Last updated on Feb 17, 2026

Get the free mississippi probate claim form

Show details

IN THE COURT OF COUNTY, IN THE MATTER OF THE ESTATE OF, DECEASEDCAUSE NO. Petition For Order Requiring Production of Will Comes now Petitioner, an adult resident citizen of the (City, County, State),

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is petition probate forms

Petition probate forms are legal documents required to initiate the probate process of a deceased person's estate.

pdfFiller scores top ratings on review platforms

I have been trying this application and…

I have been trying this application and its great, however the capabilities are still limited and hopefully it will improve later.Thanks to the developer, this helps me a lot.

great but i dont need it offened

Great customer support! I was unable to use the service for all the forms I needed, so cancelled within the free trial period. I deleted account, but was still charged. I sent a message to support team and within a few minutes, ***** refunded and made sure account was cancelled! Very impressed!

EVERYTHING TO SUBMIT MY FORMS

Very easy to use. Customer service very helpful

Great

Who needs mississippi probate claim form?

Explore how professionals across industries use pdfFiller.

How to fill out a petition probate forms form

Understanding the petition for order requiring production of will

A petition for order requiring production of will is initiated when a person believes that they are entitled to view the deceased's Last Will and Testament, essential for understanding the distribution of the estate. This petition is crucial in situations where a will has not been made available, as it compels the custodian to produce the document. Legally, this petition is grounded in probate laws aimed at ensuring estate transparency.

What key components are needed to prepare your petition?

When preparing your petition, it's important to include specific information about all parties involved. This not only establishes your legitimate interest but also clarifies any potential conflicts in the process.

-

Identify who can file the petition, typically interested parties like heirs or beneficiaries.

-

Provide information about the custodian of the will, who may be the executor or a relative.

-

Include the decedent's full name, date of birth, and residency status.

-

Create a list including all individuals who may have an interest in the estate, along with their contact information.

-

Note any past petitions related to the will or estate, as they can impact your case.

How do you draft your petition step-by-step?

Drafting your petition involves carefully completing the court form and clearly articulating your interest in the estate.

-

Be thorough in completing important fields, such as the names of parties and case number.

-

Express why you believe the will should be produced, providing context and urgency.

-

Clearly communicate your legal interest in the estate; vague statements can lead to denial.

-

Ensure your document meets regional legal formatting and filing requirements.

What steps are involved in filing your petition?

Filing your petition correctly is vital for ensuring that your request is heard. A few key aspects define the procedure.

-

Identify the proper court where the deceased’s estate will be handled to ensure it's filed correctly.

-

Be prepared for potential costs associated with filing, which can vary by jurisdiction.

-

Ensure you have all necessary documents, such as identification and prior petitions, when filing.

What to do if the respondent refuses to produce the will?

If the custodian refuses to produce the will, you have certain legal rights that need to be upheld. Understanding these rights is essential to protect your interests throughout the probate process.

-

If the will is not produced, you may have grounds to compel production legally.

-

Prepare for potential disputes about the contents of the will and how they affect your claims.

-

Consider hiring a probate attorney if disputes become complex or adversarial.

How can pdfFiller assist with your probate documents?

pdfFiller is a powerful tool for managing your probate documents efficiently, offering unique features for users.

-

Utilize its features for filling your petition seamlessly; templates save time.

-

Easily eSign your documents and collaborate with interested parties through shared access.

-

Safely store and manage your probate documents in the cloud, ensuring security and accessibility.

What common mistakes should you avoid in your probate petition?

Mistakes in your petition can lead to rejections or delays. Awareness of common errors can enhance your application.

-

Missing critical details can result in petition rejection, so double-check your work.

-

Not informing all interested parties can lead to legal complications and further delays.

-

Requirements can vary by state, so familiarizing yourself with the local laws is crucial.

How to monitor the status of your petition?

Once your petition is submitted, keeping track of its progress is essential. This helps you stay informed about the court's actions.

-

Use online court resources or contact the court to get updates on your petition's status.

-

Be aware of the timeline for hearings; knowing potential delays is key to effective planning.

-

Maintain communication with court personnel for timely updates and guidance on next steps.

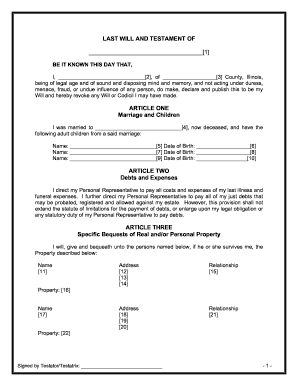

How to fill out the mississippi probate claim form

-

1.Obtain the petition probate form from pdfFiller.

-

2.Open the PDF file using pdfFiller's online editor.

-

3.Carefully read the instructions provided at the top of the form.

-

4.Fill in the decedent's full name, date of death, and residence details in the designated fields.

-

5.Enter your own information, including your name, address, and relationship to the decedent.

-

6.Specify whether there is a will and, if so, attach a copy to the form.

-

7.Provide details about the beneficiaries and their shares as outlined in the will.

-

8.Include any necessary additional documents, such as a death certificate or proof of identity.

-

9.Review all entered information for accuracy before proceeding to the next step.

-

10.Save the completed form and download it for submission to the probate court.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.