Get the free dissolve company companies

Show details

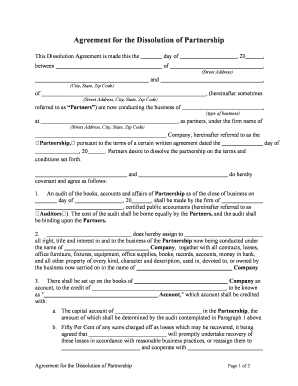

RESOLUTION OF THE MEMBERS OF A LIMITED LIABILITY COMPANY Pursuant to the Operating Agreement of, a Limited Liability Company, hereinafter Company, and applicable laws, a meeting of the Members of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign llc dissolve make form

Edit your llc dissolve form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your llc dissolve company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing llc dissolve create online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dissolve companies make form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limited liability companies form

How to fill out US-206LLC

01

Obtain Form US-206LLC from the appropriate state agency or website.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill out the identifying information, including your LLC's name, address, and purpose.

04

Provide information about the members or managers of the LLC, including names and addresses.

05

Indicate the duration of the LLC if it is not intended to be perpetual.

06

Include any additional information required by the specific state regulations.

07

Review the completed form for accuracy and completeness.

08

Submit the form along with any required fees to the appropriate state office, either online or via mail.

Who needs US-206LLC?

01

Individuals or groups looking to form a Limited Liability Company (LLC) in the United States.

02

Business owners seeking legal protection for their personal assets.

03

Entrepreneurs planning to operate a business under an LLC structure.

04

Those seeking to take advantage of the tax benefits associated with LLCs.

Fill

dissolve companies get

: Try Risk Free

People Also Ask about dissolve company form

Is dissolving a company the same as closing?

Dissolving a company is a formal way of closing it. Dissolution refers to the process of 'striking off' (removing) a company from the Companies House register.

Who owns the assets of a dissolved corporation?

In most cases of dissolution, a company's remaining assets are distributed to its shareholders or members after they have paid off outstanding debts from the proceeds of liquidation.

What happens if a limited company is dissolved?

When a company has been dissolved, it will cease to exist as a legal entity. All trade will stop, the company's name will be removed from the Companies House register, and it will have no further filing requirements.

Why is a limited company dissolved?

Dissolution can only be used to close a business that has no debts, or it has debts that can be settled in full. Liquidation is the method used to close a company that has severe debts it cannot afford to pay, or it has significant assets to realise before the company is closed down.

What is the difference between dissolving and terminating an LLC?

Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence. What it does is change the purpose of its existence. Instead of conducting whatever business it conducted before, a dissolved LLC exists solely for the purpose of winding up and liquidating.

What happens when an Ltd is dissolved?

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit llc limited liability online?

With pdfFiller, it's easy to make changes. Open your llc dissolve get in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out the dissolve companies edit form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign llc dissolve form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete resolution dissolve company on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your llc dissolve search, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is US-206LLC?

US-206LLC is a specific form used for reporting information related to Limited Liability Companies (LLCs) in the United States, typically focusing on income and tax responsibilities.

Who is required to file US-206LLC?

Any Limited Liability Company (LLC) that is taxed as a partnership or as a corporation and meets certain income thresholds or operational criteria is required to file US-206LLC.

How to fill out US-206LLC?

To fill out US-206LLC, provide the necessary company identification information, report income, deductions, and other relevant financial data according to the instructions provided with the form.

What is the purpose of US-206LLC?

The purpose of US-206LLC is to ensure that LLCs report their income and expenses for tax purposes, facilitating compliance with federal tax regulations.

What information must be reported on US-206LLC?

On US-206LLC, information such as LLC name, address, federal ID number, income, deductions, member distributions, and any other pertinent financial data must be reported.

Fill out your dissolve company companies form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dissolve Companies is not the form you're looking for?Search for another form here.

Keywords relevant to resolution llc dissolve

Related to llc limited companies

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.