Last updated on Feb 17, 2026

Get the free ct widow

Show details

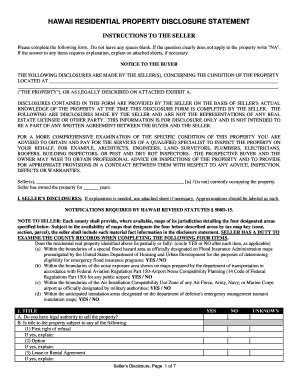

CONNECTICUT WILL INSTRUCTIONS Widow or Widower with Adult Children U.S. Legal Forms, Inc. http://www.uslegalforms.com1. This Will is designed to be completed on your computer. To do so, use your mouse

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is ct widow

A CT widow refers to a document related to Connecticut tax benefits for the surviving spouse of a deceased person, specifically regarding tax exemptions or deductions.

pdfFiller scores top ratings on review platforms

It took me a few minutes to figure out how to find you and to find the form I needed. But had no trouble after figuring out the ins and outs of what I needed to do. Thanks

It was really helpful. We could add more forms for 1120 like the overflow statement and carryover worksheet.

Product is easy to use, does what it claims to do.

Was a bit cumbersome. When I searched for forms, the system kept giving me instructions on how to search instead of stating that an error was made or what to do to continue.

I love being able to fill out forms that I wouldn't be able to normally. My handwriting can be hard to read and this makes it clean and clear. The others parties like it too! :)

Love it. Makes docs look more professional

Who needs ct widow?

Explore how professionals across industries use pdfFiller.

How to fill out a CT Widow Form

Understanding the CT Widow Form

The Connecticut Widow Form is a crucial document for widows and widowers seeking benefits in the state. Its main purpose is to ensure that bereaved spouses can access financial support while navigating their loss. This form is particularly important for those with adult children, as it lays the groundwork for benefit distribution. With tools like pdfFiller, users can easily edit the form, ensuring all necessary information is accurate and clear.

-

It serves as an official document to apply for widow benefits, helping in the transition of financial management after losing a spouse.

-

It enables access to vital benefits and can facilitate discussions on estate management, particularly when children are involved.

-

Users can take advantage of pdfFiller's platform for easier editing and management of the form, increasing efficiency.

How to navigate the widow's benefits application process?

Applying for widow's benefits in Connecticut requires careful navigation through the state's system. The application process can seem daunting, but understanding the steps can alleviate some of the stress during this difficult time. Knowing the eligibility criteria and gathering the key documentation ensures successful submissions.

-

Follow the structured process outlined by the Connecticut government to submit your application efficiently.

-

Typically, you must be the surviving spouse of a deceased individual who was covered under specific benefit plans.

-

Prepare documents such as your marriage certificate, death certificate, and any previous income verification.

Filling out the Connecticut Widow Form: Field-by-field guide

Completing the Connecticut Widow Form accurately is vital to ensure timely processing. This section will offer detailed instructions on how to fill in each portion of the form, emphasizing accuracy in data entry to prevent delays.

-

Follow clear guides on what to include in fields regarding personal and financial information.

-

Include your name, county of residence, and any identification numbers as required.

-

Double-check all entries and ensure all documents are attached to avoid any processing holdups.

Understanding the articles of the will: Key sections

Understanding the articles of the will is crucial for filling out the CT Widow Form correctly. Each article has specific requirements that outline the distribution of assets and the deceased's wishes.

-

Include precise names of the deceased spouse and children, ensuring the relationships are accurately represented in the document.

-

Clearly specify how the property should be distributed, addressing any concerns about naming individuals and defining types of property.

-

Designate the homestead for beneficiaries with appropriate legal terminology to avoid disputes in the future.

What are common challenges in form submission?

Submitting the CT Widow Form can present several challenges, often due to errors or incomplete information. Recognizing these frequent pitfalls allows applicants to mitigate risks and streamline the review process.

-

Common issues include missing signatures, incomplete fields, or providing inaccurate personal information.

-

Be prepared for a review time which could vary depending on documentation completeness and correctness, affecting benefit timelines.

How to streamline your workflow with pdfFiller?

Using pdfFiller can greatly enhance your efficiency throughout the document preparation and submission process. The platform allows users to create, edit, and eSign documents seamlessly from anywhere.

-

Access templates specifically designed for Connecticut widow forms that make completing them easier.

-

Utilize the eSign feature to obtain quick approvals from required signatories.

-

Manage forms effectively with collaboration features allowing multiple users to work on a document at the same time.

What resources are available for additional support?

For those seeking further assistance, numerous resources are available. Understanding where to find legal guidance can help in ensuring that all aspects of the CT Widow Form and related benefits are comprehensively addressed.

-

Locate attorneys or support organizations specializing in widow benefits, who can provide tailored advice.

-

Connect with Connecticut state government websites for up-to-date guidelines and additional forms.

-

Reach out to pdfFiller's customer support for questions regarding form usage or technical issues.

How to fill out the ct widow

-

1.Open pdfFiller and upload the CT widow document.

-

2.Review the instructions provided on the document carefully to understand what information is required.

-

3.Begin filling out your personal information, such as your name, address, and contact details in the specified fields.

-

4.Provide details regarding your deceased spouse, including their name, date of birth, and date of death, as requested.

-

5.Enter any necessary financial information, such as income details relevant to tax deductions.

-

6.If applicable, include any documentation required to support your claims, like death certificates or marriage licenses, by uploading these files.

-

7.Review all entered data to ensure accuracy and completeness before submission.

-

8.Once verified, save the completed document in your desired format or direct it for submission as further instructed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.