MA-ET10 free printable template

Show details

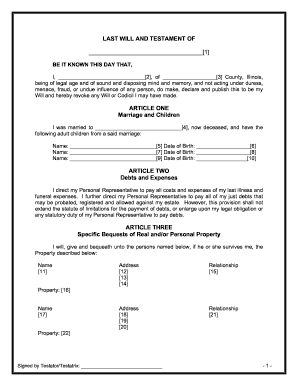

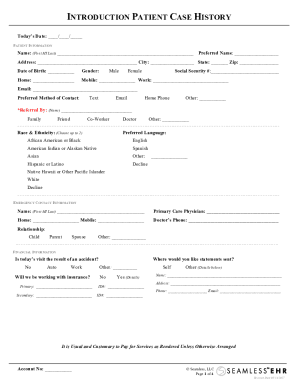

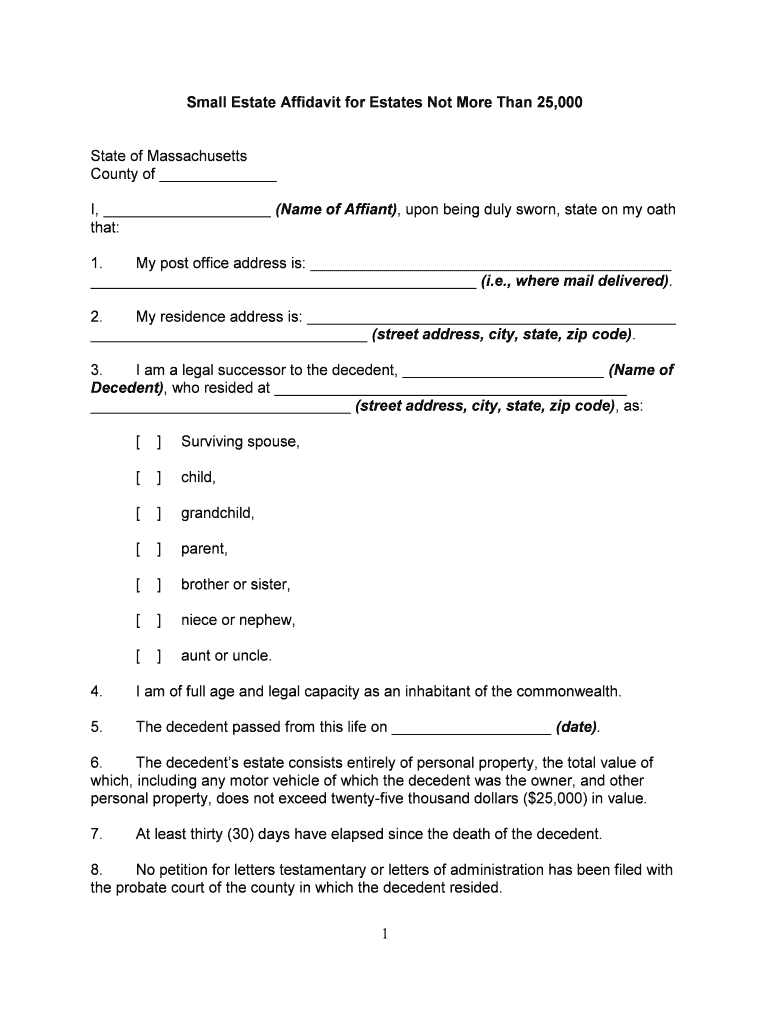

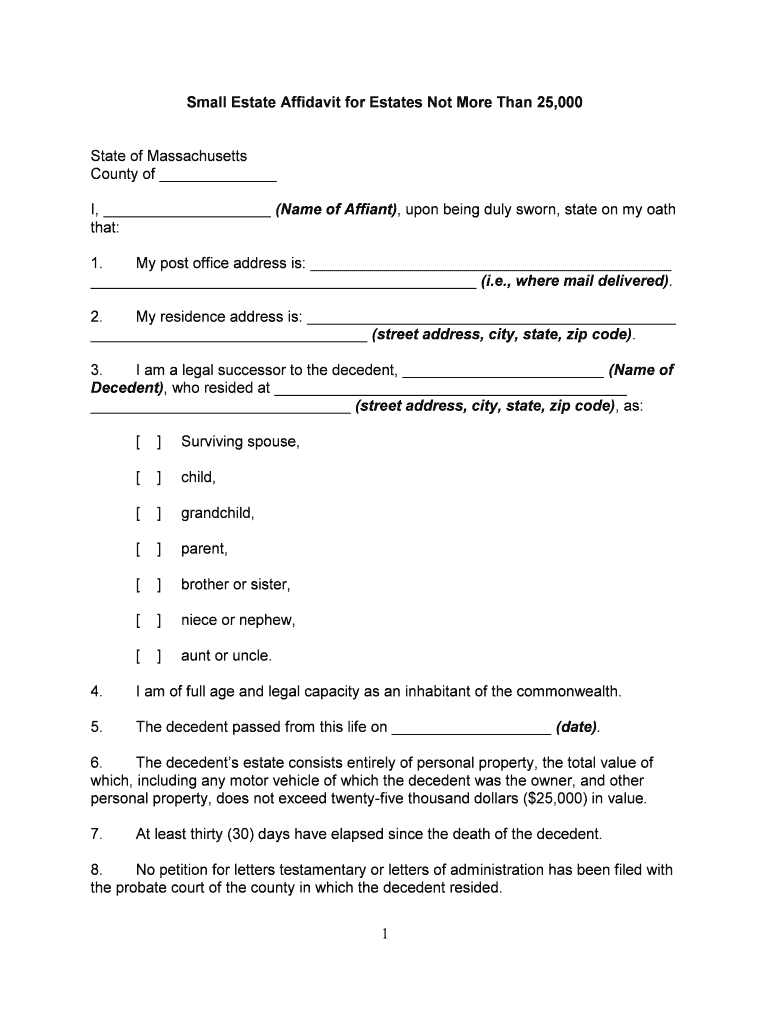

Small Estate Affidavit for Estates Not More Than 25,000State of Massachusetts County of I, (Name of Affine), upon being duly sworn, state on my oath that: 1. My post office address is: (i.e., where

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small estate affidavit form

Edit your massachusetts small estate affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small estate affidavit massachusetts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ma small estate affidavit form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit small estate form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out massachusetts small estate affidavit form

How to fill out MA-ET10

01

Gather necessary personal information, including your name, address, and Social Security number.

02

Fill in the section for the purpose of the MA-ET10 form, specifying the type of request being made.

03

Provide detailed information about your income and any relevant financial documents as required.

04

Complete the eligibility criteria section, ensuring all required conditions are met.

05

Review and verify all information for accuracy and completeness before submission.

06

Sign and date the form at the designated area.

Who needs MA-ET10?

01

The MA-ET10 form is needed by individuals seeking medical assistance benefits in Massachusetts.

02

It is also necessary for those who are applying for programs related to healthcare assistance and financial aid.

Fill

massachusetts affidavit

: Try Risk Free

People Also Ask about ma estate affidavit

What is the probate process in Massachusetts?

Massachusetts probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

How do I file a small estate affidavit in Massachusetts?

1:46 2:46 Massachusetts Small Estate Affidavit - EXPLAINED - YouTube YouTube Start of suggested clip End of suggested clip And the will if it exists. Step two fill out the affidavit. Complete the affidavit using theMoreAnd the will if it exists. Step two fill out the affidavit. Complete the affidavit using the information collected. And get it notarized. Step three file with the probate court filed the affidavit.

How long after someone dies do you have to file probate in Massachusetts?

The general rule is that an estate has to be probated within 3 years of when the decedent died. However, this deadline doesn't apply to: A voluntary administration. Determining heirs.

Do all estates have to go through probate in Massachusetts?

Whether an estate has to be probated depends on how the decedent's (the person who has died) property is titled (owned) when they die. Some property may not be part of the probate estate because it passes directly to another person by law.

How much does an estate have to be worth to go to probate in Massachusetts?

Massachusetts does not have what's known as an Affidavit procedure for small estates, but they do have a summary probate procedure. An estate value must be less than $25,000 and have no real property to qualify.

How long does it take to probate an estate in Massachusetts?

The probate process can take about 12-18 months. Per Massachusetts law, “an estate must be probated within three years.” Many factors can delay the probate process. As a Massachusetts probate lawyer, I can help work to avoid the delays and ensure that any complications that occur are resolved quickly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ma affidavit make online?

pdfFiller has made it easy to fill out and sign small estate affidavit form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit small estate affidavit form on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing small estate affidavit form right away.

How do I edit small estate affidavit form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share small estate affidavit form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is MA-ET10?

MA-ET10 is a tax form used in Massachusetts for the reporting of certain types of income and expenses, specifically related to the estate tax.

Who is required to file MA-ET10?

Any estate that has a gross value exceeding the Massachusetts estate tax threshold is required to file MA-ET10.

How to fill out MA-ET10?

To fill out MA-ET10, gather the necessary financial information regarding the estate, complete the form with accurate income and expense details, and submit it along with any required documentation by the specified deadline.

What is the purpose of MA-ET10?

The purpose of MA-ET10 is to ensure that estates comply with Massachusetts tax laws by accurately reporting their financial activities and calculating any estate taxes owed.

What information must be reported on MA-ET10?

MA-ET10 must report information such as the value of the estate, details of assets, liabilities, expenses, and any deductions applicable to the estate.

Fill out your small estate affidavit form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Estate Affidavit Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.