VA-LS-006 free printable template

Show details

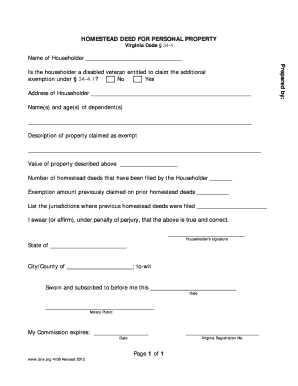

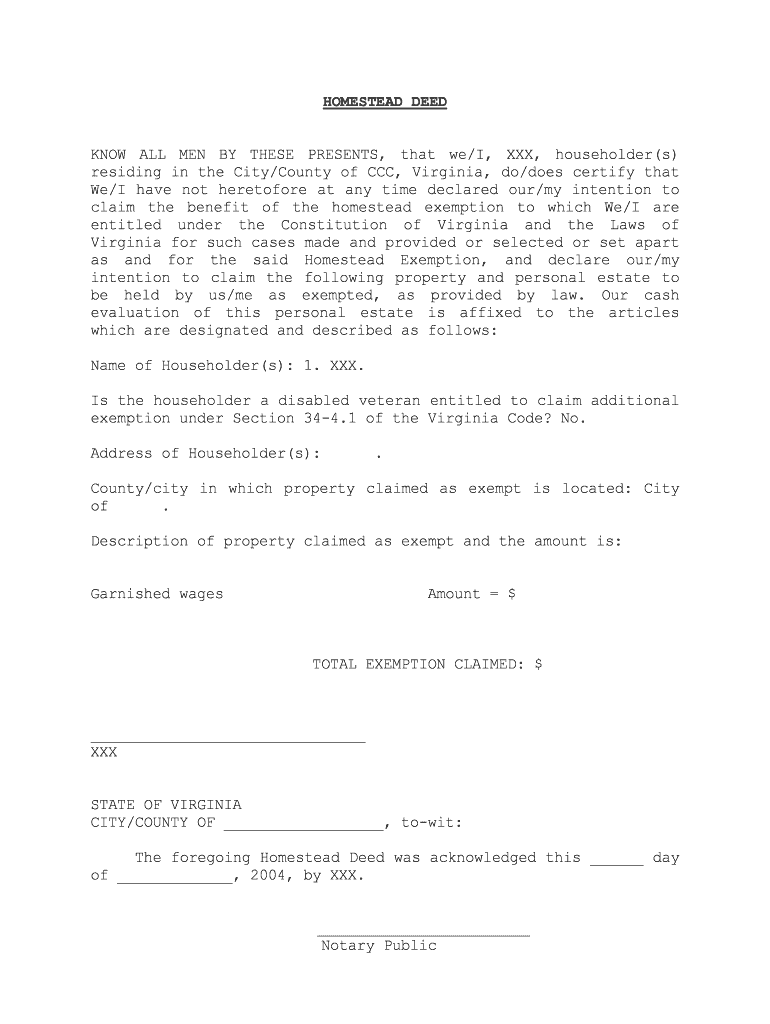

HOMESTEAD DEED

KNOW ALL MEN BY THESE PRESENTS, that we/I, XXX, householder(s)

residing in the City/County of CCC, Virginia, do/does certify that

We/I have not heretofore at any time declared our/my

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign homestead deed virginia form

Edit your virginia homestead form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homestead deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit virginia homestead exemption form online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit virginia homestead tax exemption form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out virginia deed form

How to fill out VA-LS-006

01

Begin by gathering all necessary personal information, including your name, address, Social Security number, and contact information.

02

Review the instructions on page 1 of the VA-LS-006 form to understand the purpose and requirements of the form.

03

Fill in the section related to your military service, specifying your dates of service and branch of the military.

04

Complete the financial information section accurately, reporting your income, expenses, and assets as required.

05

If applicable, provide additional information regarding any dependents or other relevant circumstances.

06

Review the entire form to ensure all information is accurate and complete before signing.

07

Submit the completed VA-LS-006 form to the appropriate VA office as instructed.

Who needs VA-LS-006?

01

Individuals who are veterans or active service members seeking assistance with VA benefits, or those applying for long-term services and support from the VA may need to fill out VA-LS-006.

Fill

virginia homestead act

: Try Risk Free

People Also Ask about virginia homestead law

What is the tax exemption for over 65 in Virginia?

In addition, Virginia allows an exemption of $800* for each of the following: Age 65 or over: Each filer who is age 65 or over by January 1 may claim an additional exemption. When a married couple uses the Spouse Tax Adjustment, each spouse must claim his or her own age exemption.

Who qualifies for homestead exemption in Virginia?

Virginia homestead laws allow residents to designate up to $5,000 worth of real estate (including mobile homes) as a homestead, plus $500 for each dependent. If a resident is sixty-five years of age or older, or a married couples files for an exemption together, up to $10,000 may be exempted under the homestead laws.

Does VA have a homestead exemption?

What are the qualifications for this exemption? You qualify for this 100% homestead exemption if you meet these requirements: You own a home and occupy it as your residence homestead. You are receiving 100% disability compensation from the US Department of Veterans Affairs for a service-connected disability.

How do I become exempt from property taxes in Virginia?

Owner/Applicant must be at least 65 or permanently disabled as of December 31 of the previous year. Sworn affidavits from two medical doctors licensed in Virginia or two military officers who practice medicine in the United States Armed Forces - use the Tax Relief Affidavit of Disability (PDF) for their completion.

Who qualifies for Virginia homestead exemption?

Virginia homestead laws allow residents to designate up to $5,000 worth of real estate (including mobile homes) as a homestead, plus $500 for each dependent. If a resident is sixty-five years of age or older, or a married couples files for an exemption together, up to $10,000 may be exempted under the homestead laws.

What property is exempt from creditors in Virginia?

Personal Property Exemptions Up to $5,000 in household furnishings. Up to $5,000 in family heirlooms. Up to $1,000 in clothing. Your wedding and engagement rings.

What is the homestead tax exemption in Virginia?

Under the Virginia exemption system, homeowners can exempt up to $25,000 of equity in a home or other property covered by the homestead exemption. The exemption applies to real property, which includes your home or condominium and personal property used as a residence, so your mobile home would also be covered.

Is Virginia a good place to homestead?

Virginia is a great state for homesteading. It has excellent laws regarding living off-grid, is an open-carry state, and allows a homestead exemption. Virginia is also a great place to homeschool children, work in the cottage food industry, and raise livestock as well thanks to relaxed regulations.

Who qualifies for personal property tax relief in Virginia?

General Information. Personal property tax relief is provided for any passenger car, motorcycle, or pickup or panel truck having a registered gross weight with DMV of 10,000 pounds or less on January 1. Qualifying vehicles must be owned or leased by an individual and be used 50% or less for business purposes.

What is a Virginia homestead deed?

General Information. A Homestead Deed prevents creditors from attaching/levying one's personal property and equity in real estate. Normally, such an instrument is filed when an individual is going into bankruptcy or is anticipating a judgment against him/her.

How do I file for homestead exemption in Virginia?

Virginia Homestead Declarations In Virginia, you must file a homestead declaration (a form filed with the county recorder's office to record your right to a homestead exemption) before filing for bankruptcy to claim the homestead exemption. Contact your county or city recorder for information about the procedure.

Does Virginia have homestead exemption?

The Virginia homestead exemption is a right granted under the Virginia law and can be found in 34- 4 of the Virginia Code Annotated. The exemption provides for $5,000 of protection per person on any asset the person chooses – such as money in bank or tax refunds.

Does Virginia have a homestead exemption for seniors?

Background. The Virginia General Assembly enacted legislation allowing Loudoun County to provide an exemption from real property taxes on the principal dwelling and up to three acres for residents who are at least 65 years of age or permanently and totally disabled.

How do I apply for property tax exemption in Virginia?

In all cases, you must apply for property tax relief in order to receive it. The deadline is often around May 1 of each year. Call your local Commissioner of the Revenue or other local assessment official for the exact date and local eligibility rules for your county, city, or town.

What does homestead exemption waived mean in Virginia?

A: It means that in the contract you signed you waived your right to claim a Homestead exemption, generally $5,000, under Virginia law. Matthew Lane Kreitzer agrees with this answer. Consumers: Ask Lawyers Questions and Get Answers for Free!

What is the age deduction for 2022 in Virginia?

Taxpayers Age 65 & Older If you, or your spouse, were born on or before January 1, 1958, you may qualify to claim an age deduction of up to $12,000 each for 2022. The age deduction you may claim will depend upon your birth date, filing status and income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send virginia homestead exemption form for eSignature?

virginia homestead exemption form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in virginia homestead exemption form?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your virginia homestead exemption form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit virginia homestead exemption form straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing virginia homestead exemption form right away.

What is VA-LS-006?

VA-LS-006 is a specific form used by certain entities in Virginia for reporting and compliance purposes related to specific laws or regulations.

Who is required to file VA-LS-006?

Entities such as businesses and organizations that meet certain criteria established by Virginia law are required to file VA-LS-006.

How to fill out VA-LS-006?

To fill out VA-LS-006, individuals should provide the necessary information as outlined in the form instructions, including relevant details about the entity and the information being reported.

What is the purpose of VA-LS-006?

The purpose of VA-LS-006 is to ensure compliance with state regulations and to collect necessary data for governmental purposes.

What information must be reported on VA-LS-006?

Information that must be reported on VA-LS-006 typically includes the entity's contact information, relevant financial data, and any other information required by the state.

Fill out your virginia homestead exemption form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Virginia Homestead Exemption Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.