universal banking

01

To fill out financial inclusion universal banking, follow these steps:

02

Start by gathering all the necessary documentation, such as identification documents, proof of address, and income details.

03

Visit a bank or financial institution that offers universal banking services.

04

Approach a customer service representative and inform them that you want to apply for financial inclusion universal banking.

05

Fill out the application form, providing accurate and complete information.

06

Submit the required documents along with the application form.

07

Wait for the bank to process your application. This may take a few days.

08

Once your application is approved, you will be notified by the bank.

09

Visit the bank and meet with a banking officer to discuss the details and benefits of financial inclusion universal banking.

10

Set up your account and familiarize yourself with the banking services available to you.

11

Start using your account for various financial transactions, such as depositing and withdrawing money, paying bills, and accessing other banking services.

Who needs financial inclusion universal banking?

01

Financial inclusion universal banking is beneficial for a wide range of individuals and groups, including:

02

- Low-income individuals who lack access to mainstream financial services

03

- Small business owners who need affordable banking solutions

04

- Rural and remote communities where physical bank branches are limited or non-existent

05

- Underserved populations, such as women, youth, and individuals with disabilities

06

- Migrants and refugees who require secure and accessible financial services

07

- Social welfare recipients who need a secure platform for receiving and managing their funds

08

- Individuals seeking to improve their financial literacy and capabilities

09

In essence, financial inclusion universal banking is designed to cater to the needs of individuals and communities who have been excluded or underserved by traditional banking systems.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute financial inclusion universal banking online?

pdfFiller makes it easy to finish and sign financial inclusion universal banking online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit financial inclusion universal banking in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing financial inclusion universal banking and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the financial inclusion universal banking electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your financial inclusion universal banking in minutes.

What is financial inclusion universal banking?

Financial inclusion universal banking is a mechanism to provide banking services to underserved or unbanked populations.

Who is required to file financial inclusion universal banking?

Financial institutions are required to file financial inclusion universal banking.

How to fill out financial inclusion universal banking?

To fill out financial inclusion universal banking, financial institutions need to report on the number of accounts opened for underserved populations and the services offered to them.

What is the purpose of financial inclusion universal banking?

The purpose of financial inclusion universal banking is to ensure that all individuals have access to basic banking services and financial products.

What information must be reported on financial inclusion universal banking?

Financial institutions must report on the number of accounts opened for underserved populations, the types of services provided, and any outreach efforts to promote financial inclusion.

Fill out your financial inclusion universal banking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Inclusion Universal Banking is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.