CT PC-301 2019 free printable template

Show details

RESET

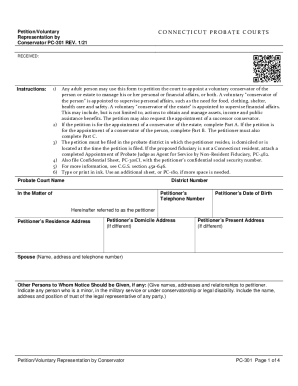

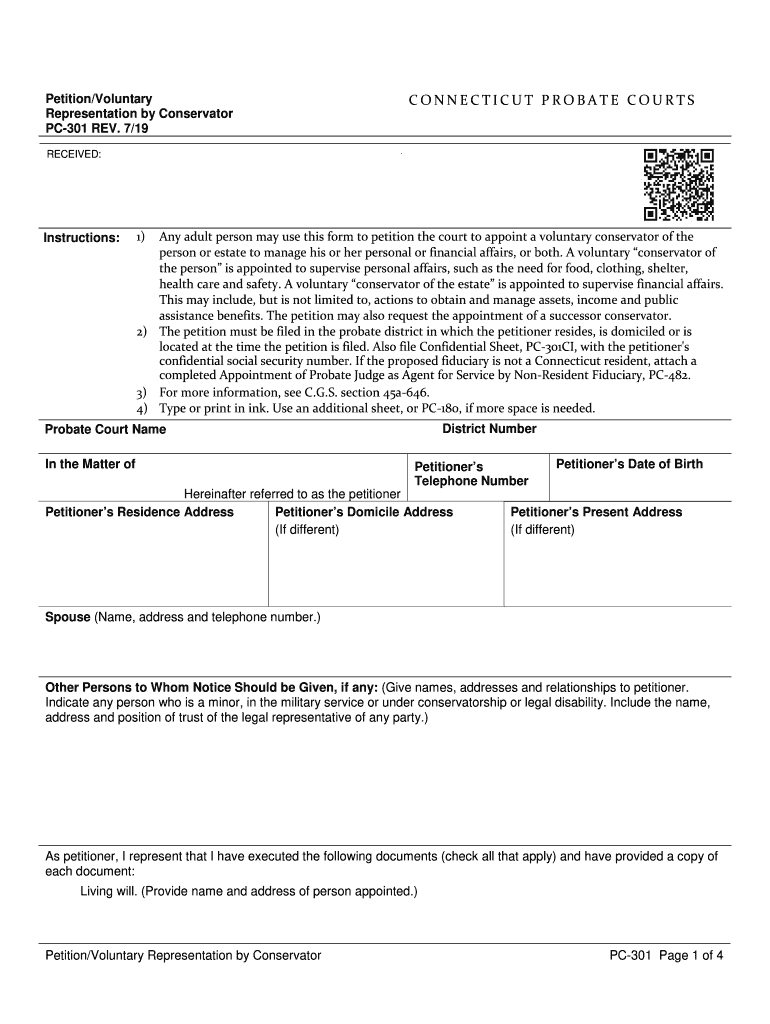

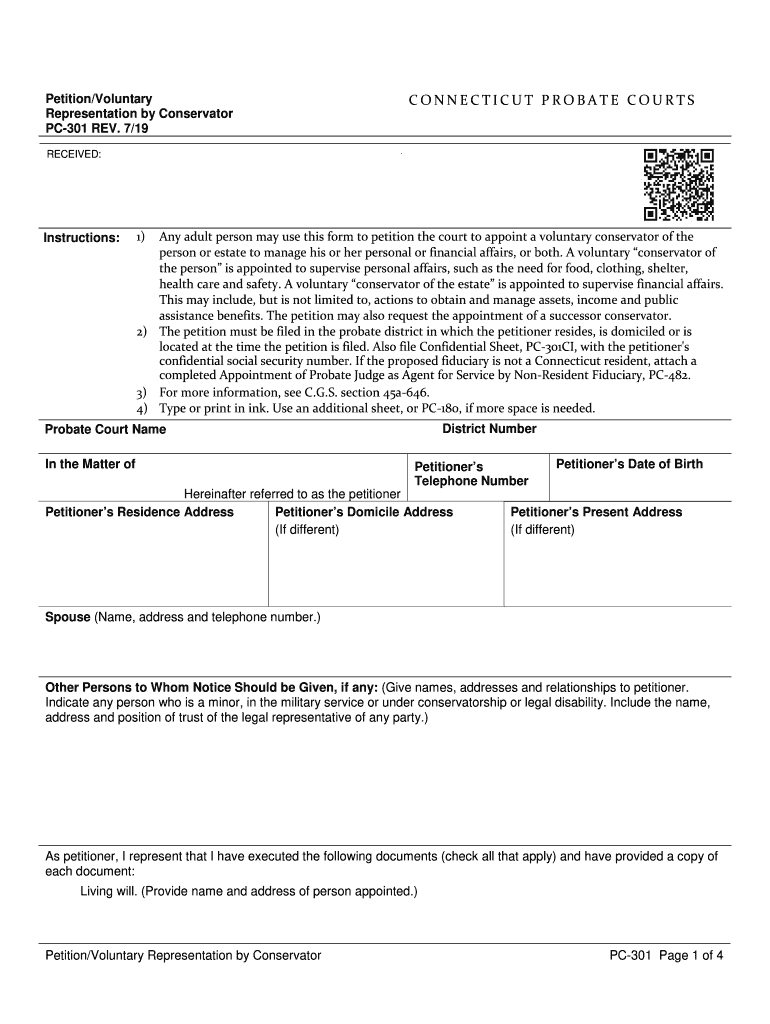

Petition/Voluntary

Representation by Conservator

PC301 REV. 7/19CONNECTICUT PROBATE COURTSRECEIVED:Instructions:1)Any adult person may use this form to petition the court to appoint a voluntary

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT PC-301

Edit your CT PC-301 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT PC-301 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT PC-301 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CT PC-301. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT PC-301 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT PC-301

How to fill out CT PC-301

01

Obtain the CT PC-301 form from the official Connecticut government website or the local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details about any business income or loss you are reporting.

04

Enter the necessary deductions and credits that apply to your situation.

05

Double-check all figures for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form to the appropriate state agency by the deadline.

Who needs CT PC-301?

01

Individuals who have self-employment income in Connecticut.

02

Business owners reporting income or losses in Connecticut.

03

Anyone needing to claim specific deductions or credits associated with their business activities.

Fill

form

: Try Risk Free

People Also Ask about

What are the types of conservatorship in California?

There Are Three Types of Conservatorship Actions: General Probate Conservatorship. Limited Conservatorship. LPS (Lanternman-Petris-Short) Conservatorship (W&I 5350-5371)

How much does it cost to get a conservatorship in California?

How much does conservatorship cost? The basic filing fee to file temporary letters of conservatorship California is $60 if you don't obtain legal representation. Lawyers usually charge a flat fee for each service they provide, which can reach $1,000 for a Standard conservatorship of person or estate with one filer.

How long does a conservatorship last in California?

An LPS conservatorship terminates automatically after one year or upon the death of the conservatee or court order.

How do I get involuntary conservatorship in CT?

In Connecticut, the probate courts have sole jurisdiction over the appointment of conservators. A person filing an application for conservatorship must apply to the probate court in the probate district where the respondent (the person alleged to be incapable) resides at the time the application is filed.

Who qualifies for conservatorship in California?

A Limited Conservatorship (PrC 1827.5 1828.5 2351.5) is only for a person who is developmentally disabled. In this type of conservatorship the powers of the conservator are limited so that the disabled person may live as independently as possible.

How much does a conservator get paid in CT?

The salary range for a Conservator job is from $55,883 to $80,737 per year in Westport, CT. Click on the filter to check out Conservator job salaries by hourly, weekly, biweekly, semimonthly, monthly, and yearly.

What does being a conservator mean?

A conservator is a court-appointed role. The conservator is responsible for managing the financial and personal affairs of a person who is incapacitated, or a minor. Conservators are subject to scrutiny by the court. For example, they often must document their management of the conservatee's finances.

What is a voluntary conservatorship in California?

A “voluntary conservatorship” is one in which the elder agrees that he or she should be conserved. Most voluntary conservatorships can be established within a few months at a reasonable cost. In a “contested conservatorship”, either the elder or a family member or friend objects to the conservatorship.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CT PC-301?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific CT PC-301 and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my CT PC-301 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your CT PC-301 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit CT PC-301 on an Android device?

You can edit, sign, and distribute CT PC-301 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is CT PC-301?

CT PC-301 is a form used for the reporting of personal property tax in the state of Connecticut.

Who is required to file CT PC-301?

Individuals and businesses that own personal property, such as equipment, furniture, and other tangible assets, are required to file CT PC-301.

How to fill out CT PC-301?

To fill out CT PC-301, provide the required personal information, list all personal property owned as of the assessment date, and calculate the total value of the property being reported.

What is the purpose of CT PC-301?

The purpose of CT PC-301 is to assess and levy taxes on personal property to ensure compliance with state tax laws.

What information must be reported on CT PC-301?

CT PC-301 requires reporting information such as the owner's name, address, type of personal property, description of the property, and its assessed value.

Fill out your CT PC-301 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT PC-301 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.