Get the free texas deed

Show details

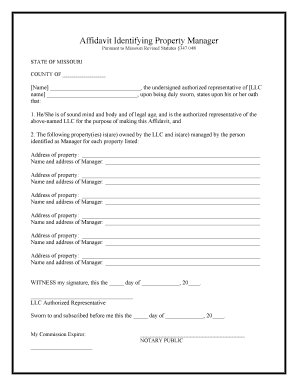

Prepared by and after Recording Return to:

Name:

Firm/Company:

Address:

Address 2:

City, State, Zip:

Phone:Assessors Property Tax Parcel/Account Number:))))))))))

Above This Line Reserved For Official

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tx deed form

Edit your texas deed file form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assignment trust form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing assignment deed draft online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit assignment deed form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas assignment deed form

How to fill out TX-120RE

01

Gather all necessary documentation such as your Texas driver’s license or ID number.

02

Obtain the TX-120RE form, which can typically be found on the Texas Department of Motor Vehicles website.

03

Fill out the personal information section, including your name, address, and contact information.

04

Provide details about the vehicle for which you are requesting the electronic title.

05

Include any required fees, which may vary based on your situation.

06

Review the completed form for accuracy and completeness.

07

Submit the form as per instructions, either online or by mail to the appropriate agency.

Who needs TX-120RE?

01

Individuals who are applying for an electronic title for their vehicle in Texas.

02

People who have recently purchased a vehicle and need to transfer the title electronically.

03

Those who may have lost their physical title and require a replacement in electronic format.

Fill

assignment deed

: Try Risk Free

People Also Ask about tx trust form

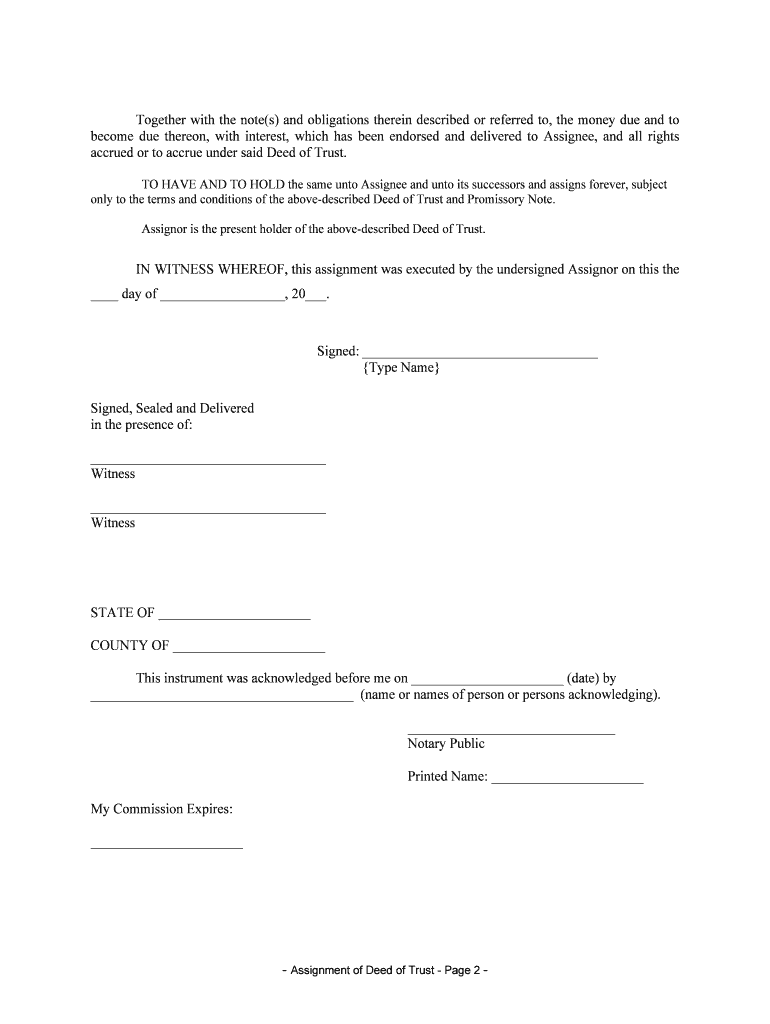

How do I file a new deed in Texas?

Your signed and notarized Warranty Deed needs to be filed in the property records in the county clerk's office of the county in which the property is located. The county clerk will charge a recording fee of about $30 to $40, depending on the county. The fee should be paid by a cashier's check or money order.

How do I change the deed on my house in Texas?

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

How do I register a deed in Texas?

WHERE DO I RECORD THE DEED? After the deed has been signed and notarized, the original needs to be filed and recorded with the county clerk in the county where the property is located. You can mail the deed or take it to the county clerk's office in person. Only original documents may be recorded.

Who can draft a deed in Texas?

Your deed will be prepared by a Texas licensed attorney in about an hour. This fee does not include the county recording fee. The county recording fee is approximately $15 to $40, depending on the county the property is located in.

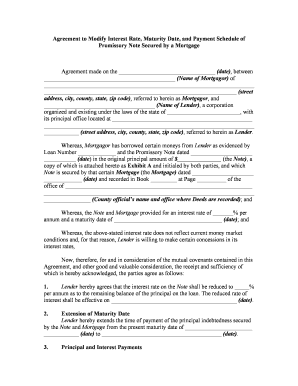

What is a Texas form of deeds?

A Texas deed form allows for the transfer of real estate from one party (the grantor) to another (the grantee). The transfer is completed by filling in one of the deed types whilst entering the names of the parties, the consideration (or “purchase price), and the legal description.

How do I get a property deed in Texas?

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send assignment trust for eSignature?

When you're ready to share your texas deed trust, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit texas deed form online?

With pdfFiller, it's easy to make changes. Open your texas deed form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for signing my texas deed form in Gmail?

Create your eSignature using pdfFiller and then eSign your texas deed form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is TX-120RE?

TX-120RE is a tax form used in certain jurisdictions to report specific tax information related to real estate.

Who is required to file TX-120RE?

Individuals or entities that have engaged in real estate transactions or possess real property in the jurisdiction requiring the form must file TX-120RE.

How to fill out TX-120RE?

To fill out TX-120RE, provide accurate information regarding the real estate transactions, including property details, dates, and involved parties, and ensure the form is signed and dated.

What is the purpose of TX-120RE?

The purpose of TX-120RE is to collect information for tax assessment and compliance related to real estate holdings and transactions.

What information must be reported on TX-120RE?

The information that must be reported on TX-120RE includes property identification, transaction dates, buyer and seller details, and the assessment of any applicable taxes.

Fill out your texas deed form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Deed Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.