ND-019-78 free printable template

Show details

2016 U.S. Legal Forms, Inc. NORTH DAKOTA MINERAL DEED Individual to Individual Control Number: ND01978I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields created using

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign north dakota mineral deed form

Edit your nd mineral deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your north dakota mineral deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

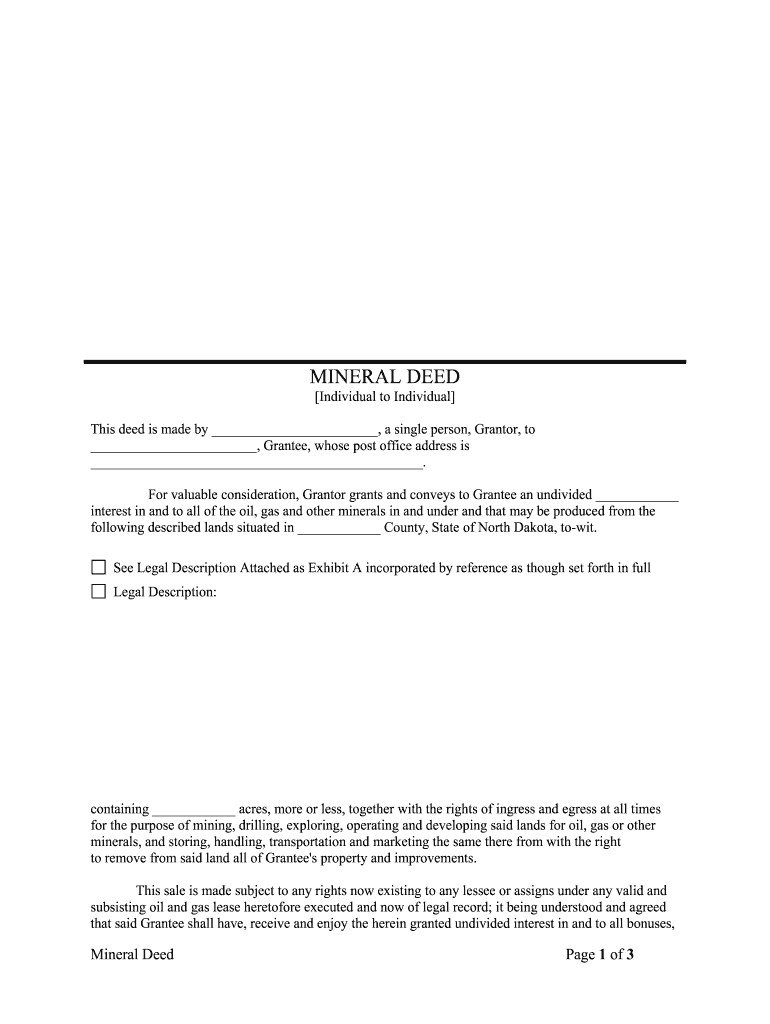

Editing north dakota mineral form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mineral deed form north dakota. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

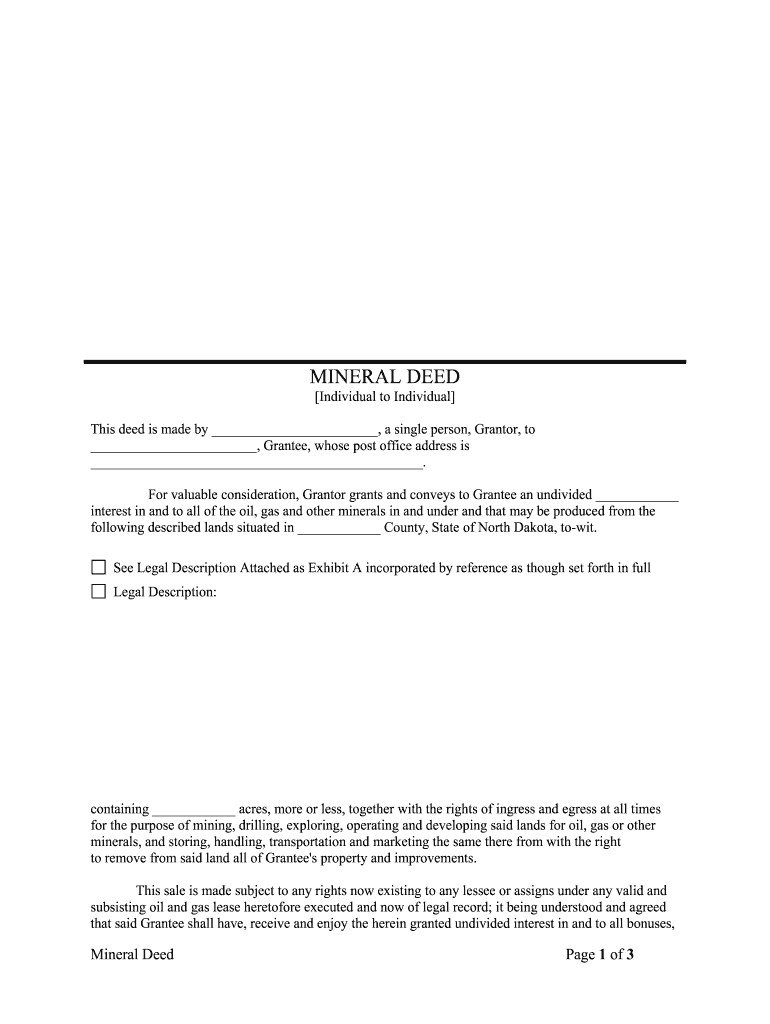

How to fill out mineral deed form

How to fill out ND-019-78

01

Obtain the ND-019-78 form from the relevant authority's website or office.

02

Read the instructions carefully to understand the purpose of each section.

03

Fill in your personal information at the top, including your name, address, and contact details.

04

Provide the required identification details as specified in the form.

05

Complete any additional sections that apply to your specific situation.

06

Review all information for accuracy and completeness before submission.

07

Sign and date the form as indicated.

08

Submit the filled-out form to the designated office or electronically, as required.

Who needs ND-019-78?

01

Individuals applying for a specific government program or service that requires ND-019-78.

02

Organizations or entities that need to provide historical data or information for compliance purposes.

03

Anyone required to document specific information as mandated by regulatory bodies.

Fill

form

: Try Risk Free

People Also Ask about

How much are mineral rights worth in North Dakota?

First International Bank & Trust's MineralTracker recently produced and presented a 40-page summary to the North Dakota Land Board estimating the total value of North Dakota-owned oil and gas mineral rights at $2.8 billion, an 18% increase from prior year.

Do mineral rights expire in North Dakota?

38-18.1-02. Statement of claims - Recording - Reversion. Any mineral interest is, if unused for a period of twenty years immediately preceding the first publication of the notice required by section 38-18.1-06, deemed to be abandoned, unless a statement of claim is recorded in ance with section 38-18.1-04.

What is the fair market value of mineral rights?

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

What is the value of North Dakota mineral rights?

Producing Mineral Rights Value To get the value for producing mineral rights is quite straightforward in North Dakota. To estimate the value, mineral owners can sum the value of the last three royalty checks and divide the total by 3 to get the average value of one month's royalty.

How do I find out if I own mineral rights in North Dakota?

How can I find out who owns the oil rights on property in North Dakota? To determine mineral rights on a parcel of land, you need to go to the County Recorder's Office in the county of that parcel and request any recorded deed documents for the parcel.

How do you value mineral rights in North Dakota?

To estimate mineral rights value in North Dakota you need to multiple your total lease bonus by 2x to 3x. Generally speaking the mineral rights value in North Dakota for leased mineral rights will be between 2x to 3x the lease bonus.

What are common examples of minerals a person might own the rights to?

Owning mineral rights (often referred to as a "mineral interest" or a "mineral estate") gives the owner the right to exploit, mine, and/or produce any or all minerals they own. Minerals can refer to oil, gas, coal, metal ores, stones, sands, or salts.

Can you own mineral rights in Florida?

A mineral right is legal ownership of subsurface resources — oil, natural gas, etc. — of a certain parcel of land. In Florida, these rights can be split, or severed from the surface property and bought, sold or leased on their own.

What are the elements of a mineral deed?

These diligence provisions will usually contain at least three elements: restrictions on conveyances, title, and when/how the purchase price can be revised.

How do you put a value on mineral rights?

The value of mineral rights depends on various factors, including the mineral, the location, whether the right is producing, and more. The rule of thumb is widely accepted as a multiple of three to five times the income the right is currently producing, which doesn't apply to non-producing rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 481377435 form to be eSigned by others?

Once you are ready to share your 481377435 form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I execute 481377435 form online?

pdfFiller has made it easy to fill out and sign 481377435 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in 481377435 form without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your 481377435 form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is ND-019-78?

ND-019-78 is a specific tax form used to report certain financial information to the relevant authorities.

Who is required to file ND-019-78?

Individuals and businesses that meet certain criteria regarding income or financial activities are required to file ND-019-78.

How to fill out ND-019-78?

To fill out ND-019-78, you need to provide personal and financial information as required, ensuring all sections of the form are completed accurately.

What is the purpose of ND-019-78?

The purpose of ND-019-78 is to collect relevant tax information from individuals and entities for regulatory and compliance purposes.

What information must be reported on ND-019-78?

ND-019-78 requires the reporting of income, expenses, deductions, and any other relevant financial data as specified in the form instructions.

Fill out your 481377435 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

481377435 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.