US-00576 free printable template

Show details

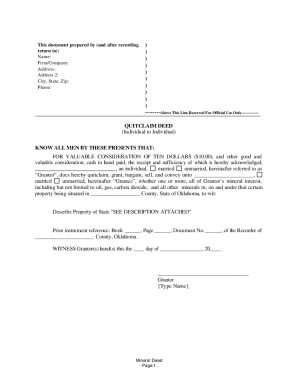

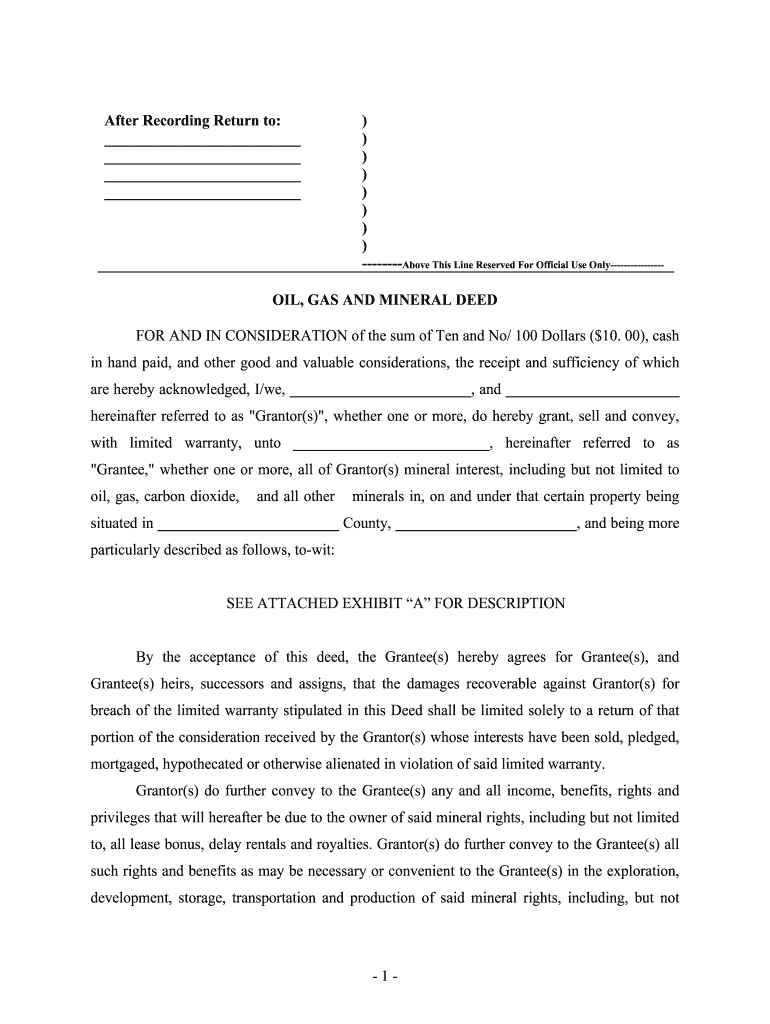

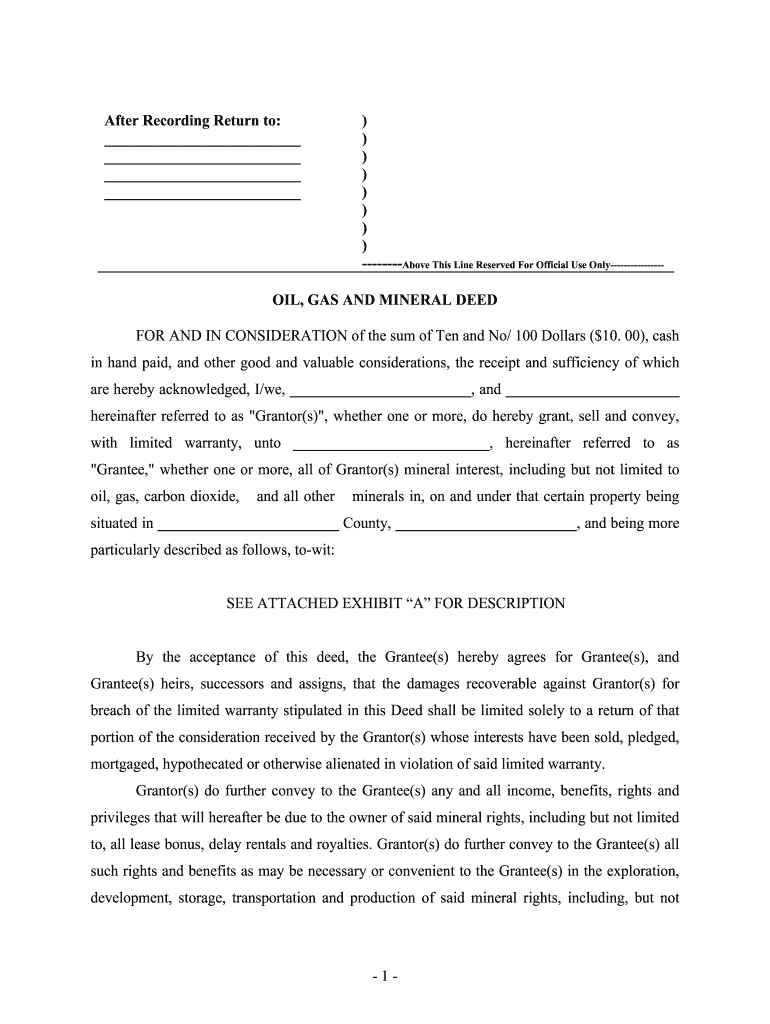

After Recording Return to:)))))))) Above This Line Reserved For Official Use Only, GAS AND MINERAL DEED FOR AND IN CONSIDERATION of the sum of Ten and No/ 100 Dollars ($10. 00), cash in hand paid,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 481367506 form

Edit your mineral deed form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mineral deed template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

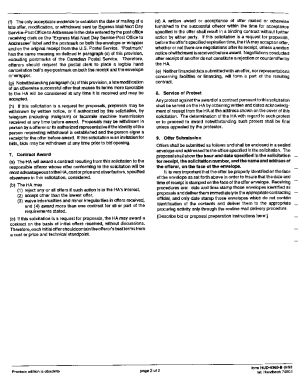

How to edit deed mineral online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oil gas mineral form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

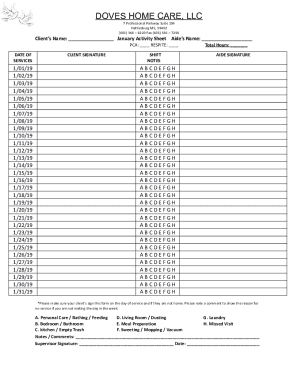

How to fill out how to transfer mineral rights in oklahoma form

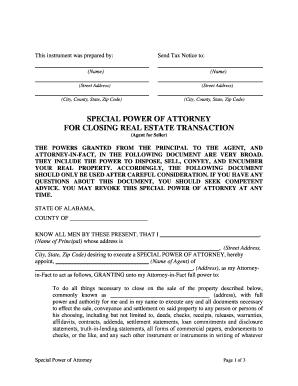

How to fill out US-00576

01

Gather the necessary personal information, including your name, address, and contact details.

02

Locate the specific section for the purpose of the form and clearly state your intent.

03

Fill in the relevant sections accurately, ensuring that all required fields are completed.

04

Review the form for any errors or missing information.

05

Sign and date the form where indicated.

06

Submit the completed form according to the provided instructions.

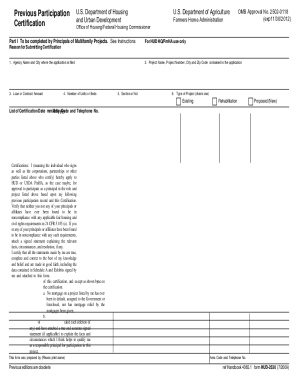

Who needs US-00576?

01

Individuals applying for certain benefits or services that require the completion of US-00576.

02

Organizations assisting clients with applications that need this specific form.

03

Anyone required to document specific information as mandated by a governmental agency.

Fill

mineral deed get

: Try Risk Free

People Also Ask about

How do I transfer mineral rights in Texas?

For transfers of mineral rights ownership by deed, a mineral deed needs to be created and registered for such transactions. Check with the local government or state recorder of deeds where the land is located to see if a form for a mineral deed can be printed for use.

What is a term royalty deed?

What Is A Royalty Deed? A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

Do mineral rights transfer with property in Texas?

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

What does it mean when mineral rights do not transfer?

Mineral rights do not necessarily transfer with the property. Typically, a property conveyance (sale) transfers the rights of both the surface land and the minerals underneath until the mineral rights are sold. Mineral rights convey or are conveyed — meaning transferred to a new owner — through a deed.

How do I get a mineral deed in Texas?

Check The County Clerk's Office: You need to head over to the county clerk's office in the county where the minerals are located at. The office contains data, documents, and records of leases and deeds that have been filed for mineral rights.

What is a mineral deed in Texas?

What is a Mineral Deed? A mineral deed is a legal form that transfers ownership of part or all the minerals, gas, or water on or under the land. The owner of the mineral deed typically owns the option to extract minerals, but does not have any right to the surface of the land, or any buildings on it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mineral deed form?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific mineral deed form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out the mineral deed form form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign mineral deed form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete mineral deed form on an Android device?

Use the pdfFiller mobile app to complete your mineral deed form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is US-00576?

US-00576 is a specific form used for reporting certain financial or taxation-related information to the relevant authorities in the United States.

Who is required to file US-00576?

Individuals or entities that meet specific criteria for reporting under US tax regulations are required to file US-00576.

How to fill out US-00576?

To fill out US-00576, follow the instructions provided on the form, ensuring that all required information is entered accurately and completely.

What is the purpose of US-00576?

The purpose of US-00576 is to collect data for tax compliance, ensuring that taxpayers report their financial information correctly to the IRS.

What information must be reported on US-00576?

US-00576 requires reporting information such as identification details, income details, and any applicable deductions or credits.

Fill out your mineral deed form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mineral Deed Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.