MN-01-82 free printable template

Show details

2016 U.S. Legal Forms, Inc. MINNESOTA TRANSFER ON DEATH DEED Individual to Individual Control Number: MN0182I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields created

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer death deed form

Edit your transfer on death deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer on death deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer on death deed online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transfer on death deed. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer on death deed

How to fill out MN-01-82

01

Gather all necessary personal information such as your name, address, and contact details.

02

Locate the specific section for income information and prepare to enter your earnings.

03

Fill out the section regarding your household composition, including any dependents.

04

Provide details about any relevant medical expenses or financial obligations.

05

Review the form for any specific instructions related to your situation.

06

Sign and date the form in the appropriate section.

Who needs MN-01-82?

01

Individuals applying for state assistance programs.

02

Families seeking financial support due to low income.

03

People needing to report changes in their financial status to state agencies.

Fill

form

: Try Risk Free

People Also Ask about

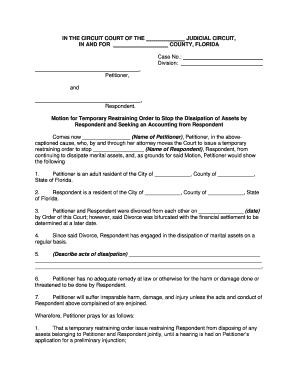

How does a transfer on death deed work in MN?

A transfer on death deed is valid if the deed is recorded in a county in which at least a part of the real property described in the deed is located and is recorded before the death of the grantor owner upon whose death the conveyance or transfer is effective.

How do I file a transfer on death deed in Minnesota?

You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office or county registrar of titles (see "Recording Your Deed" below to determine which) before your death. Otherwise, it won't be valid. You can make a Minnesota transfer on death deed with WillMaker.

What is a transfer on death for vehicles in Minnesota?

The Minnesota Legislature established a Transfer-On-Death (TOD) form so vehicle owners can pass their vehicles onto their loved ones immediately upon death, avoiding probate. The beneficiary can be an individual person or a trust (e.g. revocable living trust).

How to transfer a car title when owner is deceased in Minnesota?

Transferring the Vehicle Title as a Trustee A copy of the trust indicating you as the trustee. Proof of death. A declaration stating the applicant is inheriting the vehicle, or a copy of the trust that shows the beneficiary, if the new vehicle owner is a legal heir. Payment for the MN vehicle title transfer fee.

What are the disadvantages of a transfer on death deed?

TOD/POD disadvantages: these accounts pass directly to the beneficiary and do not go through probate, if the executor does not have enough probate assets to pay the debts of the estate, creditors are entitled to claim some non- probate assets, including TOD accounts.

Does Minnesota allow transfer on death deed?

A transfer on death deed is valid if the deed is recorded in a county in which at least a part of the real property described in the deed is located and is recorded before the death of the grantor owner upon whose death the conveyance or transfer is effective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my transfer on death deed directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign transfer on death deed and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit transfer on death deed online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your transfer on death deed to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the transfer on death deed form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign transfer on death deed and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is MN-01-82?

MN-01-82 is a form used by the State of Minnesota for reporting specific financial information related to income and taxes.

Who is required to file MN-01-82?

Individuals and businesses that meet certain income thresholds or specific criteria set by the Minnesota Department of Revenue are required to file MN-01-82.

How to fill out MN-01-82?

To fill out MN-01-82, individuals should gather their financial documents, complete each section of the form accurately, and ensure that all required calculations and data are provided before submitting it to the appropriate state department.

What is the purpose of MN-01-82?

The purpose of MN-01-82 is to gather official financial data for tax assessment and evaluation of taxpayer obligations in the state of Minnesota.

What information must be reported on MN-01-82?

Information that must be reported on MN-01-82 includes personal identification details, income sources, deductions, tax credits, and any other relevant financial data as specified in the form's guidelines.

Fill out your transfer on death deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer On Death Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.