AZ-POA-2 free printable template

Show details

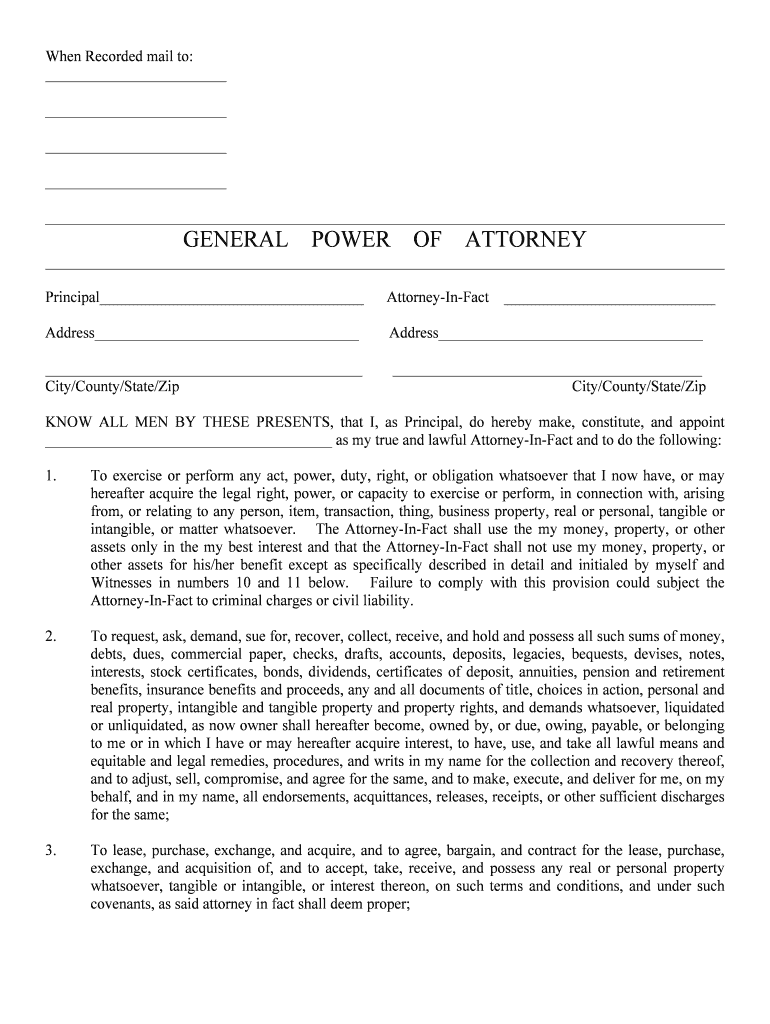

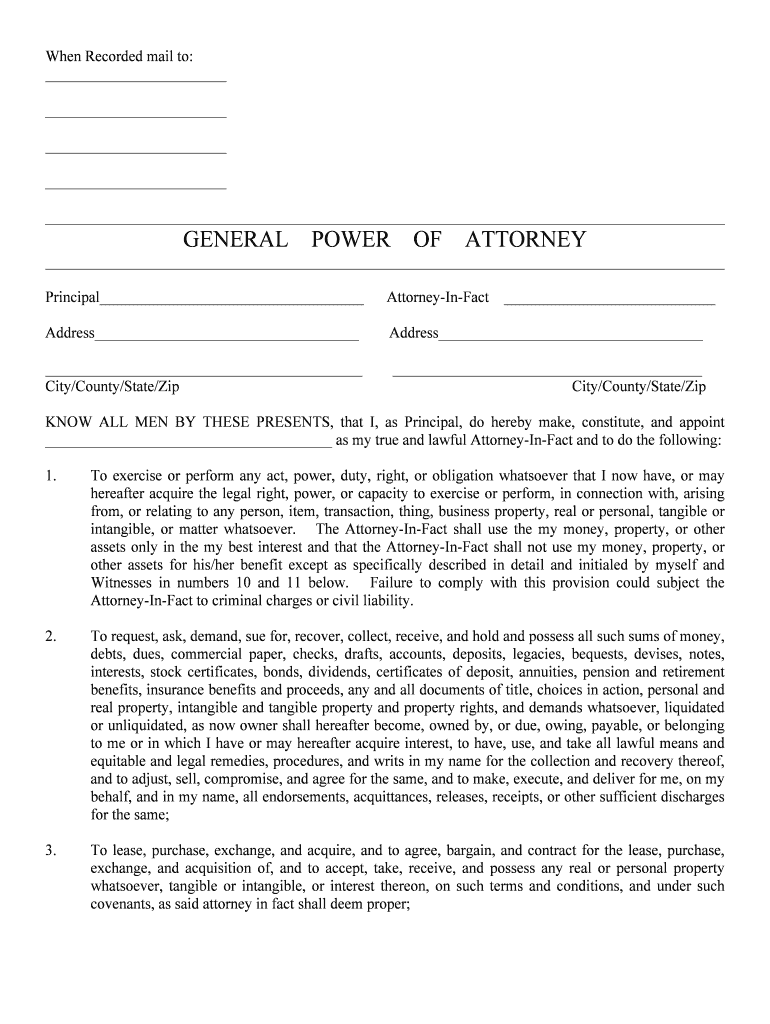

When Recorded mail to: GENERAL POWER OF ATTORNEY Principal AttorneyInFact Address City/County/State/Zip City/County/State/Know ALL MEN BY THESE PRESENTS, that I, as Principal, do hereby make, constitute,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign az poa form

Edit your power attorney poa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your az poa make form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit arizona poa form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit arizona poa form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out arizona poa form

How to fill out AZ-POA-2

01

Obtain the AZ-POA-2 form from the appropriate state agency or website.

02

Fill out the identifying information at the top, such as your name and address.

03

Clearly state the specific powers you are granting, detailing any limitations if necessary.

04

Include the name and contact information of the individual you are appointing as your agent.

05

Write the effective date of the power of attorney.

06

Sign and date the form in the designated area.

07

Have your signature notarized by a licensed notary public, if required.

08

Provide copies of the signed AZ-POA-2 to your agent and any relevant parties.

Who needs AZ-POA-2?

01

Individuals who wish to designate someone to make financial or legal decisions on their behalf, particularly if they anticipate being unable to handle their affairs due to illness, travel, or incapacity.

Fill

form

: Try Risk Free

People Also Ask about

Does a power of attorney have to be filed with the court in Ohio?

No, power of attorney documentation is not filed with the courts. However, in some parts of Ohio, the property will get filed with the county recorder's office to allow the attorney to manage real estate property. Otherwise, simply signing the document is all that the law requires.

How do I get power of attorney for an elderly parent in Ohio?

How to Get a POA for Elderly Parents in Good Health Talk it through with your parent(s) At this point, you should have a better idea of what type of power of attorney would suit your situation. Consult with a lawyer. The laws governing powers of attorney vary from state to state. Document your rights. Execute the document.

How do you get POA in Oregon?

Steps for Making a Financial Power of Attorney in Oregon Create the POA Using a Form, Software or an Attorney. Sign the POA in the Presence of a Notary Public. Store the Original POA in a Safe Place. Give a Copy to Your Agent or Attorney-in-Fact. File a Copy With the Recorder's Office.

What is the process of POA?

If a Power of Attorney is in respect to an immovable property of value more than ₹100, it is compulsory to get that registered for it to be legally valid. A POA must be authenticated by a sub-registrar or it must be notarized by the notary especially in the case where the power to sell land is granted to the agent.

How much does it cost to get a power of attorney in Ohio?

Some lawyers charge by the hour, with the average hourly rate for a family or probate lawyer typically in the $250 to $350 range. However, you also may be able to draft some POA forms online at low cost.

What are the disadvantages of power of attorney?

What Are the Disadvantages of a Power of Attorney? A Power of Attorney Could Leave You Vulnerable to Abuse. If You Make Mistakes In Its Creation, Your Power Of Attorney Won't Grant the Expected Authority. A Power Of Attorney Doesn't Address What Happens to Assets After Your Death.

How much does it cost to get a power of attorney in Texas?

Generally, an attorney will charge in the $100 to $200 range for a power of attorney. Most estate planning attorneys have estate planning packages that include a will, a trust, powers of attorney, and other documents.

How quickly can you get POA?

Once the LPA is submitted, the Government says it can take up to 20 weeks to register. The power will take effect as soon as the LPA is registered, so the attorney will be able to start making decisions straightaway, unless they specify otherwise on the application.

How much does a POA cost in Texas?

Many lawyers charge a set fee to prepare a POA. Fees may vary ing to the type of POA, its length, and complexity, but the average cost of a power of attorney is about $300. Some lawyers charge by the hour, with the average hourly rate for a family or probate lawyer typically in the $250 to $350 range.

What is the best form of power of attorney?

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.

What is a Florida durable power of attorney?

A Florida durable power of attorney form represents a way in which an individual, or principal, can have someone act for them with regard to their finances and other areas of life. The durable type of POA stays in effect even if the principal ends up in a situation where he or she cannot think or act or communicate.

Do you need a lawyer to get a power of attorney in Texas?

In Texas, you're not required to hire a lawyer to create your power of attorney — you can do it yourself, saving you time and money. As long as you follow Texas's requirements, any POA you create is legally binding.

Where can I get a power of attorney form in Ohio?

The state of Ohio provides a statutory form POA for financial decisions. It doesn't have a standardized form for a medical POA. In both cases, you can use FreeWill's free online software to create a power of attorney document tailored to your needs. Complete the form, sign it, and then have it notarized or witnessed.

How much does it cost to get power of attorney in Oregon?

How much might I typically need to pay for a lawyer to help me get a Power of Attorney form in Oregon? The cost of working with the average lawyer to draft a Power of Attorney might range anywhere between $200 and $500, based on your location.

What are reasonable attorney fees in Texas?

The typical lawyer in Texas charges between $159 and $433 per hour. Costs vary depending on the type of lawyer, so review our lawyer rates table to find out the average cost to hire an attorney in Texas.

Do you need witnesses for POA in Oregon?

Signing Requirements (§ 127.515(2)(b)) – Two (2) witnesses or a notary acknowledgment. Durable (Financial) Power of Attorney – Can be used to appoint a person to manage your financial affairs, including the acquisition and disposition of assets.

Do you need a notary for power of attorney Ohio?

While Ohio does not technically require you to get your POA notarized, notarization is strongly recommended. Under Ohio law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuine—meaning your POA is more ironclad.

Which type of power of attorney grants the greatest powers?

General power of attorney A general POA gives your agent considerable power over your affairs, but there are still some things they can't do. For example, they can't enter into a marriage on your behalf, or make changes to your last will and testament.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in arizona poa form without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit arizona poa form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my arizona poa form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your arizona poa form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out arizona poa form on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your arizona poa form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is AZ-POA-2?

AZ-POA-2 is a form used in Arizona to authorize someone to represent a taxpayer before the Arizona Department of Revenue.

Who is required to file AZ-POA-2?

Taxpayers who wish to designate a representative for tax matters before the Arizona Department of Revenue are required to file AZ-POA-2.

How to fill out AZ-POA-2?

To fill out AZ-POA-2, provide the taxpayer's information, the representative's information, and specify the tax matters and tax years for which the authorization applies.

What is the purpose of AZ-POA-2?

The purpose of AZ-POA-2 is to formally authorize a representative to act on behalf of a taxpayer in dealing with tax issues and communications with the Arizona Department of Revenue.

What information must be reported on AZ-POA-2?

AZ-POA-2 must report the taxpayer's name, address, and tax identification number, as well as the representative's name, address, and contact information, along with the specific tax matters and tax years involved.

Fill out your arizona poa form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Poa Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.