Get the free notice beneficiaries will

Show details

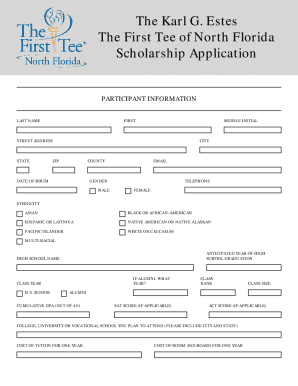

NOTICE TO BENEFICIARIES Name: Address: Address: City: State: Name: Address: Address: City: State: Name: Address: Address: City: State:Zip:Name Address: Address: City: State:Zip:Zip:Name Address: Address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pennsylvania beneficiaries create form

Edit your notice beneficiaries will form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice beneficiaries will form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice beneficiaries will form online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit notice beneficiaries will form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice beneficiaries will form

How to fill out PA-WIL-800

01

Begin by downloading the PA-WIL-800 form from the official website.

02

Fill out the header section with your personal details, including name, address, and contact information.

03

Provide the appropriate tax period for which you are reporting.

04

Complete the income section, entering all relevant earnings from work.

05

Specify any deductions or credits you are eligible for in the corresponding sections.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form as per the instructions provided, either electronically or via mail.

Who needs PA-WIL-800?

01

Individuals who are filing for work-related claims or benefits in Pennsylvania.

02

Employers who need to report wages or payroll information.

03

Anyone seeking to update or amend their worker's information.

Fill

form

: Try Risk Free

People Also Ask about

Who gets 16061.7 notice?

Under probate code section 16061.7, when a trust or a portion of a trust becomes irrevocable, the Trustee has a legal obligation to send notice to all legal heirs of the decedent and beneficiaries of a trust within 60 days following the irrevocability of the trust.

Do trustees have to inform beneficiaries?

Trustees have a duty to inform a beneficiary of the existence and terms of the trust and of the general nature of their interest. Beyond these duties, establishing what information and documents a beneficiary is entitled to see is not always clear cut and it is a common issue that arises when dealing with trusts.

How are beneficiaries of a trust notified?

Trust beneficiaries and heirs are entitled to receive a notice by mail called the “Statutory Notification by Trustee.” The Trustee must send a Statutory Notification by mail, along with copies of the Trust document, to all Trust beneficiaries and heirs of the deceased Grantor.

What are the obligations of trustees to beneficiaries?

Trustees must act impartially between the beneficiaries and ensure that one beneficiary does not benefit at the expense of another. Consider for example an interest in possession trust where one beneficiary is entitled to income with others entitled to capital on the death of that person.

Do beneficiaries have to be notified?

Yes, state probate laws require that any beneficiaries included in a Will are notified. This duty lands on the executor, who is responsible for managing the Will and filing for probate. They are nominated by the Testator in the Will and are officially appointed by the probate court to this role.

What notice is sent to the beneficiaries heirs and executors?

A Notice to Heirs document enables you to officially notify those family members, and others mentioned in the Will, that they may be potential heirs to the estate. It alerts them to an informal probate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the notice beneficiaries will form electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your notice beneficiaries will form in minutes.

How can I fill out notice beneficiaries will form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your notice beneficiaries will form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out notice beneficiaries will form on an Android device?

Use the pdfFiller app for Android to finish your notice beneficiaries will form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is PA-WIL-800?

PA-WIL-800 is a form used for reporting wages and employer withholding tax in Pennsylvania.

Who is required to file PA-WIL-800?

Employers with employees who receive wages in Pennsylvania are required to file PA-WIL-800.

How to fill out PA-WIL-800?

To fill out PA-WIL-800, employers must provide information about their wages paid, taxes withheld, and employee details as specified in the form's instructions.

What is the purpose of PA-WIL-800?

The purpose of PA-WIL-800 is to report wage information and any taxes withheld from employees to the Pennsylvania Department of Revenue.

What information must be reported on PA-WIL-800?

PA-WIL-800 requires reporting of total wages paid, the amount of withholding tax, employer identification information, and details regarding employees.

Fill out your notice beneficiaries will form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Beneficiaries Will Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.