Get the free maryland surviving spouse

Show details

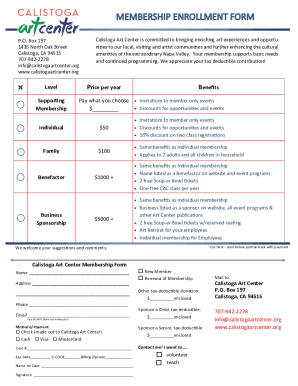

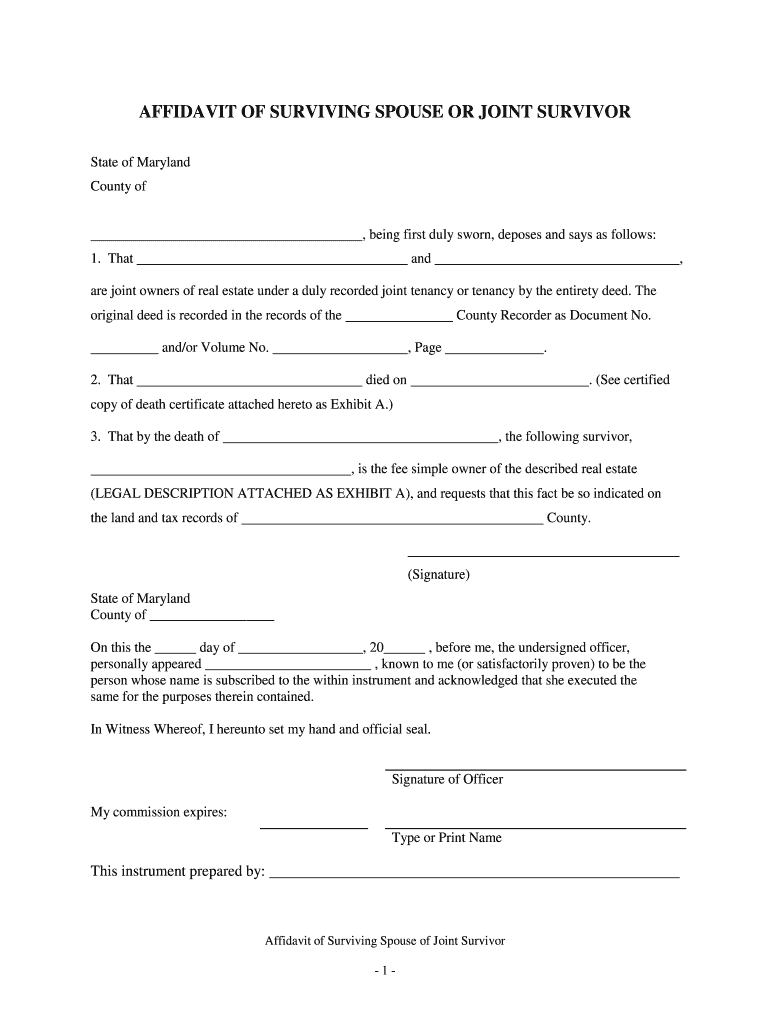

2016 U.S. Legal Forms, Inc. MARYLAND AFFIDAVIT OF SURVIVING SPOUSE OR JOINT SURVIVORControl Number: MDAFFJI001I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields created

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surviving joint form

Edit your md spouse form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland surviving spouse form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maryland surviving spouse form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit maryland surviving spouse form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out maryland surviving spouse form

How to fill out maryland surviving spouse:

01

Obtain the necessary forms: To fill out the maryland surviving spouse paperwork, you will need to obtain the appropriate forms from the Maryland Department of Health or their website. These forms typically include the necessary information and documentation required for the application process.

02

Gather required documents: Before filling out the maryland surviving spouse forms, gather all the required documents. These documents may include a death certificate of the deceased spouse, proof of marriage, and any other supporting documentation that may be relevant to the application.

03

Fill out the forms: Complete the maryland surviving spouse forms by providing accurate and honest information. Be sure to follow the instructions provided on the forms carefully to ensure that you do not miss any required sections or signatures.

04

Submit the forms and documents: Once you have filled out the maryland surviving spouse forms, make copies of all the paperwork for your records. Then, submit the completed forms and the required documents to the appropriate office or agency, as indicated on the forms or instructions.

05

Wait for processing: After submitting your maryland surviving spouse application, it will be processed by the relevant authorities. The processing time may vary, so be patient and wait for a response. You may contact the office or agency if you have any questions or concerns about the status of your application.

Who needs maryland surviving spouse?

01

Individuals who have lost their spouse: Anyone who has lost their husband or wife may need the maryland surviving spouse benefits if they meet the eligibility criteria set by the state.

02

Surviving spouses seeking financial assistance: Maryland surviving spouse benefits can provide financial assistance and support to those who have lost their spouse. This assistance can help with various expenses and provide stability during a difficult time.

03

Individuals looking for survivor benefits: The maryland surviving spouse benefit program may include survivor benefits that can help individuals maintain their financial well-being after the loss of their spouse. These benefits may include pension, health insurance, or other forms of support.

Overall, anyone who has lost their spouse in Maryland and meets the eligibility criteria can benefit from applying for the maryland surviving spouse benefits. The program is designed to provide support and assistance to those who are experiencing the loss of a loved one.

Fill

form

: Try Risk Free

People Also Ask about

What are the rights of a husband when the wife dies?

Right of Survivorship Deeds Assets that are owned in what is called joint tenancy or joint tenancy with right of survivorship, such as real estate, bank accounts and vehicles, will also pass directly to the surviving spouse after one spouse dies.

What is the spousal allowance for the estate in Maryland?

No surviving Minor Child, but surviving Children: Spouse – First $15,000 plus ½ of residue. Children – Balance of residue.

What is the surviving spouse law in Maryland?

Maryland law protects spouses from being disinherited by the other. The rule of law called the elective share gives the surviving spouse the right to receive a fixed amount of the deceased spouse's estate.

How do I transfer ownership of a car after death in Maryland?

The family member needs the title, a certified copy of the death certificate or the letter (form VR-278 or VR-264P) sent by the MVA notifying the surviving vehicle owner that the title must be transferred to remove the deceased owners name.

When a husband dies what is the wife entitled to Maryland?

Spouses in Maryland Inheritance Law If you have living parents, but no children, your spouse will inherit $15,000 of the intestate property and then half of the remaining property. Your parents will inherit the other half of the remaining property.

What is the survivorship law in Maryland?

Property held as joint tenants with right of survivorship or as Tenants by the Entireties will pass to the surviving joint owner. Property held as “payable on death” will pass to the designated beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find maryland surviving spouse form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the maryland surviving spouse form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit maryland surviving spouse form in Chrome?

maryland surviving spouse form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the maryland surviving spouse form electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your maryland surviving spouse form in seconds.

What is maryland surviving spouse?

A Maryland surviving spouse is a person who was legally married to a deceased individual and qualifies for certain tax benefits or rights in inheritance according to Maryland law.

Who is required to file maryland surviving spouse?

A surviving spouse in Maryland is required to file if they are claiming the Maryland income tax exemption for a deceased spouse or seeking a deduction known as the 'surviving spouse exemption.'

How to fill out maryland surviving spouse?

To fill out the Maryland surviving spouse form, start by gathering the deceased spouse's tax information, then complete the necessary forms provided by the Maryland state tax authority, making sure to indicate your status as a surviving spouse.

What is the purpose of maryland surviving spouse?

The purpose of the Maryland surviving spouse form is to provide a mechanism for the surviving spouse to report income, claim exemptions, and facilitate the transfer of assets following the death of a spouse.

What information must be reported on maryland surviving spouse?

The information that must be reported includes the deceased spouse's name and Social Security number, the date of marriage and date of death, as well as the income and deductions associated with both spouses for the tax year.

Fill out your maryland surviving spouse form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland Surviving Spouse Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.