Last updated on Feb 20, 2026

Get the free sell assets

Show details

RESOLUTION TO SELL ASSETS, LLC (hereinafter, the Company) WHEREAS, the Company has received an offer from buyer to purchase assets to be sold, all as is particularly set forth in the Purchase Agreement

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sell assets

Selling assets involves transferring ownership of property or possessions to convert them into cash or equivalents.

pdfFiller scores top ratings on review platforms

Generally is an excellent product. I have had a few problems with the system hanging and haven't figured out the best way to use signatures.

VERY GOOD PRODUCT. WISH IT HAD "ADD/SUBTRACT" FUNCTIONS, WHICH WOULD PRECLUDE THE NEED FOR DOING SO MANUALLY AND THEN INSERTING TOTALS/SUBTOTALS MANUALLY.

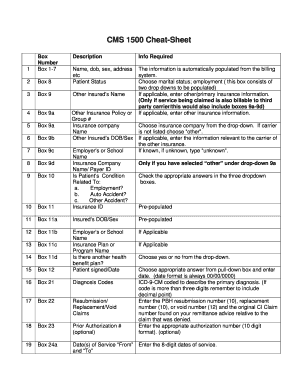

A very good and friendly in navigating the fields. Need improvement especially in the telephone number field and user address died of CMS 1500 of 2012 and UB04. Unable to include the three digits telephone area code. Address field too small to contain full address including zip codes

I has made my job easier. I use numerous forms as a Clinical Manager for a Home health agency that does not utilize EMR. I am now able to fill out these forms in half the time. I don't have to look through countless paper folders to locate my forms, just locate on my desk top, complete and print!

I use it every time I send an invoice or proposal

New to all this but getting there, thank you.

Who needs sell assets?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Selling Assets: The Resolution to Sell Assets Form

How to fill out a sell assets form form

Filling out a Resolution to Sell Assets form involves identifying the parties involved, detailing the assets for sale, and ensuring proper legal compliance. Understanding the key elements of the form is essential for a smooth transaction. Using a platform like pdfFiller can streamline this process.

What is a Resolution to Sell Assets?

A Resolution to Sell Assets form is a formal document that enables a company to approve the sale of its assets. It serves both as a record of consent from stakeholders and as a legal assertion of intended actions regarding asset transfer.

-

This form delineates the approval process necessary for selling company assets, ensuring transparency and adherence to corporate governance.

-

It includes details of the asset, involved parties, and the conditions under which the sale will proceed.

-

Legal adherence protects the company's interests and minimizes liability during the transaction.

What are the key elements of the Resolution to Sell Assets Form?

The Resolution to Sell Assets form contains several critical elements to ensure its effectiveness and compliance.

-

Clearly state the names of the company selling the assets and the buyer, as this establishes the contractual relationship.

-

Provide a comprehensive list identifying each asset, including its current valuation and condition to avoid disputes.

-

Specify how many members or stakeholders must approve the resolution to ensure corporate governance is followed.

How do you fill out the Resolution to Sell Assets Form?

Completing this form requires attention to detail and clarity in communication. A step-by-step approach ensures all necessary information is included.

-

Begin by filling out the company details, followed by the buyer's information, then proceed with asset descriptions.

-

Include any specific terms of sale and contingencies to safeguard the interests of all parties involved.

-

Use clear and concise language; for instance, specify that assets are sold 'as-is' if applicable.

What are the legal considerations and compliance requirements for selling assets?

Navigating legal requirements is crucial when selling assets. Each state has unique regulations governing asset sales.

-

Refer to your state’s commercial code for any specific rules that may apply to your sale.

-

Avoid vague descriptions of assets and failure to obtain necessary approvals, as these can lead to legal disputes.

-

Having a lawyer review the resolution protects against compliance issues and ensures all documentation is appropriate and enforceable.

How should company records be updated following the sale of assets?

Once the sale is completed, updating company records is paramount. Accurate documentation protects against future liabilities.

-

Include the Resolution to Sell Assets and any supporting documents in company files.

-

Amend agreements to reflect the asset transfer to maintain clarity within corporate governance.

-

Consider how selling assets may affect the overall company structure and future operations.

How can pdfFiller assist in the asset sale documentation process?

pdfFiller offers empowering features for creating and managing forms, making it easier to document asset sales efficiently.

-

Users can create custom forms, edit existing templates, and sign documents digitally—all in a single cloud-based solution.

-

Step-by-step instructions help users edit, sign, and store the Resolution to Sell Assets seamlessly.

-

Access documentation anywhere, ensuring your forms are always up-to-date and secure.

What does an example template of a Resolution to Sell Assets Form look like?

Using a template can simplify the preparation of a Resolution to Sell Assets Form, providing a clear structure for necessary information.

-

Includes legal affirmations and asset descriptions, tailored for particular sale conditions.

-

A template visually highlights fields to ensure all essential information is included.

-

Adjust the wording and details based on the specific assets being sold or the nature of the transaction.

What are the post-sale steps after selling assets?

After completing a sale, following up with appropriate actions is essential for ensuring a smooth transition.

-

Assess any outstanding obligations and confirm that all parties have received their necessary documentation.

-

Maintain an open line of communication for any questions or clarifications regarding the sale.

-

Provide the buyer with all relevant information regarding the assets sold to facilitate a seamless handover.

How to fill out the sell assets

-

1.Open the pdfFiller platform and log in to your account.

-

2.Select the 'Create New' option and choose 'Upload Document' to add your sell assets form!

-

3.Once opened, locate the section where you need to enter asset details, such as type, value, and relevant descriptions.

-

4.Fill in all required fields clearly and accurately, ensuring that each asset is properly identified.

-

5.If applicable, add any additional information regarding the terms of sale or conditions.

-

6.Review your entries for accuracy and completeness, ensuring no fields are left blank or filled incorrectly.

-

7.Once satisfied with the information, save the document, and if needed, choose the option to download or print it for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.