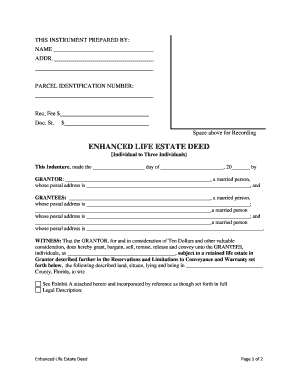

Get the free kansas transfer on death deed form

Show details

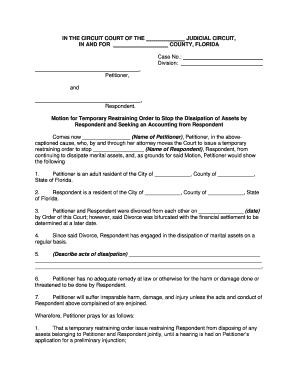

Prepared by U.S. Legal Forms, Inc. Copyright 2001 U.S. Legal Forms, Inc. STATE OF KANSASTRANSFER ON DEATH DEED Individual to Individual Control Number KS 019 77-Page 1 NOTES ON COMPLETING THESE FORMS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer on death deed kansas form

Edit your kansas transfer on death deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed tod form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer death kansas online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transfer death deed form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer death document form

How to fill out KS-019-77

01

Obtain the KS-019-77 form from the appropriate agency or website.

02

Begin with Section 1: Fill in your personal information, including your name, address, and contact details.

03

Proceed to Section 2: Provide any relevant identification numbers or references as requested.

04

Move on to Section 3: Answer the specific questions related to your application or request thoroughly.

05

In Section 4: Review and ensure that all information is accurate and complete.

06

Sign and date the form at the bottom, confirming that the information provided is true to the best of your knowledge.

07

Submit the completed form to the designated office or upload it online, following any specific submission instructions.

Who needs KS-019-77?

01

Individuals applying for a service or benefit requiring the form KS-019-77.

02

Organizations or entities that need to submit necessary documentation for regulatory compliance.

03

Any person or party involved in a legal process that mandates the completion of this form.

Fill

death beneficiary form

: Try Risk Free

People Also Ask about

What is the disadvantage of a TOD deed?

In some states, such as California, multiple beneficiaries on TOD deeds can't inherit unequal property shares, and you can't name a backup beneficiary. In addition, your estate plan may be too complex for a TOD deed if you have multiple children to whom you'd like to pass property. Not available in many states.

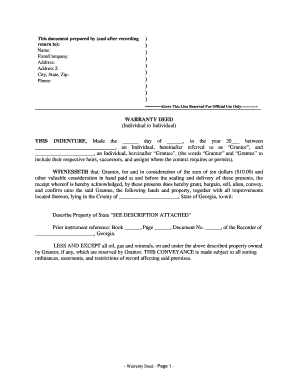

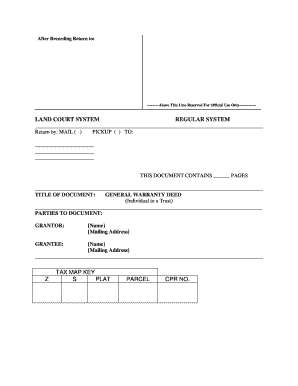

Does transfer on death avoid probate in Kansas?

TOD deeds are an estate-planning tool that allows Kansas real estate to bypass the owner's probate estate. Real estate described in a TOD deed does not pass through probate (the legal process of carrying out a will) because title automatically belongs to the beneficiary when the property owner dies.

How do I add a TOD to my car title in Kansas?

A TOD for Vehicles can be recorded by taking the title to the County Treasurer in the owner's county of residence and paying a fee. The grantor need not inform the recipient or get their approval to be able to record a TOD.

What are the drawbacks of transfer on death?

The disadvantages include the potential unintentional treatment of beneficiaries. Because a Transfer on Death Account (TOD) is a non-probate asset, it is not controlled by your will. If you update your estate plan to change beneficiaries, you'll need to do more than just change your will.

Does Kansas have a TOD deed?

(a) An interest in real estate may be titled in transfer-on-death, TOD, form by recording a deed signed by the record owner of such interest, designating a grantee beneficiary or beneficiaries of the interest. Such deed shall transfer ownership of such interest upon the death of the owner.

Is transfer on death a good idea?

A Transfer on Death Deed can be a great way to ensure your loved ones or Beneficiaries get the inheritance you intend. It streamlines the process, allowing for a simple transfer of property ownership without the headache, cost and time that probate requires.

Do cars go through probate in Kansas?

Kansas allows transfer-on-death registration of vehicles. If you register your vehicle this way, the beneficiary you name will automatically inherit the vehicle after your death. No probate court proceeding will be necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit kansas transfer on death from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like kansas transfer on death, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send kansas transfer on death to be eSigned by others?

When you're ready to share your kansas transfer on death, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the kansas transfer on death in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your kansas transfer on death right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is KS-019-77?

KS-019-77 is a specific form used for reporting financial or regulatory information, typically required by a governmental or regulatory body.

Who is required to file KS-019-77?

Entities or individuals who meet specific criteria outlined by the regulatory authority, such as businesses or organizations operating within a certain jurisdiction, are required to file KS-019-77.

How to fill out KS-019-77?

To fill out KS-019-77, gather required documentation, complete each section with accurate data, ensuring compliance with instructions, and submit the form by the designated deadline.

What is the purpose of KS-019-77?

The purpose of KS-019-77 is to collect necessary information for regulatory oversight, financial transparency, or compliance with specific laws and regulations.

What information must be reported on KS-019-77?

Information that must be reported on KS-019-77 typically includes financial data, organizational details, nature of operations, and any other information as stipulated by the regulatory body.

Fill out your kansas transfer on death online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kansas Transfer On Death is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.