US-344EM free printable template

Show details

COMMON LAW SPOUSE DECLARATION, confirm that the person listed below is my common law spouse as defined in the Group Insurance Benefits Contract, and that my relationship with this person has existed

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is US-344EM

US-344EM is a form used for reporting specific tax-related information to the Internal Revenue Service (IRS).

pdfFiller scores top ratings on review platforms

The PDF filler worked beautifully and Loved it.

The PDF filler worked beautifully and I like it. It was exceptional. But rather costly I could not afford it at this time. But I had no problems achieving what I did with documents I wanted to change.

Great service that has a lot to offer…

Great service that has a lot to offer besides editing pdf files. Love this and it has been well worth the money.

Great for editing and preparing various…

Great for editing and preparing various documents. Great help for my letting business. Tenants and Landlords, UK

Excellent program

Excellent program, did exactly what i needed in a fast and trouble free manner. 5 stars.

So Far So Good-Easy to Use

Easy to use and understand.

very good editer

very easy to use,, i recommend 100%

Who needs US-344EM?

Explore how professionals across industries use pdfFiller.

How to fill out the US-344EM form: A comprehensive guide

Understanding the US-344EM form

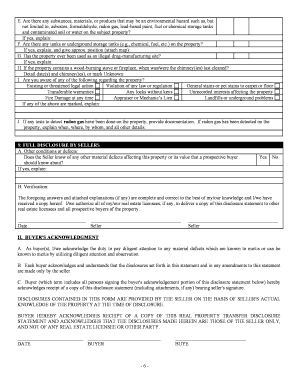

The US-344EM form is a crucial document used to declare a common-law spouse for various legal and benefit purposes. This form helps individuals establish their relationship status, primarily for insurance and tax benefits. Understanding its importance can save individuals from potential legal complications.

-

Definition of the US-344EM form and its purpose: This form serves to officially recognize common-law spouses, validating their status for legal recognition and benefits.

-

Importance of common-law spouse declarations: Accurately declaring your common-law spouse can influence health insurance coverage, tax filings, and inheritance rights.

-

Overview of legal implications: Misrepresentation or errors on the form may lead to legal disputes or loss of benefits, underscoring the significance of proper completion.

What are the eligibility criteria for common-law spouse declaration?

To declare a common-law spouse using the US-344EM form, individuals must meet specific criteria tailored to their state’s regulations. The varying laws make it essential to understand your state's stance on common-law marriage.

-

State-specific regulations regarding common-law marriage: Not all states recognize common-law marriages, so it's vital to check whether your state’s laws support your declaration.

-

Requirement of a 12-month relationship prior to declaration: Most states require couples to have lived together for at least 12 months to qualify as common-law spouses.

-

Who can be considered a common-law spouse: Legal definitions may vary, but generally, couples must share a residence, present themselves as married, and intend to marry.

How do you fill out the US-344EM form: Step-by-step guide?

Filling out the US-344EM form correctly requires attention to detail to ensure all information is accurate. Following a systematic approach will make the process smoother and ensure you don’t miss essential details.

-

Personal information required: employee and spouse details: Include complete names, addresses, and social security numbers of both parties.

-

Signature and date requirements: Each partner must sign and date the declaration, confirming the accuracy of the details provided.

-

List of common-law children for benefits purposes: If applicable, include any children from the relationship to clarify potential beneficiaries.

How can you edit and manage your US-344EM form with pdfFiller?

pdfFiller offers a seamless way to edit and manage your US-344EM form. Utilizing its cloud-based tools simplifies the process of making necessary adjustments and ensures security.

-

Using pdfFiller's editing tools for form customization: Easily modify your form with drag-and-drop functionality, adding or removing fields as needed.

-

eSigning the declaration securely: Utilize the eSignature feature for a legally binding signature, safeguarding the integrity of your document.

-

Collaborating with other stakeholders within the platform: Share your form with advisors or team members to gather input and ensure accuracy before submission.

What are the compliance and legal considerations?

When filling out the US-344EM form, it is essential to consider the compliance and legal implications associated with common-law marriages. These implications vary widely by state.

-

Understanding recognition of common-law marriage in different states: Familiarize yourself with your state's laws to ensure your marriage can be declared legally.

-

Consequences of submitting an inaccurate declaration: Providing incorrect information can lead to penalties, loss of benefits, or legal challenges.

-

Resources for legal guidance on common-law marriage: Consult legal experts or local government resources for assistance with common-law marriage issues.

What common errors should you avoid when submitting the US-344EM form?

It’s critical to review your US-344EM form for common errors before submission. Small mistakes can lead to significant complications later.

-

Missing information on the form: Double-check all required fields to ensure nothing is overlooked.

-

Incorrect signatures or dates: Ensure both parties sign and date the document at the correct spots.

-

Failing to follow state-specific filing procedures: Each state may have specific submission protocols; familiarize yourself with them.

How can you stay organized with your common-law spouse documents?

Keeping all documents related to your common-law spouse organized is key to managing your legal and administrative processes effectively. pdfFiller provides excellent document management solutions to aid in this effort.

-

Best practices for maintaining documentation: Regularly update your records to reflect any changes in your relationship status or personal information.

-

Using pdfFiller to store and access important forms: Utilize the platform to keep all related documents in one secure place, accessible from anywhere.

-

Benefits of a cloud-based document management system: Enjoy easy retrieval, sharing capabilities, and comprehensive security features.

How to fill out the US-344EM

-

1.Open the US-344EM form in pdfFiller.

-

2.Review the form requirements and sections carefully.

-

3.Begin by entering your personal information in the designated fields, including name, address, and Social Security number.

-

4.Fill out the income section by accurately reporting all relevant income sources as instructed.

-

5.Complete any applicable deductions or credits sections, ensuring you have the necessary documentation to support each entry.

-

6.Carefully review each section to confirm that all information is accurate and complete before submission.

-

7.Use the 'Save' option to keep a copy of the completed form for your records.

-

8.Once everything is verified, submit the form electronically through the designated method, or print it for mailing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.