IA-ET20 free printable template

Show details

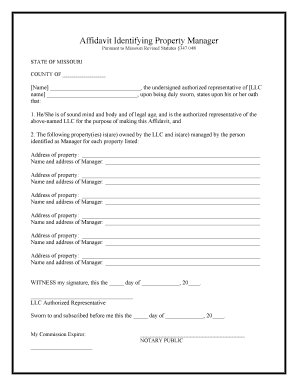

AFFIDAVIT, being duly sworn according to law on oath, under penalty of perjury, depose and say: 1. I reside at: Street Address/P.O. Box City: County: State: the spouse or the child other successor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small estate affidavit form

Edit your iowa small estate affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small estate affidavit iowa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small estate affidavit form iowa online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit iowa small estate form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iowa affidavit form

How to fill out IA-ET20

01

Obtain the IA-ET20 form from the official source or website.

02

Provide your personal information including your name, address, and contact details in the designated fields.

03

Fill out the section regarding your employment status and position.

04

Indicate your tax identification number where required.

05

Complete any additional sections that pertain to your specific situation or request.

06

Review the completed form for accuracy and completeness.

07

Submit the IA-ET20 form according to the instructions provided, either online or by mail.

Who needs IA-ET20?

01

Individuals or entities that need to apply for or amend tax-related matters.

02

Taxpayers seeking documentation to support their tax filings.

03

Businesses or organizations processing employee tax information.

Fill

small estate

: Try Risk Free

People Also Ask about

How does Title 19 work in Iowa?

It provides health insurance for people between the ages of 18 and 65. You must have income that is low enough for the program, but the income limits are higher than for regular Medicaid. You may be required to pay a monthly premium. You also do not need to have a child or be disabled.

What is the title XIX in Iowa?

Title XIX funded medical assistance includes Medicaid and various waiver programs, including the Medically Needy Program and the Elderly Waiver Program. Federal law requires states to have an estate recovery program. In Iowa the estate recovery program is provided under Iowa Code Section 249A.

What is the Estate Recovery Program in Iowa?

What is estate recovery? Estate recovery in Iowa applies to the costs a Medicaid member incurs over the age of 55, or for the costs of all others - regardless of age - in long-term care who have no reasonable expectation of returning home. It does NOT apply if you are under 55 and not in long term care.

Who qualifies for Title 19 in Iowa?

A person who is disabled ing to Social Security standards. An adult between the ages of 19 and 64 and whose income is at or below 133 percent of the Federal Poverty Level (FPL) A person who is a resident of Iowa and a U.S. citizen. Others may qualify (see list below)

Do I have to pay my husband's medical bills after he dies in Iowa?

Upon death, a consumer's debts become the responsibility of his estate. The estate's executor is the person charged with using the deceased's assets to pay off his current bills and all other debts.

How do I avoid Medicaid Estate recovery in Iowa?

Waiver and Deferral: Repayment of Medicaid benefits is waived if repayment would reduce the amount received from your estate by a surviving spouse, or by a surviving child who is under age 21, blind, or permanently and totally disabled at the time of your death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit iowa small estate affidavit in Chrome?

iowa small estate affidavit can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the iowa small estate affidavit electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your iowa small estate affidavit in seconds.

Can I create an eSignature for the iowa small estate affidavit in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your iowa small estate affidavit directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is IA-ET20?

IA-ET20 is an Iowa tax form used for reporting the estimated tax liability for individuals and businesses.

Who is required to file IA-ET20?

Individuals and entities who expect to owe tax of $1,000 or more when filing their annual tax return are required to file IA-ET20.

How to fill out IA-ET20?

To fill out IA-ET20, taxpayers must provide their estimated income, deductions, and credits, calculate their estimated tax liability, and report it on the form.

What is the purpose of IA-ET20?

The purpose of IA-ET20 is to allow taxpayers to prepay their estimated state income tax, helping to avoid penalties and interest for underpayment.

What information must be reported on IA-ET20?

IA-ET20 requires taxpayers to report their estimated income, deductions, credits, and the calculated estimated tax due for the year.

Fill out your iowa small estate affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iowa Small Estate Affidavit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.