Get the free Illinois Living Trust for individual, Who is Single, Divorced or Widow or Widower wi...

Show details

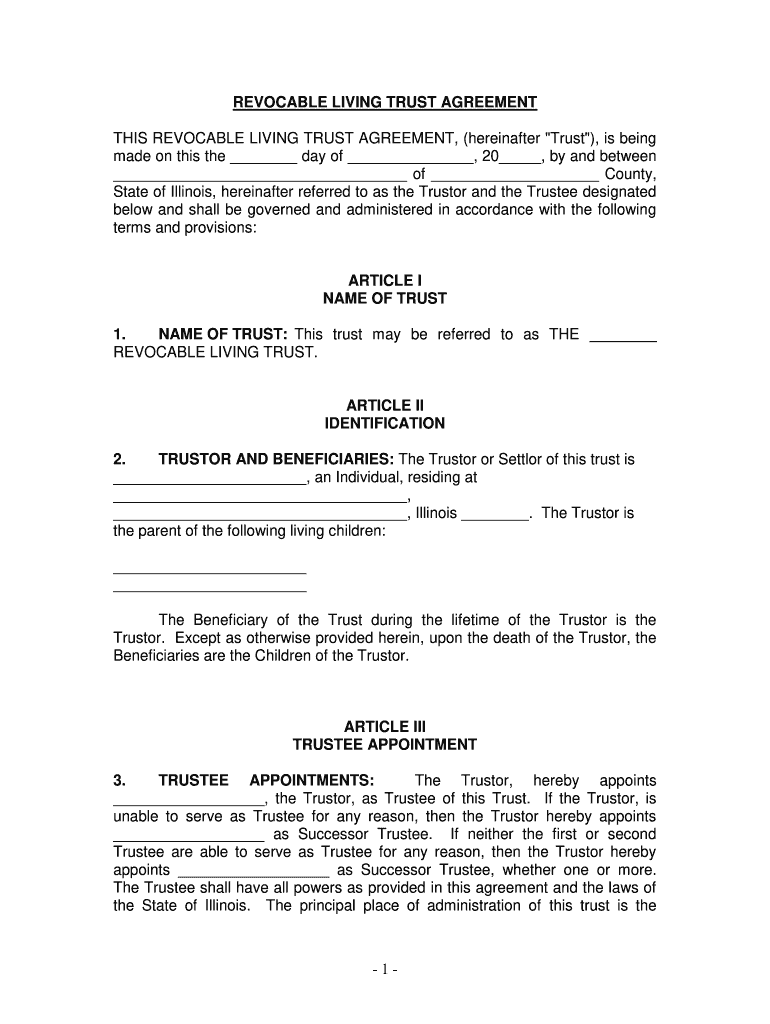

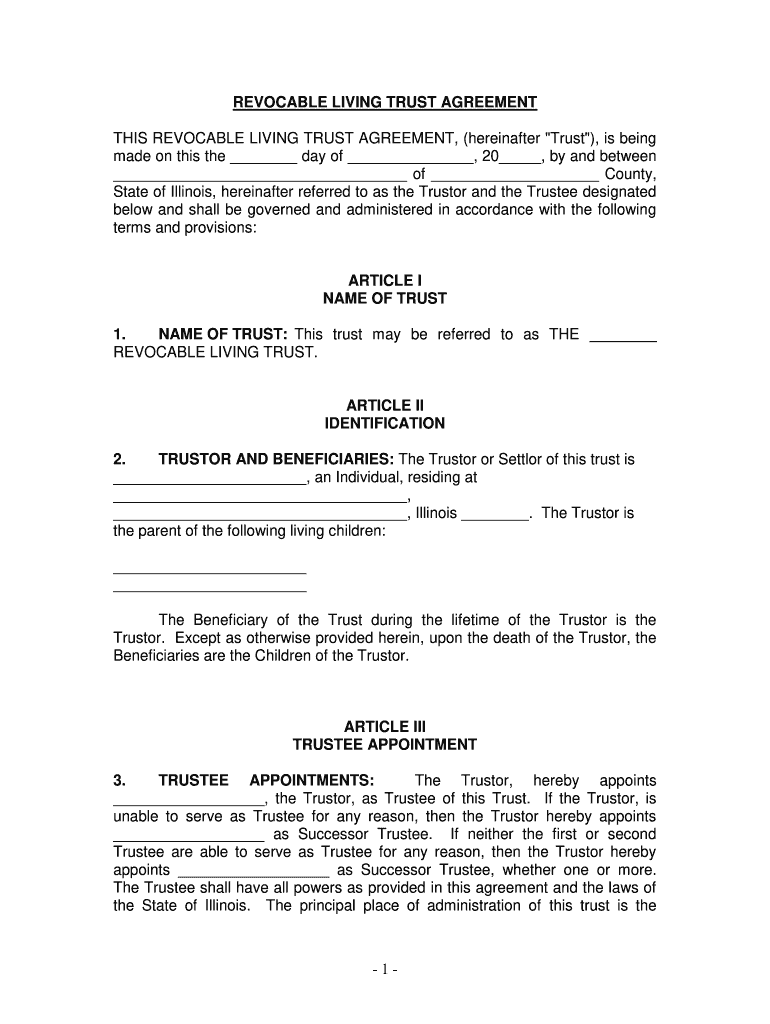

REVOCABLE LIVING TRUST AGREEMENT THIS REVOCABLE LIVING TRUST AGREEMENT, (hereinafter “Trust “), is being made on this the day of, 20, by and between of County, State of Illinois, hereinafter referred

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign illinois living trust for

Edit your illinois living trust for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois living trust for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit illinois living trust for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit illinois living trust for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out illinois living trust for

How to fill out illinois living trust for

01

Determine the type of living trust you want to create. There are two main types: revocable and irrevocable trusts.

02

Gather all the necessary documents and information. This includes identification documents, asset information, and the names of beneficiaries.

03

Determine the beneficiaries and stipulations of the trust. Decide who will receive the assets and any specific conditions or instructions you want to include.

04

Consult with a qualified attorney. It is recommended to seek legal advice when creating a living trust to ensure it meets all legal requirements and your specific needs.

05

Prepare the necessary legal documents. This may include a trust agreement, certificate of trust, and any additional documents required by the state of Illinois.

06

Review and sign the completed documents. Make sure to understand the terms of the trust and how it will be administered.

07

Transfer assets into the trust. This may involve changing titles, deeds, or beneficiary designations to reflect the trust as the owner.

08

Keep the trust documents in a safe place and inform the appropriate parties, such as trustees and beneficiaries, about the existence of the trust.

09

Periodically review and update the trust. As circumstances change, it may be necessary to make revisions to the trust to reflect your current wishes.

Who needs illinois living trust for?

01

Anyone who wants to have control over the distribution of their assets after their death may benefit from an Illinois living trust.

02

Individuals who want to avoid probate and maintain privacy regarding their assets and beneficiaries may also find a living trust beneficial.

03

People with considerable assets or complex estate planning needs may choose to use a living trust to ensure their wishes are carried out efficiently and effectively.

04

Parents with minor children may utilize a living trust to provide for the management and distribution of assets on behalf of their children.

05

Those who want to reduce estate taxes or protect their assets from potential creditors may also consider creating an Illinois living trust.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get illinois living trust for?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific illinois living trust for and other forms. Find the template you need and change it using powerful tools.

How do I edit illinois living trust for on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign illinois living trust for right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete illinois living trust for on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your illinois living trust for by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is illinois living trust for?

Illinois living trust is a legal document created during a person's lifetime that allows their assets to be distributed to beneficiaries after their death without going through the probate process.

Who is required to file illinois living trust for?

Individuals who have created an Illinois living trust and appointed a trustee to manage their assets are required to file the trust.

How to fill out illinois living trust for?

To fill out an Illinois living trust, one must include information about the grantor, trustee, beneficiaries, assets, and terms of distribution.

What is the purpose of illinois living trust for?

The purpose of an Illinois living trust is to avoid probate, provide privacy, and ensure a smooth distribution of assets to beneficiaries.

What information must be reported on illinois living trust for?

Information such as the names of the grantor, trustee, and beneficiaries, a list of assets in the trust, and the terms of distribution must be reported on the Illinois living trust form.

Fill out your illinois living trust for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Living Trust For is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.