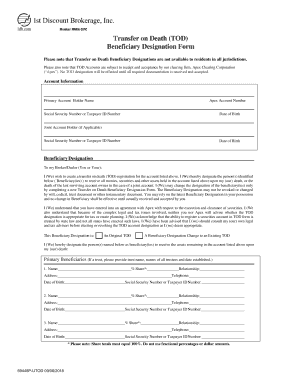

Get the free beneficiary death deed

Show details

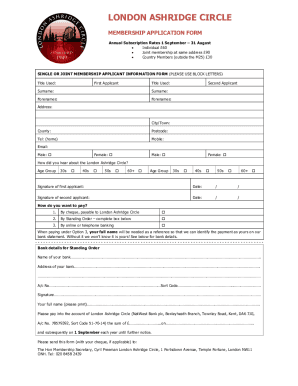

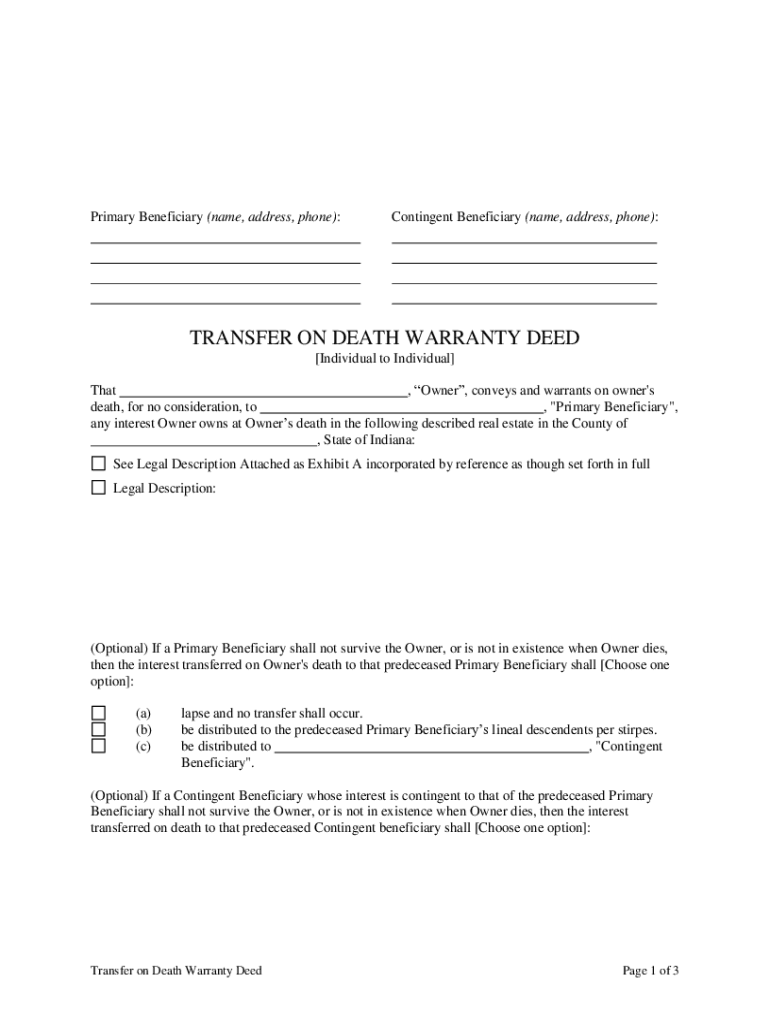

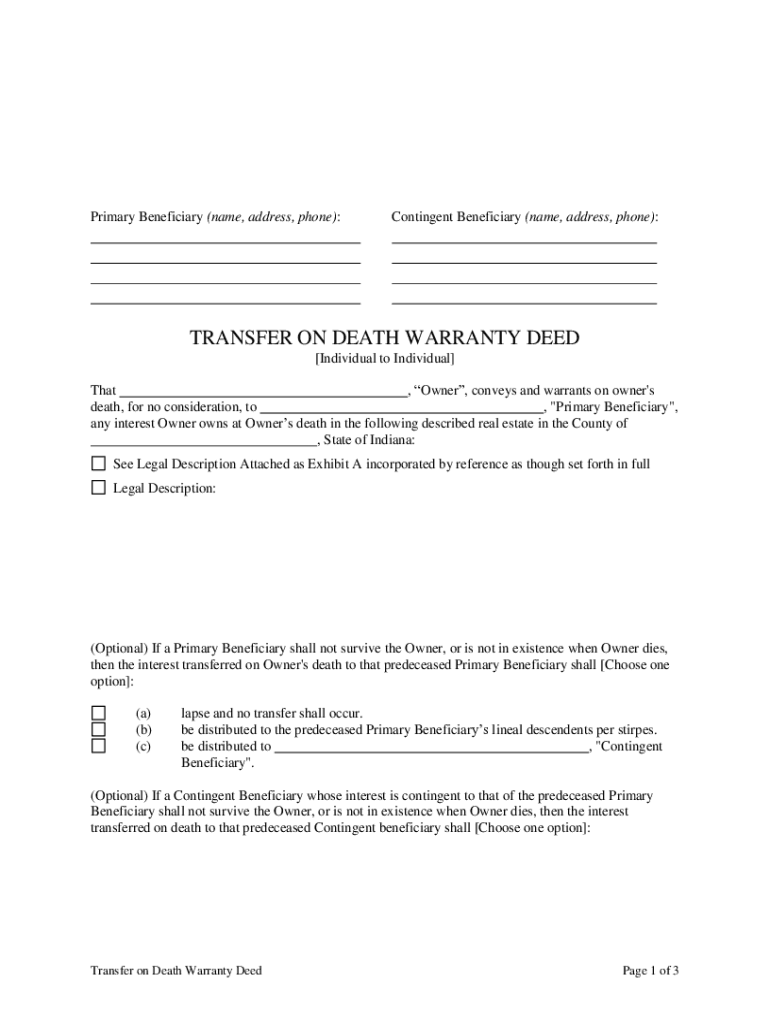

2016 U.S. Legal Forms, Inc.INDIANATRANSFER ON DEATH WARRANTY DEED Individual to Individual Control Number: IN0183I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indiana beneficiary deed form

Edit your beneficiary deed form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficiary death deed form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing beneficiary death deed form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit beneficiary death deed form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

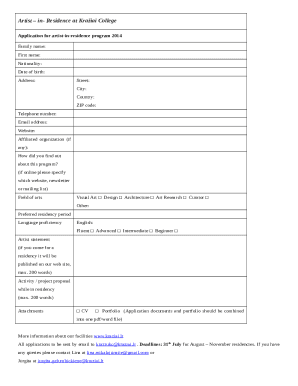

How to fill out beneficiary death deed form

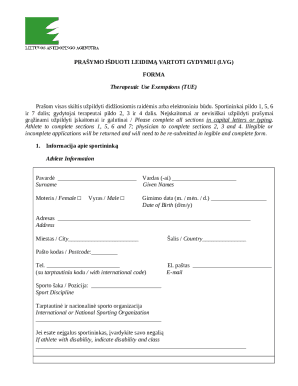

How to fill out IN-01-83

01

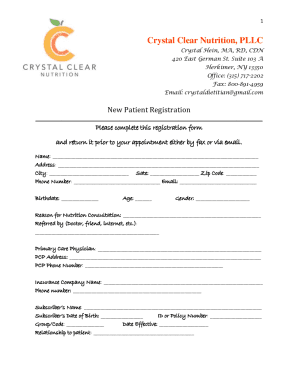

Gather all necessary personal information, including your name, address, and contact details.

02

Locate the section of the form that requires you to provide your reason for filling out IN-01-83.

03

Fill out the corresponding fields with accurate and complete information.

04

Review the form to ensure that all sections are filled out correctly.

05

Sign and date the form where indicated.

06

Submit the completed form to the appropriate agency or authority as specified in the instructions.

Who needs IN-01-83?

01

Individuals who are applying for a specific program or benefit that requires the completion of the IN-01-83 form.

02

Organizations that assist clients in applying for programs related to the form.

03

Anyone seeking to update their records with the issuing authority.

Fill

form

: Try Risk Free

People Also Ask about

Does Indiana have TOD deeds?

A TOD Beneficiary may be added to an Indiana Certificate of Title at the time of purchase (title transfer), or, if you already have title to the vehicle, you may apply for new title containing the TOD designation.

How do I file a transfer on death deed in Indiana?

You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office before your death. Otherwise, it won't be valid. You can make an Indiana transfer on death deed with WillMaker.

Which is better TOD or beneficiary?

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

How does TOD work in Indiana?

An Indiana TOD deed form allows Indiana property owners to achieve two goals. It allows the owner to avoid probate at death. Upon the owner's death, the property passes automatically to the beneficiaries named in the deed, without the need for Indiana probate. It allows the owner to retain control during life.

What are the disadvantages of a transfer on death deed?

TOD/POD disadvantages: these accounts pass directly to the beneficiary and do not go through probate, if the executor does not have enough probate assets to pay the debts of the estate, creditors are entitled to claim some non- probate assets, including TOD accounts.

Is transfer on death a good idea?

A Transfer on Death Deed can be a great way to ensure your loved ones or Beneficiaries get the inheritance you intend. It streamlines the process, allowing for a simple transfer of property ownership without the headache, cost and time that probate requires.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary death deed form for eSignature?

Once your beneficiary death deed form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute beneficiary death deed form online?

Filling out and eSigning beneficiary death deed form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I complete beneficiary death deed form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your beneficiary death deed form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IN-01-83?

IN-01-83 is a tax form used in the state of Indiana for reporting certain financial information to the Department of Revenue.

Who is required to file IN-01-83?

Individuals and organizations that meet specific financial thresholds or engage in certain taxable activities in Indiana are required to file IN-01-83.

How to fill out IN-01-83?

To fill out IN-01-83, you need to provide your personal information, financial details, and any applicable deductions or credits. Guidelines and instructions are provided with the form.

What is the purpose of IN-01-83?

The purpose of IN-01-83 is to ensure proper reporting and tracking of tax obligations and to maintain compliance with state tax laws in Indiana.

What information must be reported on IN-01-83?

IN-01-83 requires reporting of income, expenses, deductions, credits, and any other relevant financial information that pertains to the taxpayer's obligations.

Fill out your beneficiary death deed form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficiary Death Deed Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.