Get the free pdffiller

Show details

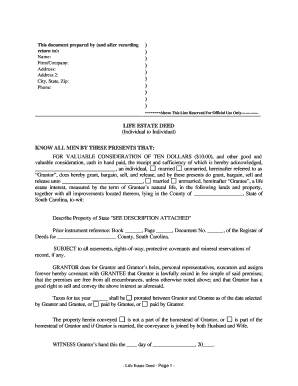

2016 U.S. Legal Forms, Inc. TEXAS ENHANCED LIFE ESTATE QUITCLAIM DEED A.K.A. Lady Bird Deed Individual to Individual Control Number: TX01 82I. TIPS ON COMPLETING THE FORMS The form(s) in this packet

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life estate deed form

Edit your texas estate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas life deed form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas life estate deed online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ladybird deed form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas lady bird form

How to fill out texas life estate deed:

01

Gather all necessary information: You will need the names and addresses of the Grantor (current owner) and the Grantee (person receiving the life estate), as well as a legal description of the property.

02

Obtain the correct form: Look for a Texas life estate deed form, which can typically be found online or at a local county clerk's office. Make sure it complies with the legal requirements in Texas.

03

Fill in the form accurately: Complete all required fields on the form, including the names and addresses of the Grantor and Grantee, legal description of the property, and any additional information requested.

04

Seek legal advice if necessary: If you have any doubts or concerns about filling out the deed correctly, it is always advisable to consult with a legal professional who specializes in real estate matters.

05

Sign the deed: Once the form is filled out correctly, both the Grantor and Grantee need to sign the deed in the presence of a notary public.

06

Record the deed: The completed and signed deed must be recorded in the county where the property is located. Contact the county clerk's office to learn about their specific requirements for recording deeds.

Who needs texas life estate deed:

01

Individuals who wish to transfer their property to someone else while retaining the right to live on or use the property for the rest of their lives may need a Texas life estate deed.

02

This type of deed is commonly used in estate planning to ensure the property passes smoothly to the intended beneficiary upon the life tenant's death.

03

It can also be useful for Medicaid planning, as transferring the property through a life estate may help protect its value from being considered for eligibility and asset spend-down purposes.

04

Moreover, individuals who want to avoid the probate process for transferring their property upon their death may find a Texas life estate deed beneficial.

05

It is important to consult with a legal professional to determine if a life estate deed is the appropriate option for your specific circumstances and to ensure compliance with Texas laws and regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is an enhanced life estate deed in Texas?

A Lady Bird deed is a special kind of deed that is commonly recognized by Texas law. Also called an enhanced life estate deed, it can be used to transfer property to beneficiaries outside of probate. It gives the current owner continued control over the property until his or her death.

How does a life estate deed work in Texas?

What is a Life Estate in Texas? A life estate is a property interest that limits itself by the tenant's lifetime. In other words, the life tenant holds the right to use and occupy the property for their lifetime, after which the remainderman takes possession.

Can a life estate be reversed in Texas?

Reversing a Life Estate There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed.

Does a lady bird deed have to be recorded in Texas?

In order for a Transfer on Death Deed to be valid, it must be signed, notarized, and recorded in the property records of the county where the property is located. In contrast, a Lady Bird Deed does not have a recording requirement. All that is required for a deed to be valid in Texas is delivery to the Grantee.

Can you revoke a life estate deed in Texas?

Your Rights of Ownership Retained During Your Life The Lady Bird Deed, if drafted properly, allows you as the owner of the “life estate” in the property to mortgage, lease, sell, change your beneficiaries, or even revoke the deed, without the consent of the remaindermen.

What are the rights of a life estate in Texas?

What is a Life Estate in Texas? A life estate is a property interest that limits itself by the tenant's lifetime. In other words, the life tenant holds the right to use and occupy the property for their lifetime, after which the remainderman takes possession.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

pdffiller form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit pdffiller form from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your pdffiller form into a dynamic fillable form that you can manage and eSign from anywhere.

Can I edit pdffiller form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share pdffiller form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is texas life estate deed?

A Texas life estate deed is a legal document that allows property owners to transfer their property to a designated beneficiary while retaining the right to live in and use the property during their lifetime.

Who is required to file texas life estate deed?

The property owner, also known as the grantor, is required to file the Texas life estate deed with the county clerk's office in the county where the property is located.

How to fill out texas life estate deed?

To fill out a Texas life estate deed, you typically need to provide the names of the grantor and the beneficiary, a legal description of the property, the life estate holder's rights, and the signature of the grantor, which must be notarized.

What is the purpose of texas life estate deed?

The purpose of a Texas life estate deed is to allow property owners to ensure the property passes to their chosen beneficiaries upon their death, while retaining control and use of the property during their lifetime.

What information must be reported on texas life estate deed?

The information that must be reported on a Texas life estate deed includes the names of the grantor and the beneficiaries, the legal description of the property, the intended use of the life estate, and the signatures of the involved parties.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.