Get the free oregon corporation

Show details

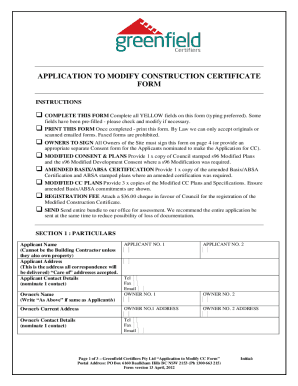

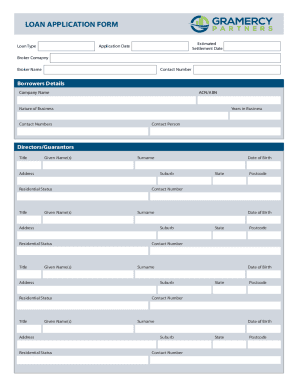

INSTRUCTIONS FOR COMPLETING Example: 1 will become JOHN DOE.ARTICLE ONE The full name of the corporation must be provided at the top of the page and in Article I, Section 1 of the bylaws. Field 1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oregon bylaws create form

Edit your oregon corporation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon corporation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oregon corporation form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oregon corporation form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oregon corporation form

How to fill out Oregon corporation:

01

Research and decide on a business name: Before filling out the Oregon corporation form, you need to have a unique business name that complies with the state's regulations. Make sure to check the Oregon Secretary of State website to ensure the name is available.

02

Choose a registered agent: Oregon requires all corporations to have a registered agent, who will receive legal and official documents on behalf of the company. You can appoint yourself or hire a professional registered agent service.

03

Complete the Articles of Incorporation: Obtain the Articles of Incorporation form from the Oregon Secretary of State website. Fill out the form with accurate information about your corporation, including the business name, registered agent details, principal office address, and purpose of the corporation.

04

Prepare the necessary attachments: Along with the Articles of Incorporation, you may need to include additional attachments such as a cover letter, a certificate of assumed business name (if applicable), or other supporting documents. Review the instructions on the form to ensure you provide all required attachments.

05

Pay the filing fee: There is a filing fee associated with submitting the Oregon corporation form. Check the current fee amount on the Secretary of State website, and include the payment in the form of a check or money order made payable to the Oregon Secretary of State.

06

Submit the completed form: Once you have filled out the Articles of Incorporation and gathered all necessary attachments, mail the completed form and payment to the Oregon Secretary of State. The address for submission can be found on their website.

07

Await confirmation: After submitting the form, it may take several weeks for the Oregon Secretary of State to process your application and send you a confirmation. Once you receive the confirmation, your Oregon corporation will be officially registered.

Who needs Oregon corporation?

01

Entrepreneurs starting new businesses: Individuals who are looking to establish a formal legal structure for their business in Oregon can benefit from forming a corporation. This structure provides limited liability protection and allows for potential tax advantages.

02

Small business owners: Even small businesses can benefit from forming a corporation in Oregon. Incorporating your business can help separate personal and business assets, provide credibility to your customers and vendors, and offer potential tax planning opportunities.

03

Companies seeking investors: If your business is looking to raise capital through venture capitalists, angel investors, or crowdfunding, having a formal corporation structure can be advantageous. Investors often prefer to invest in corporations rather than sole proprietorships or partnerships.

Overall, anyone looking to protect their personal assets, establish credibility, access business financing, or plan for future growth can consider forming an Oregon corporation. It is always recommended to consult with an attorney or a certified public accountant (CPA) to understand the specific legal and tax implications for your business.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a sole proprietorship and an LLC in Oregon?

An LLC exists separately from its owners—known as members. However, members are not personally responsible for business debts and liabilities. Instead, the LLC is responsible. A sole proprietorship is an unincorporated business owned and run by one person.

How do I set up a corporation in Oregon?

To start a corporation in Oregon, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State, Corporation Division. You can file this document online or by mail. The articles cost $100 to file.

What are the benefits of an LLC in Oregon?

Benefits of starting an Oregon LLC: Protect your personal assets from your business liability and debts. Simple to create, manage, regulate, administer and stay in compliance. Easily file your taxes and discover potential advantages for tax treatment. Low cost to file ($100)

How much does it cost to start a corporation in Oregon?

Starting a business in Oregon FAQ Corporations must file Articles of Incorporation. Both filings cost $100. You also pay $100 to register your business entity name with the Oregon Business Registry and an additional $50 if you want to register a DBA (called an assumed business name in Oregon).

What is the difference between an LLC and an S Corp in Oregon?

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.

What is an Oregon LLC?

A limited liability company (LLC) offers liability protection and tax advantages, among other benefits for small businesses. LLC formation in Oregon is easy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit oregon corporation form from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your oregon corporation form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send oregon corporation form to be eSigned by others?

Once your oregon corporation form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out oregon corporation form using my mobile device?

Use the pdfFiller mobile app to fill out and sign oregon corporation form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is oregon corporation?

An Oregon corporation is a legal entity that is registered under the laws of the state of Oregon, allowing individuals to conduct business under a corporate structure.

Who is required to file oregon corporation?

Anyone who wishes to establish a business entity in Oregon as a corporation is required to file the necessary formation documents with the state.

How to fill out oregon corporation?

To fill out an Oregon corporation, you must complete the Articles of Incorporation form, which includes information such as the corporation's name, purpose, registered agent, and number of shares authorized.

What is the purpose of oregon corporation?

The purpose of an Oregon corporation is to limit the liability of its owners while allowing for management and profit distribution among shareholders.

What information must be reported on oregon corporation?

Information that must be reported includes the corporation's name, principal office address, registered agent's name and address, number of shares, and the names of the incorporators.

Fill out your oregon corporation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon Corporation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.