AZ-01-09 free printable template

Show details

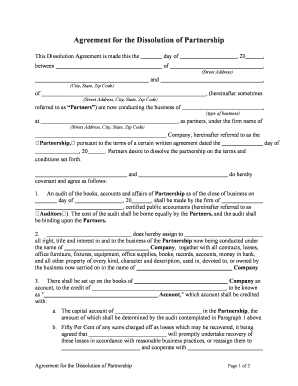

PRELIMINARY TWENTY DAY NOTICEINDIVIDUAL TO:Owner name and Address Contractor Name and Address Lender Name and Address Supplier Name and Address In accordance with Arizona Revised Statutes section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign arizona preliminary 20 day notice form

Edit your 20 day preliminary notice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona 20 day notice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona preliminary liens online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 20 day notice form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 20 day pre lien form

How to fill out AZ-01-09

01

Obtain the AZ-01-09 form from the relevant authority.

02

Read the instructions carefully before beginning to fill out the form.

03

Enter your personal information in the designated sections, including your name, address, and contact details.

04

Provide any required identification numbers or codes as specified.

05

Fill in the specific details requested in each section, ensuring accuracy and clarity.

06

Review your completed form for any errors or omissions.

07

Sign and date the form as required.

08

Submit the form according to the instructions, either online or via mail.

Who needs AZ-01-09?

01

Individuals or businesses required to report certain information to the regulatory body.

02

Anyone involved in transactions or activities that necessitate compliance with local regulations.

03

Professionals needing to document specific data for legal or administrative purposes.

Fill

az mechanic liens

: Try Risk Free

People Also Ask about arizona 20 day

How do tax lien sales work in Arizona?

Arizona law allows an investor to receive up to 16% interest per annum on the tax lien certificate. The bidder with the lowest bid on the interest rate wins the auction on each lien. If you are the successful bidder, you pay the outstanding taxes and receive a tax lien certificate.

Can you buy tax liens in Arizona?

Arizona allows investors to purchase unpaid real property taxes from counties as an investment in the form of tax lien certificates on real property. Every year, the counties have auctions to sell these unpaid property tax liens. For example, Maricopa County conducts its on-line auction in February of each year.

How do I buy tax delinquent properties in Arizona?

You can either get issued a tax lien certificate, which means you're just buying a piece of paper to earn interest, or you can go to an auction, buy a tax-defaulted property, and you would get a deed to the property. In one case, you get a deed. In the other case, you get interest on your money.

Is Arizona a tax lien state?

Arizona is a tax lien state that pays an annualized rate of return of up to 16%. If you don't get paid, you get the property, and you get it without a mortgage. Arizona has 15 counties, and in Maricopa County alone, they could have 15,000 or more tax lien certificates available.

Is it worth investing in tax liens?

Property tax liens can be a viable investment alternative for experienced investors familiar with the real estate market. Those who know what they are doing and take the time to research the properties upon which they buy liens can generate substantial profits over time.

How do tax liens work in AZ?

In Arizona, if property taxes are not paid, the County Treasurer will sell the delinquent lien at public auction. People buy tax liens for two reasons: first, to obtain ownership of a property through foreclosing the lien; or second, to obtain a high rate of interest on the amount invested.

How do you bid on a tax lien in Arizona?

To be eligible to bid, you must complete the following steps on the auction web site: Complete online registration. Complete IRS Form W-9, W-8BEN, or W-8BEN-E as applicable. Submit a deposit (online via ACH) Establish a budget. Receive bidder number assignment.

How long does a tax lien last in Arizona?

After three years from the date of the tax lien sale but no later than 10 years the CP holder may begin a judicial foreclosure action to obtain ownership of the property.

What is the tax lien percentage in Arizona?

Arizona tax liens can pay up to 16% return on your investment when the tax lien is repaid by the property owner. In some cases, the tax lien certificate holder can become the property owner.

How to buy over the counter tax liens in Arizona?

Buying over the counter tax liens in Arizona is not complicated. Tax lien certificates that don't sell at auction will eventually end up on a different list at the county. You can just go to the county, ask for the list, and purchase the certificates right there over the counter without having to do any bidding.

Can you buy tax liens in AZ?

Arizona allows investors to purchase unpaid real property taxes from counties as an investment in the form of tax lien certificates on real property. Every year, the counties have auctions to sell these unpaid property tax liens. For example, Maricopa County conducts its on-line auction in February of each year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pre lien az in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing az notice liens and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my az lien laws in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your az preliminary 20 day notice and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit arizona preliminary notice straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing 20 day notice.

What is AZ-01-09?

AZ-01-09 is a specific form or report used in regulatory or compliance contexts, typically associated with reporting certain types of financial or operational data.

Who is required to file AZ-01-09?

Entities or individuals who meet specific criteria set by the governing authority or regulatory body, typically including businesses or organizations operating in certain industries.

How to fill out AZ-01-09?

To fill out AZ-01-09, one must follow the provided instructions on the form, including collecting necessary data, entering it in the designated fields, and ensuring all required information is complete before submission.

What is the purpose of AZ-01-09?

The purpose of AZ-01-09 is to collect pertinent information for regulatory compliance, monitoring, or analysis by the relevant authority.

What information must be reported on AZ-01-09?

The information reported on AZ-01-09 typically includes financial data, operational metrics, or other specific information as mandated by the regulatory body.

Fill out your 20 day preliminary lien online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Notice Liens is not the form you're looking for?Search for another form here.

Keywords relevant to preliminary notice

Related to 20 day form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.