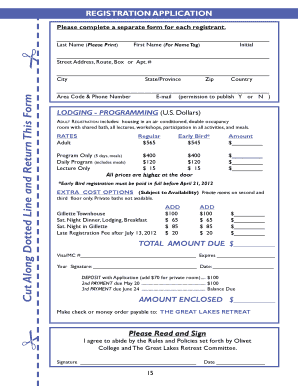

Get the free california agreement to act as trustee form

Show details

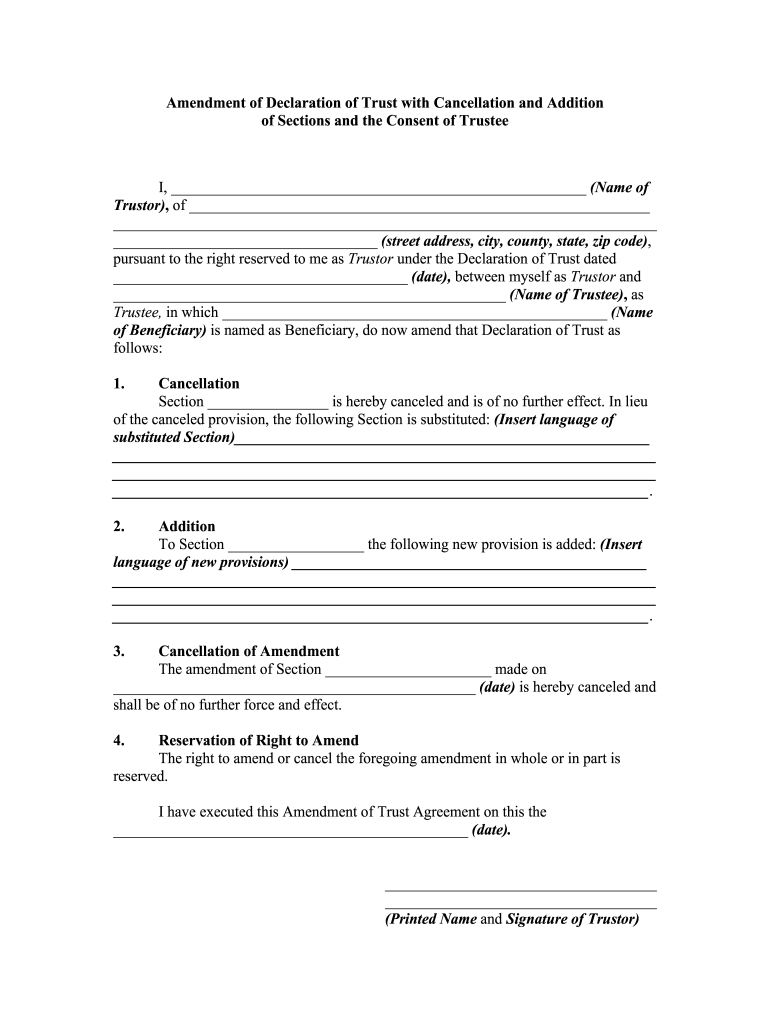

Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustees, (Name of Trust or), of (street address, city, county, state, zip code), pursuant to the right

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign amendment trust form

Edit your california agreement to act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california agreement to act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california agreement to act online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit california agreement to act. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california agreement to act

How to fill out trust trustee form:

01

Gather all necessary information related to the trust, including the trust document, names and contact information of beneficiaries, and details of trust assets.

02

Review the form instructions carefully to ensure a complete and accurate filling.

03

Start by providing the basic information required, such as your name, address, and contact details.

04

Provide the necessary information about the trust, such as its name, date of creation, and the name of the settlor.

05

Specify the role and responsibilities of the trustee, including any limitations or conditions mentioned in the trust document.

06

List all beneficiaries of the trust, including their names, addresses, and relationship to the settlor.

07

Indicate any special instructions or provisions mentioned in the trust document that the trustee needs to be aware of.

08

If required, include information regarding any successor trustees or trusteeship transitions.

09

Sign and date the form, and ensure any additional required documentation is attached.

10

Review the completed form for accuracy and completeness before submitting it.

Who needs trust trustee form?

01

Individuals who have been appointed as trustees of a trust.

02

Estate planning attorneys or legal professionals involved in the administration of trusts.

03

Beneficiaries or other parties with a vested interest in the trust, who may need to provide information regarding the trustee.

Fill

form

: Try Risk Free

People Also Ask about

Can a trust have the same trustee and beneficiary?

The short answer is yes, a beneficiary can also be a trustee of the same trust—but it may not always be wise, and certain guidelines must be followed. Is it a good idea for a beneficiary to be a trustee? There are good reasons for naming a trust beneficiary as trustee. For one, it is convenient.

How do you write a beneficiary letter to a trust?

A beneficiary should be addressed in a letter in the same manner as any other professional person. The letter should be addressed to the beneficiary, using her title and full name. Begin the salutation with the word “dear” and then state all relevant issues in a concise and clear manner.

Do trusts have to be filed in Missouri?

No family trust company shall conduct business in this state without paying a filing fee and registering with the Secretary of State.

Can a trustee take money from a beneficiary?

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust ing to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

How do you become a trustee in California?

Anyone can be appointed Trustee, but in most cases, the Trustee is the Settlor's surviving spouse, adult child, relative, or a friend. The Trustee could also be another third party the Settlor trusts. Sometimes a Settlor will appoint an attorney, trust company, or another estate administration professional.

How do you address a trustee?

are not formally addressed in writing as (Special Rank)+(Name), e.g., Regent Smith, Trustee Jones, or Governor Wilson. Members of a boards are formally addressed as Mr./Ms./Dr./whatever honorific they typically use + name and are identified as a chair or member of a Board of (name of board).

What are the responsibilities of a trustee in California?

7 Important Duties of a Trustee in California Duty of Loyalty. Duty of Impartiality. Duty to Avoid Conflicts of Interest. Duty of Disclosure of Information. Duty Not to Delegate. Duty to Enforce or Defend Claims. Duty to Keep Trust Assets Separate from trustee's own property.

Is a beneficiary and trustee the same?

Trustee vs. Beneficiary. A Trustee is a person or persons designated by trust instruments to distribute the estate assets to the trust beneficiaries. A beneficiary is an individual or entity who will receive the trust assets once the Trustee fulfills their fiduciary obligation to the Trustor.

What is required of a trustee in California?

A trustee must “make the trust property productive.” A trustee must not comingle trust property with outside assets and must clearly label trust property. A trustee has the duty to reasonably enforce claims of the trust and defend against legal actions that could harm the trust financially.

Are trusts public record in Missouri?

A living trust in Missouri offers you and your family privacy since the trust never becomes public record and does not require any court proceeding. The assets you place in the trust, the names of your beneficiaries, and the terms of the distribution remain out of the public eye.

Who can serve as a trustee in California?

Any beneficiary who is 14 years of age or older can nominate a trustee, even though a minor under the age of 18 is not legally qualified to serve as trustee. be appointed as trustee of any trust unless the Court finds that no other qualified person is willing to act as trustee.

What are the three duties of a trustee?

The trustee must distribute the property in ance with the settlor's instructions and desires. His or her three primary jobs include investment, administration, and distribution. A trustee is personally liable for a breach of his or her fiduciary duties.

Do beneficiaries get a copy of the trust Missouri?

Once your position as a beneficiary of an irrevocable trust (after your loved one passes and their revocable trust becomes irrevocable, for example) vests, you have the right to receive a copy of the trust documents.

Who has more power a trustee or beneficiary?

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

What happens when trust is lost?

If a Trust is lost, it may be presumed to be revoked. If you create a new Trust and find the old one, the Trust with the latest date will replace the others.

How do you write a trustee letter?

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

What are two mandatory duties of a trustee?

In general, the main duties of Trustees are: To act in the best interests of the beneficiaries To be impartial between beneficiaries. To pay the correct beneficiaries* To get to know the terms of the Trust (the Trust Deed), the assets and liabilities of the Trust, and who the possible beneficiaries may be.

What is a letter of trustee?

August 11, 2021. “Letters of Trusteeship” is a court document giving the nominated trustee of a trust created under a Last Will and Testament (“Will”) the power to act. Such a trust is called a testamentary trust because it is created in a Will.

How do I get a copy of my trust in Missouri?

How to Get a Copy of a Trust Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send california agreement to act to be eSigned by others?

When you're ready to share your california agreement to act, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the california agreement to act in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your california agreement to act and you'll be done in minutes.

How do I edit california agreement to act straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing california agreement to act, you need to install and log in to the app.

What is trust trustee form?

A trust trustee form is a legal document used to designate a person or entity responsible for managing and administering the assets held in a trust as per the trust agreement.

Who is required to file trust trustee form?

The trustee of the trust is required to file the trust trustee form to report the trust's financial activities and ensure compliance with tax regulations.

How to fill out trust trustee form?

To fill out a trust trustee form, provide details about the trust, such as the name of the trust, the trustee's contact information, and the trust's tax identification number, along with financial information as required.

What is the purpose of trust trustee form?

The purpose of the trust trustee form is to provide necessary information to tax authorities, ensuring that the trust is properly administered and that tax obligations are met.

What information must be reported on trust trustee form?

The information that must be reported includes the trust's name, tax identification number, trustee’s details, beneficiary information, and a summary of the trust's income, deductions, and distributions.

Fill out your california agreement to act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Agreement To Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.