US-00646 free printable template

Show details

FAMILY SPECIALIZED TRUSTIRREVOCABLE TRUST AGREEMENT dated this day of, 20 between (“Granter “) residing at and (“Trustee “) residing at. ARTICLE 1: CREATION OF TRUST 1.1Trust Property. The

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is US-00646

US-00646 is a government form used to apply for specific federal benefits.

pdfFiller scores top ratings on review platforms

HUGE time saver! Especially for those federal tax PDFs that are not fillable.

Simply flawless without any complaints, everything works as expected. An excellent tool.

Took a little while to get familiar with it !! But, I think it's 'GREAT'!! Do you have anything for Minnesota Taxes?

I have had no formal training however it seems very easy and user friendly, however it does not able have all of the facilities that we require. But a good program overall.

It does most things well, and is easy to use.

Pretty easy to use. There is a good selection of forms to choose from. I used it to fill out CRPs for my renters. I wish you could re-open a form that you had saved and make changes to it...maybe you can, but I couldn't figure out how.

Who needs US-00646?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Completing the US-00646 Form

What is the purpose of the US-00646 form?

The US-00646 form is primarily used to establish a Special Needs Trust Agreement, offering vital support for families with individuals who have disabilities. This form plays a crucial role in defining the legal relationship between beneficiaries and grantors while ensuring that the needs of the special needs individuals are met. It's essential to understand the legal implications and compliance requirements tied to this form to avoid potential pitfalls.

What are the key sections of the US-00646 form?

The US-00646 form is structured to facilitate clear communication of important information regarding the Trust. The application form requires meticulous completion, and it includes vital sections influenced by New York State Assembly provisions, reflecting any specific local legalities that could affect the Trust. A careful review of each section is crucial before finalizing the form.

-

A detailed walkthrough of each section and its specific requirements.

-

Understanding how local laws influence the form and Trust establishment.

-

A checklist to review all components of the form before submission.

How do complete the US-00646 form step by step?

Filling out the US-00646 form involves a systematic approach to ensure all necessary fields are captured accurately. It entails a section-by-section breakdown which includes entering grantor and trustee details and specifying contributions to the Trust Property. Careful attention must be paid when defining the Trust Property and additional provisions concerning its management and disposition.

-

Accurate identification of each party involved is essential.

-

Clearly describe the assets included in the Trust.

-

Outline how the Trust estate will be managed and who inherits what.

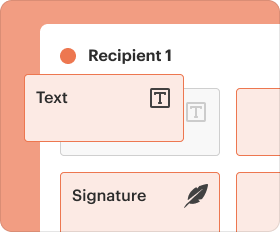

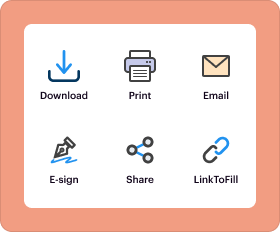

What are the interactive tools available for form management?

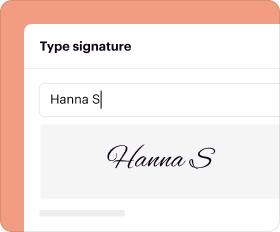

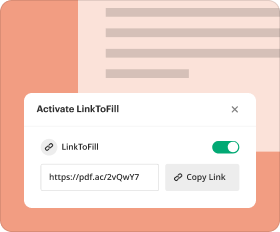

Utilizing tools such as pdfFiller can enhance the efficiency of filling out and editing the US-00646 form. This platform provides eSigning capabilities, ensuring that signatures are legally binding. Additionally, collaboration features enable teams to work together seamlessly on Trust Agreements, elevating accuracy and security throughout the process.

-

Features that help in easily filling out and editing the form.

-

Ensures the signatures on the US-00646 form are legally recognized.

-

Allows multiple users to work on Trust Agreements in real-time.

How to manage your trust after completion?

After completing the US-00646 form and establishing the Trust, it's essential to implement best practices for ongoing management. Maintaining an irrevocable trust requires diligence in adhering to legal and financial obligations. Additionally, being prepared to handle any challenges or disputes regarding the Trust can help secure the interests of the beneficiaries.

-

Regular reviews and compliance checks can help in maintaining a healthy Trust.

-

Understanding legal requirements ensures the Trust remains valid and effective.

-

Proactively addressing disputes can protect both the grantor's and beneficiary's interests.

What common mistakes should avoid when completing the US-00646 form?

Filling out the US-00646 form requires meticulous attention to detail to avoid common errors. Frequent mistakes can be easily overlooked, leading to complications in the Trust establishment process. It's advisable to double-check the form for completeness before submission and to consult with legal professionals when necessary.

-

Identifying common pitfalls can save time and resources during the filing process.

-

Ensures accuracy and completeness before submission can prevent delays.

-

Engaging experts can mitigate risks and enhance compliance.

What are the final steps for filing and record keeping?

Once the US-00646 form is completed, it is crucial to know the steps for submission to the relevant authority. Keeping Trust documents secured and easily accessible after filing is also important, as you may face audits or reviews from state or federal agencies in the future.

-

Guidelines on how to properly submit the completed form.

-

Best practices for organizing and accessing Trust documents post-filing.

-

Be aware of possible agency reviews to remain prepared.

How to fill out the US-00646

-

1.Download the US-00646 form from the official website or access it through pdfFiller.

-

2.Open the PDF file in pdfFiller.

-

3.Begin by entering your personal information in the designated fields, including your full name, address, and contact details.

-

4.Continue filling out the sections relevant to the specific benefits you are applying for, making sure to provide accurate and detailed information.

-

5.If applicable, attach any required documentation by using the upload feature to ensure your application is complete.

-

6.Review your filled-out form thoroughly for any errors or missing information.

-

7.Once confirmed, sign the form electronically using pdfFiller’s signature tool.

-

8.Save the completed form in your preferred format, or directly submit it through pdfFiller if submission options are available.

-

9.Keep a copy of the submitted form for your records and follow up on the application status as necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.